(Bloomberg) — Economist Nouriel Roubini, who correctly predicted the 2008 financial crisis, sees a “long and ugly” recession in the US and globally occurring at the end of 2022 that could last all of 2023 and a sharp correction in the S&P 500. Most Read from Bloomberg “Even in a plain vanilla recession, the S&P 500 can fall by 30%,” said Roubini, chairman and chief executive officer of Roubini Macro Associates, in an interview Monday. In “a real hard landing,” which he expects, it… Source link

Read More »Stocks on the move after hours: Ford, Cognex and more

Ford (F): Shares fell in extended trading after the company warned of larger costs due to inflation and supply chain challenges. Ford now sees inflation related supply costs to be about $1 billion higher during the quarter compared to its previous estimate and sees supply shortages to affect about 40,000 to 45,000 vehicles, shifting some revenue to the fourth quarter. Ford sees 3Q adjusted EBIT of $1.4 billion to $1.7 billion but reaffirmed its adjusted full-year EBIT guidance. Bitcoin ( Source link

Read More »Stocks fall as Wall Street braces for Fed meeting

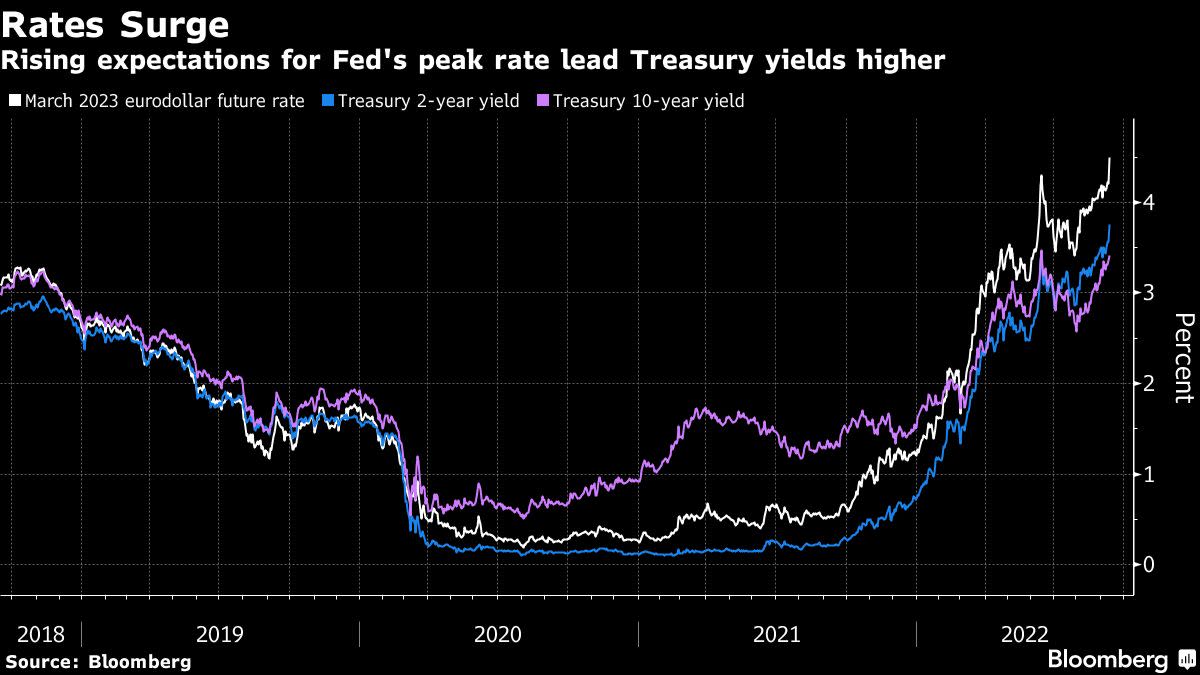

U.S. stocks were firmly lower early Monday after all three major indexes logged their worst week in three months. The S&P 500, Dow Jones Industrial Average, and tech-heavy Nasdaq were each off by roughly 0.6% at the start of the trading session. Meanwhile in the bond market, the benchmark U.S. 10-year Treasury note spiked to 3.49%, its highest level since 2011, while the 2-year Treasury note inched past a 15-year high of 3.9%. Investors are gearing up for the Federal Reserve’s two-day policy… Source link

