When legends speak, people listen – and few investors match the legendary status of Ray Dalio. The founder of Bridgewater Associates has built his firm from a 2-room apartment operation into the world’s largest hedge fund, with more than $150 billion in assets under management, and a net gain exceeding $46 billion. Dalio believes that the next two to four years will see our global economic and political systems change in ways that are unpredictable now. And the key to survival, for… Source link

Read More »Billionaire George Soros Bets on These 3 ‘Strong Buy’ Stocks

Keeping up the returns would be a neat trick in today’s market, as the main indexes are all steeply down for the year so far – with losses of 15% on the S&P 500 and 24% on the NASDAQ. For investors, then, the best strategy may just be to follow a winner. Billionaire investing legend George Soros is most definitely a winner. He’s built a portfolio worth billions, and had possibly the greatest bull run in hedge fund history, averaging 30% annualized returns for 30 years. Starting in 1992,… Source link

Read More »Time to Bottom Fish? 3 ‘Strong Buy’ Stocks That Are Down Around 50% This Year

What to make of the markets right now? Last week brought more losses in what’s been a volatile year for stocks. The five straight weeks of market declines marked the longest such streak in over a decade. More ominously, they came in along with a number of other disturbing data points. The April jobs numbers, released on Friday, came to 428,000 jobs added for the month, superficially strong and well above the 391,000 expected. But the labor remains depressed, and the total number of workers,… Source link

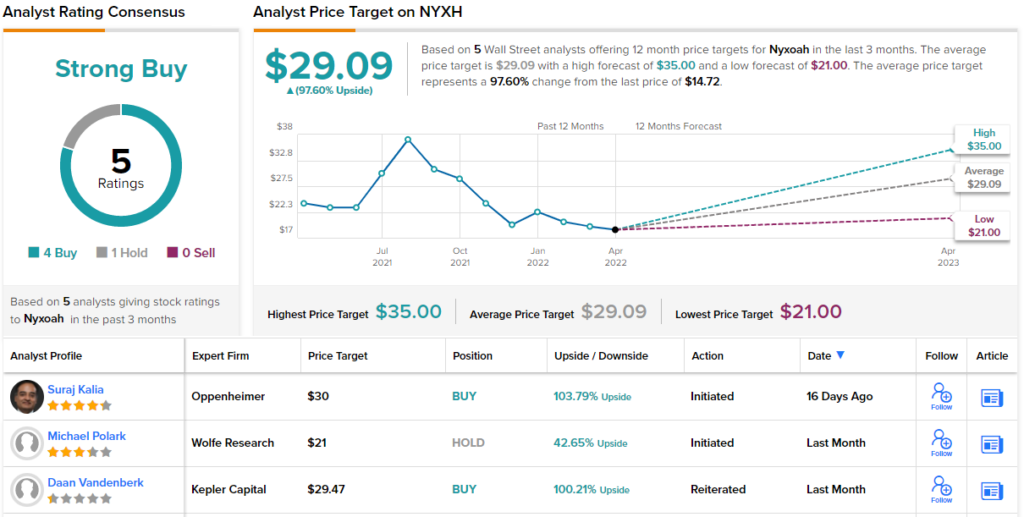

Read More »2 ‘Strong Buy’ Stocks Oppenheimer Sees Surging Over 80%

The markets went into bloodbath mode on Thursday as all the main indexes tumbled by at least 3%, with the NASDAQ’s 5% drop the most acute. That represented the tech-heavy index’s biggest one-day dive since June 2020. The force of the plunge confirms what we all know by now – the market headwinds are piling up, one upon the other. At its base, the issue is simple: there are too many problems, coming in too fast, and both the impersonal markets and the individual investors are finding it… Source link

Read More »Airbnb Q1 results top estimates as company sees ‘strong sustained pent-up demand’ for travel

Airbnb (ABNB) reported first-quarter results that exceeded estimates, as virus-related restrictions eased further and helped lift business. The company also reported its first quarter of positive adjusted EBITDA even as it navigated a jump in Omicron cases at the beginning of this year and international disruptions due to Russia’s invasion of Ukraine. Shares of Airbnb rose 6.5% in after-hours trading immediately following the results. Here’s what the lodging company posted in fiscal… Source link

Read More »2 “Strong Buy” Dividend Stocks With at Least 7% Dividend Yield

One thing is clear in the current market conditions: it’s a time of transition. Over the past four months, the stock market has shifted from the bull run we saw in 2021 into a far more volatile state of affairs. The market dipped into correction territory in March, bounced back out in April, and now is heading down again. One result of this has been an increase in bond yields, as equities have dropped. And with the Federal Reserve embarking on a new round of interest rate hikes, that… Source link

Read More »Brian Flores should stay strong in lawsuit

To Brian Flores, Steve Wilks and Ray Horton: Stay strong. Please stay strong. On Thursday, as part of documents submitted in the Flores class-action lawsuit against the league alleging racial discrimination, the NFL and the individual teams named in the lawsuit expressed their intention to file a motion to compel arbitration or alternatively, a motion to have the case dismissed entirely on the grounds that it is “without merit.” It’s to be expected that the league and teams would go this route… Source link

Read More »3 ‘Strong Buy’ Dividend Stocks to Consider as the Russia-Ukraine War Escalates

We’re closing in on two weeks since Russian forces invaded Ukraine, starting Europe’s largest land war since 1945. So far, the Western nations have avoided commitments to oppose Russian arms directly, and have responded by sending munitions and humanitarian aid to Ukraine while instituting sanctions against Russia. The situation is complicated by Russian’s position as a major producer in the global energy markets, and Europe’s increasing reliance in the past decade on Russian natural… Source link

Read More »Corporate America’s strong earnings into 2022 is good news for stocks: strategist

Central bank jitters and intensifying geopolitical tensions have pummeled equity markets in recent weeks and sent the S&P 500 into correction territory Tuesday for the first time in two years. But despite a turbulent start to 2022, strong earnings momentum remains a tailwind for stocks. The S&P 500 Index is on pace to beat the consensus estimate for earnings per share at $208 as companies finish logging fourth-quarter results. The figure is 22% higher than the EPS of $170 analysts had… Source link

Read More »2 “Strong Buy” Stocks That Are Too Cheap to Ignore

Volatility, and descending trends, that’s the path the markets are taking these days. While the usual headwinds are all in play, the chief worry now is coming from Eastern Europe. Will Russia invade, or won’t it? A shooting conflict, involving a superpower, taking place in one of Europe’s most agriculturally productive and mineral-rich countries, has huge potential for political and economic fallout, enough to keep pundits and market watchers awake at night. But an in-depth analysis of… Source link

Read More »