Costco (COST): Total comparable store sales rose 8.5% in September, beating Wall Street’s earnings estimate of 6.3% growth. Comparable sales excluding the impacts from changes in gasoline prices and foreign exchange rose 8.6%. Net sales for last month totaled $21.5 billion, up 10.1% from a year ago. Ford (F): The company is raising the price of its F-150 lightning for the second time in recent months, driven by higher costs and supply chain issues. The 2023 F-150 Lightning Pro, which is… Source link

Read More »Stocks soar for second straight day as October relief rally intensifies

U.S. stocks charged sharply higher Tuesday as Wall Street built on momentum from a broad market rally that kicked off the month and quarter earlier this week. The benchmark S&P 500 surged 3%, its largest two-day climb since April 2020 — with the strongest daily breadth reading since late 2018, per data from Bespoke Investment Group. The Dow Jones Industrial Average jumped 826 points, or 2.8%, for its second straight day of gains of more than 700 points. The technology-heavy Nasdaq Composite… Source link

Read More »Stocks waver in choppy trading after the S&P 500 touches new lows

U.S. stocks struggled to find their footing in choppy trading Friday after a vicious sell-off that sent the S&P 500 to lows not seen since 2020. The bellwether index hovered around the flatline, while the Dow Jones Industrial Average sank 120 points, or 0.4%. The technology-focused Nasdaq Composite gained 0.3%. Investors will close out a brutal month and quarter on Friday. The S&P 500’s 2.1% drop on Thursday marked its 49th decline of 1% or more this year, marking the most downside… Source link

Read More »Stocks bear market ‘will continue into the first quarter,’ portfolio manager says

Battered investors hoping for a reprieve from the teeth of the bear market may have to wait until early 2023. That’s the blunt assessment from Pimco portfolio manager Erin Browne. “I think it [the bear market] will continue into the first quarter of next year because the Fed is going to keep hiking [rates],” Browne warned on Yahoo Finance Live (video above). “And so it’s hard to have with any certainty right now what next year will bring.” That’s hardly welcome analysis in what has been a… Source link

Read More »Stocks open mixed after 10-year Treasury briefly hits 4%

U.S. stocks struggled for direction early Wednesday after the 10-year Treasury yield – a key economic linchpin – briefly spiked past 4%, hitting a closely watched level for the worst bond sell-off in decades. The S&P 500 was up a modest 0.1%, while the Dow Jones Industrial Average added 60 points, or around 0.2%. The Nasdaq Composite was off by 0.2%. Across the Atlantic, the Bank of England said it would carry out temporary purchases of long-dated U.K. government bonds, an emergency… Source link

Read More »Stocks extend losses after S&P 500 slides to 2022 low

U.S. stocks turned lower following a morning bounce Tuesday after the S&P 500 slid to a new closing low and the Dow Jones Industrial Average entered an official bear market – a drop of 20% or more from a broad market index’s most recent high. The S&P 500 tumbled 0.7% after paring a gain of more than 1%, falling deeper below its June 16 close, while the Dow Jones Industrial shed more than 200 points. The tech-heavy Nasdaq Composite declined 0.4%. On Tuesday, Chicago Fed President Charles… Source link

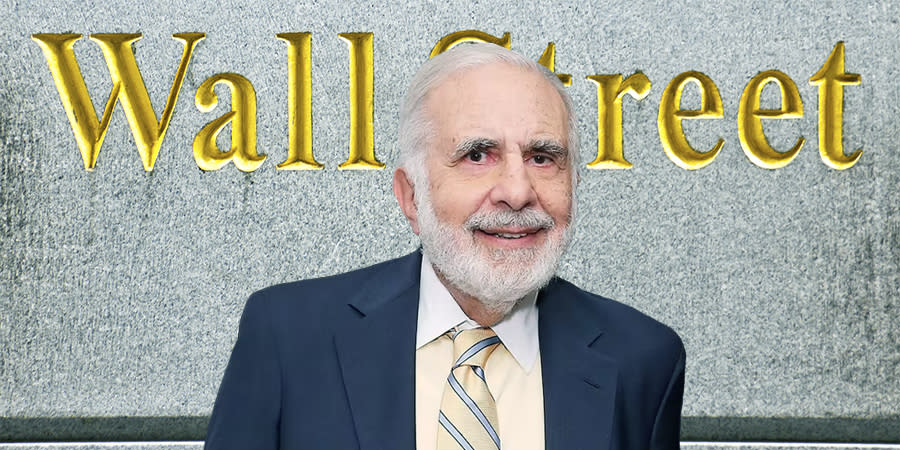

Read More »Carl Icahn Uses These 2 Dividend Stocks to Protect His Portfolio

After a grisly 1H22 which represented the stock market’s worst performance since 1970, the second half is shaping up to be a bit of a disappointment too. After clawing back some of the losses, it’s been onto the slide again with the S&P 500 almost back to the mid-June lows. The bad news, according to billionaire investor Carl Icahn, is that things could still get worse from here. “I think a lot of things are cheap, and they’re going to get cheaper,” said Icahn, pointing to the… Source link

Read More »Stocks plummet as Fed, growth fears intensify

U.S. stocks slid Friday morning as fears of aggressive Federal Reserve policy had equity markets pace towards a big weekly loss and Treasury yields continue a perilous climb to fresh highs. The benchmark S&P 500 tumbled 1.2% early into the session. The Dow Jones Industrial Average plunged more than 300 points, or 1.1%, falling below the 30,000 level for the first time since June. The technology-heavy Nasdaq Composite off by 1.2%. Meanwhile, the 10-year U.S. Treasury note spiked above 3.7%,… Source link

Read More »Stocks fall for third day as investors mull rate hike, Powell remarks

U.S. stocks closed lower Thursday to cap a turbulent session after the Federal Reserve’s latest policy announcement and subsequent remarks from Chair Jerome Powell sent markets into disarray. The benchmark S&P 500 slid 0.9%, while the Dow Jones Industrial Average shed 100 points, or 0.4%. The technology-heavy Nasdaq Composite tumbled 1.4%. The moves extend a Fed-induced sell-off Wednesday that saw the S&P 500 and Dow each erase around 1.7% and the Nasdaq plummet 1.8%, and mark a third… Source link

Read More »Stocks plunge after rate hike, Powell comments

U.S. stocks tumbled in volatile trading Wednesday afternoon as the Federal Reserve dealt another outsized interest rate hike in its fight against stubborn inflation. The U.S. central bank lifted its benchmark policy rate by 0.75% for a third consecutive time, bringing the federal funds rate to a new range of 3.0% to 3.25% — its highest level since 2008 — from a current range between 2.25% and 2.5%. The S&P 500 and Dow Jones Industrial Average each shed around 1.7%, while the… Source link

Read More »