Is the bear market over? This is the question that everyone wants to know. After a near-historic decline over the first half of the year, the stock market has been on a roll over the past month, with the S&P 500 rising nearly 9%, while the Nasdaq is up 14%. JPMorgan chief global markets strategist Marko Kolanovic has an upbeat message for those concerned about the sustainability of the rally. “Risk markets are rallying despite some disappointing data releases, indicating bad news was already… Source link

Read More »JetBlue CEO sees ‘extremely strong’ demand, no ‘domination’ if it acquires Spirit

JetBlue CEO Robin Hayes sees no loss in altitude for consumer demand headed into the back half of the year, despite swirling recession fears and disappointing financial results from the airline. “Demand remains extremely strong,” Hayes said on Yahoo Finance Live Tuesday. “We continue to see extremely strong demand [into the fourth quarter.]” The bullish take from Hayes comes as JetBlue shares fell 6% on Tuesday’s session after higher costs for labor and fuel weighed on second quarter… Source link

Read More »2 ‘Strong Buy’ Dividend Stocks Under $10 With at Least 10% Dividend Yield

Dividend stocks are the Swiss army knives of the stock market. When dividend stocks go up, you make money. When they don’t go up — you still make money (from the dividend). Heck, even when a dividend stock goes down in price, it’s not all bad news, because the dividend yield (the absolute dividend amount, divided by the stock price) gets richer the more the stock falls in price. Knowing all this, wouldn’t you like to own find great dividend stocks? Of course you would! Using the Source link

Read More »2 “Strong Buy” Stocks That Are Too Cheap to Ignore

The last few days’ trading have been enough to make our heads spin. Markets have shifted up and down, showing both volatility and a short-term upward trend, a pattern that has investors wondering if this is the start of a sustained run of gains, or just a bear-market rally. Stiffel Chief Equity Strategist Barry Bannister believes that there’s less reason for fear and lays out a strong case for upside. “We forecast the S&P 500 up to 4,200 in 3Q22E and recommend Cyclical Growth groups…… Source link

Read More »Stocks close higher after upbeat retail sales, strong Citi earnings

U.S. stocks rallied Friday to cap a four-day losing streak on Wall Street. Sentiment was buoyed by better-than-expected retail sales data and a surprise earnings beat from Citigroup (C). The S&P 500 surged 1.9%, while the Dow Jones Industrial Average added 657 points, or roughly 2.2%. The tech-heavy Nasdaq climbed 1.8%. Blowout second-quarter results from Citi lifted shares of banking industry peers to post the best intraday rally for the sector since May, according to Bloomberg data. The mega… Source link

Read More »Here’s why Jim Cramer believes that the market will soon bounce and have a ‘strong rally’ through late August

After the S&P 500 posted its worst first-half performance since 1970, many investors are wondering whether the downtrend would continue for the remainder of the year. But according to CNBC’s Jim Cramer, we could be at a turnaround. “I said to [David Faber] that July 13th will be the bottom. I said that in February,” he reminds viewers. Cramer also uses analysis from market technician Larry Williams to show that the market could be ready for a rebound in the not-so-distant future. “The… Source link

Read More »Insiders Are Flashing a Strong Buy Signal for These 2 Stocks

Downturns can bring a lot of pain, but they can also bring on plenty of opportunities, as lower stock prices start making costs of entry more attractive. Before taking advantage of these opportunities, however, investors need to find a recognizable signal that will set them apart. One popular signal to follow is the insider buying, the trades made by high-ranking company officers whose positions give them the ‘inside’ track on their company’s likely prospects – and therefore, of the… Source link

Read More »Stocks drop after strong jobs data renews rate worries

U.S. stocks slid Friday to close the week lower as investors weighed May jobs data that likely gave Fed policymakers a signal labor market conditions can weather a more aggressive rate hiking cycle. Friday’s sell-off was led by tech stocks, with the Nasdaq Composite falling 2.5%. The S&P 500 fell 1.6%, while the Dow Jones Industrial Average shed 350 points, or 1%. Treasury yields rose following Friday’s jobs data, with the yield on 10-year Treasury jumping as much as 7 basis points to just… Source link

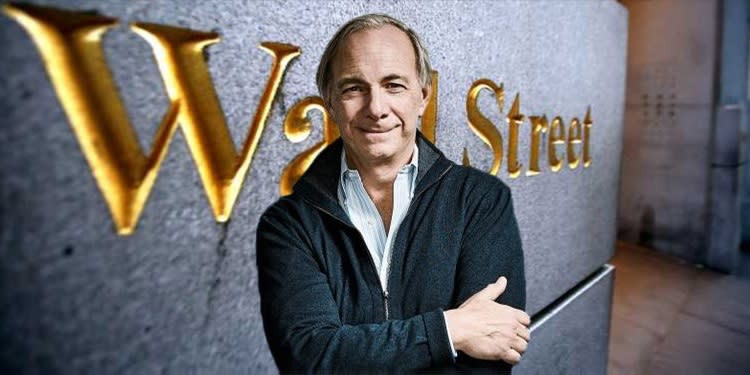

Read More »Billionaire Ray Dalio Pulls the Trigger on These 2 ‘Strong Buy’ Stocks

When legends speak, people listen – and few investors match the legendary status of Ray Dalio. The founder of Bridgewater Associates has built his firm from a 2-room apartment operation into the world’s largest hedge fund, with more than $150 billion in assets under management, and a net gain exceeding $46 billion. Dalio believes that the next two to four years will see our global economic and political systems change in ways that are unpredictable now. And the key to survival, for… Source link

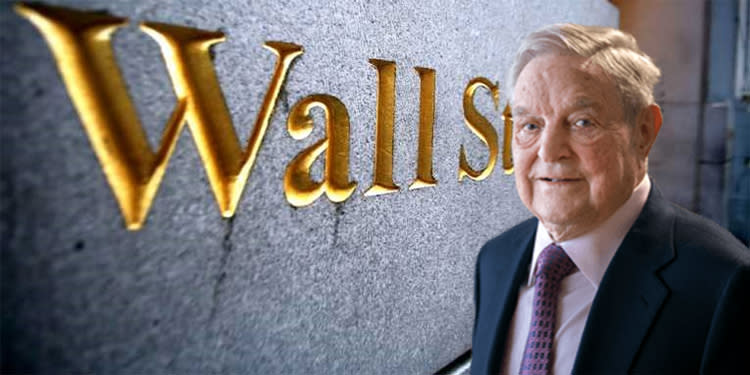

Read More »Billionaire George Soros Bets on These 3 ‘Strong Buy’ Stocks

Keeping up the returns would be a neat trick in today’s market, as the main indexes are all steeply down for the year so far – with losses of 15% on the S&P 500 and 24% on the NASDAQ. For investors, then, the best strategy may just be to follow a winner. Billionaire investing legend George Soros is most definitely a winner. He’s built a portfolio worth billions, and had possibly the greatest bull run in hedge fund history, averaging 30% annualized returns for 30 years. Starting in 1992,… Source link

Read More »