Read More »Stocks plummet on heels of FedEx earnings warning

Stocks tumbled Friday morning, deepening a sell-off across U.S. equity markets that placed all three major averages on pace for a weekly loss. The moves came as traders weighed an ominous warning from FedEx about the global economy. The S&P 500 slid 1.2% at the start of trading as the Dow Jones Industrial Average shed 350 points, or 1.1%. The technology-heavy Nasdaq Composite led losses, plunging 1.6%. FedEx (FDX) withdrew its full-year guidance late Thursday and delivered messaging around its… Source link

Read More »Rates at 4.5% Would Sink Stocks by 20%

(Bloomberg) — Ray Dalio came out with a gloomy prediction for stocks and the economy after a hotter-than-expected inflation print rattled financial markets around the globe this week. Most Read from Bloomberg “It looks like interest rates will have to rise a lot (toward the higher end of the 4.5% to 6% range),” the billionaire founder of Bridgewater Associates LP wrote in a LinkedIn article dated Tuesday. “This will bring private sector credit growth down, which will bring private… Source link

Read More »Morgan Stanley expects the S&P 500 to plunge another 17%-27% within the next four months — use these 3 top recession-resistant stocks for protection

Morgan Stanley expects the S&P 500 to plunge another 17%-27% within the next four months — use these 3 top recession-resistant stocks for protection If you think the stock market selloff has come to an end, Morgan Stanley has some bad news. The S&P 500 is already down 14% year to date, but the Wall Street juggernaut believes the market has yet to hit a bottom. “Our ’22/’23/’24 base case estimates are now 3%/13%/14% below consensus, respectively,” a team of Morgan Stanley analysts led by… Source link

Read More »Boursa Kuwait data now available on “Yahoo Finance” media platform and “Apple Stocks” application

Kuwait City: Boursa Kuwait today announced that the exchange’s data and that of the listed companies is now available on the “Yahoo Finance” online platform and the “Apple Stocks” application. Boursa Kuwait announced this as part of its efforts to offer regional and global investors access to stock prices and associated data, and to Boursa Kuwait indices, which could all be added to the users watch list. The” Apple Stocks” application is pre-installed on Apple smartphones,… Source link

Read More »Two ways of thinking about this chart of stocks and recessions

This post was originally published on TKer.com. Jim Reid, macro strategist at the bank, wrote that “historically the S&P 500 normally always only bottoms in a recession and usually not until mid-way through.” Reid and his colleagues expect the U.S. economy to enter a recession in 2023. As such, they also believe the S&P 500 is “likely” to see a low that year before resuming any rally. There are two ways of thinking about this chart. First, recessions are common in history and… Source link

Read More »Stocks rally to snap three-week losing streak

U.S. stocks extended a broad-based rebound Friday, capping a sell-off that spanned three consecutive weeks. The S&P 500 jumped 1.5%, building on back-to-back sessions of gains, while the Dow Jones Industrial Average soared 377 points, or about 1.2%. Technology stocks led the way up, with the Nasdaq Composite climbing 2.1%. Oil extended a volatile run as prices resumed their climb Friday. West Texas Intermediate (WTI) and Brent crude oil futures each rose 4% to $86.88 per barrel and $92.84 per… Source link

Read More »Stocks extend gains into third day, oil rises

U.S. stocks extended a broad-based rebound Friday, with Wall Street on pace to snap a three-week losing streak. The S&P 500 jumped 1.6%, building on back-to-back sessions of gains, while the Dow Jones Industrial Average soared 400 points, or about 1.3%. Technology stocks led the way up, with the Nasdaq Composite climbing 2%. Oil extended a volatile run as prices resumed their climb Friday. West Texas Intermediate (WTI) and Brent crude oil futures each rose 4% to $86.88 per barrel and $92.84… Source link

Read More »