(Bloomberg) — US stocks turned sharply lower in late trading after comments by the Bank of England chief on removing market support rattled investor sentiment. Benchmark Treasury yields rose and the dollar gained. Most Read from Bloomberg The S&P 500 slid amid renewed selling in tech shares that sent the Nasdaq 100 down more than 1%. Long-end Treasuries bore the brunt of losses and the pound tumbled after BOE Governor Andrew Bailey urged investors to finish winding up positions that they… Source link

Read More »YouTube star says towing with Ford’s new electric pickup is a ‘total disaster’ in viral video — but Wall Street still likes these 3 EV stocks

‘This truck can’t do normal truck things’: YouTube star says towing with Ford’s new electric pickup is a ‘total disaster’ in viral video — but Wall Street still likes these 3 EV stocks It’s no secret that electric cars are becoming more and more popular these days. But will the EV trend carry over to pickup trucks? According to Tyler Hoover — who runs the Hoovie’s Garage YouTube channel with 1.4 million subscribers — an electric pickup truck might not be a great option if… Source link

Read More »Wall Street Is Missing the Risk to Stocks If Inflation Is Beaten

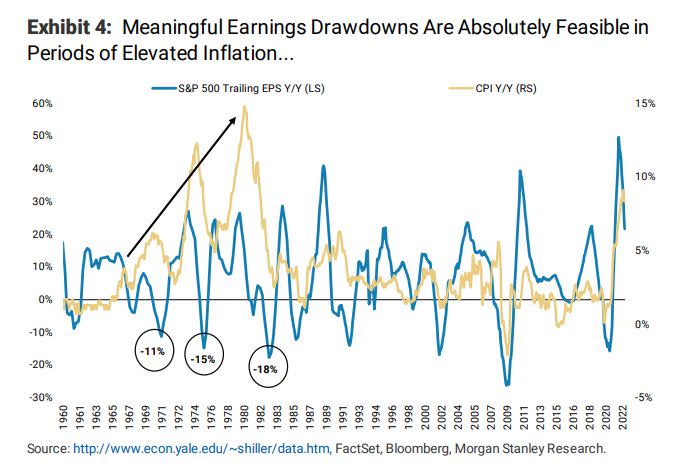

(Bloomberg) — The conventional wisdom with stock bulls is that prices will take off when the Federal Reserve wins its fight against inflation. But the end of surging consumer costs could unleash another round of bad news. Most Read from Bloomberg A small chorus of researchers has for months warned of a potential hazard to earnings should the campaign to tamp down inflation succeed. Specifically, the squeeze on margins that could occur should an indicator known as corporate operating leverage… Source link

Read More »Stocks waver after rally sputters, jobless claims rise

U.S. stocks were mixed at the start of trading Thursday after a dramatic two-day rally that kicked off the quarter fizzled. The S&P 500 edged down 0.1%, while the Dow Jones Industrial Average sank 90 points, or 0.3%. The technology-heavy Nasdaq Composite was an outlier — up a modest 0.2%. The moves early Thursday came after fresh data from the Labor Department showed a jump in the number of Americans filing for first-time unemployment insurance last week. Initial jobless claims rose sharply… Source link

Read More »Top trending stocks after hours: Costco, Ford, Abbvie

Costco (COST): Total comparable store sales rose 8.5% in September, beating Wall Street’s earnings estimate of 6.3% growth. Comparable sales excluding the impacts from changes in gasoline prices and foreign exchange rose 8.6%. Net sales for last month totaled $21.5 billion, up 10.1% from a year ago. Ford (F): The company is raising the price of its F-150 lightning for the second time in recent months, driven by higher costs and supply chain issues. The 2023 F-150 Lightning Pro, which is… Source link

Read More »Stocks soar for second straight day as October relief rally intensifies

U.S. stocks charged sharply higher Tuesday as Wall Street built on momentum from a broad market rally that kicked off the month and quarter earlier this week. The benchmark S&P 500 surged 3%, its largest two-day climb since April 2020 — with the strongest daily breadth reading since late 2018, per data from Bespoke Investment Group. The Dow Jones Industrial Average jumped 826 points, or 2.8%, for its second straight day of gains of more than 700 points. The technology-heavy Nasdaq Composite… Source link

Read More »Stocks waver in choppy trading after the S&P 500 touches new lows

U.S. stocks struggled to find their footing in choppy trading Friday after a vicious sell-off that sent the S&P 500 to lows not seen since 2020. The bellwether index hovered around the flatline, while the Dow Jones Industrial Average sank 120 points, or 0.4%. The technology-focused Nasdaq Composite gained 0.3%. Investors will close out a brutal month and quarter on Friday. The S&P 500’s 2.1% drop on Thursday marked its 49th decline of 1% or more this year, marking the most downside… Source link

Read More »Stocks bear market ‘will continue into the first quarter,’ portfolio manager says

Battered investors hoping for a reprieve from the teeth of the bear market may have to wait until early 2023. That’s the blunt assessment from Pimco portfolio manager Erin Browne. “I think it [the bear market] will continue into the first quarter of next year because the Fed is going to keep hiking [rates],” Browne warned on Yahoo Finance Live (video above). “And so it’s hard to have with any certainty right now what next year will bring.” That’s hardly welcome analysis in what has been a… Source link

Read More »Stocks open mixed after 10-year Treasury briefly hits 4%

U.S. stocks struggled for direction early Wednesday after the 10-year Treasury yield – a key economic linchpin – briefly spiked past 4%, hitting a closely watched level for the worst bond sell-off in decades. The S&P 500 was up a modest 0.1%, while the Dow Jones Industrial Average added 60 points, or around 0.2%. The Nasdaq Composite was off by 0.2%. Across the Atlantic, the Bank of England said it would carry out temporary purchases of long-dated U.K. government bonds, an emergency… Source link

Read More »Stocks extend losses after S&P 500 slides to 2022 low

U.S. stocks turned lower following a morning bounce Tuesday after the S&P 500 slid to a new closing low and the Dow Jones Industrial Average entered an official bear market – a drop of 20% or more from a broad market index’s most recent high. The S&P 500 tumbled 0.7% after paring a gain of more than 1%, falling deeper below its June 16 close, while the Dow Jones Industrial shed more than 200 points. The tech-heavy Nasdaq Composite declined 0.4%. On Tuesday, Chicago Fed President Charles… Source link

Read More »