After a grisly 1H22 which represented the stock market’s worst performance since 1970, the second half is shaping up to be a bit of a disappointment too. After clawing back some of the losses, it’s been onto the slide again with the S&P 500 almost back to the mid-June lows. The bad news, according to billionaire investor Carl Icahn, is that things could still get worse from here. “I think a lot of things are cheap, and they’re going to get cheaper,” said Icahn, pointing to the… Source link

Read More »Stocks plummet as Fed, growth fears intensify

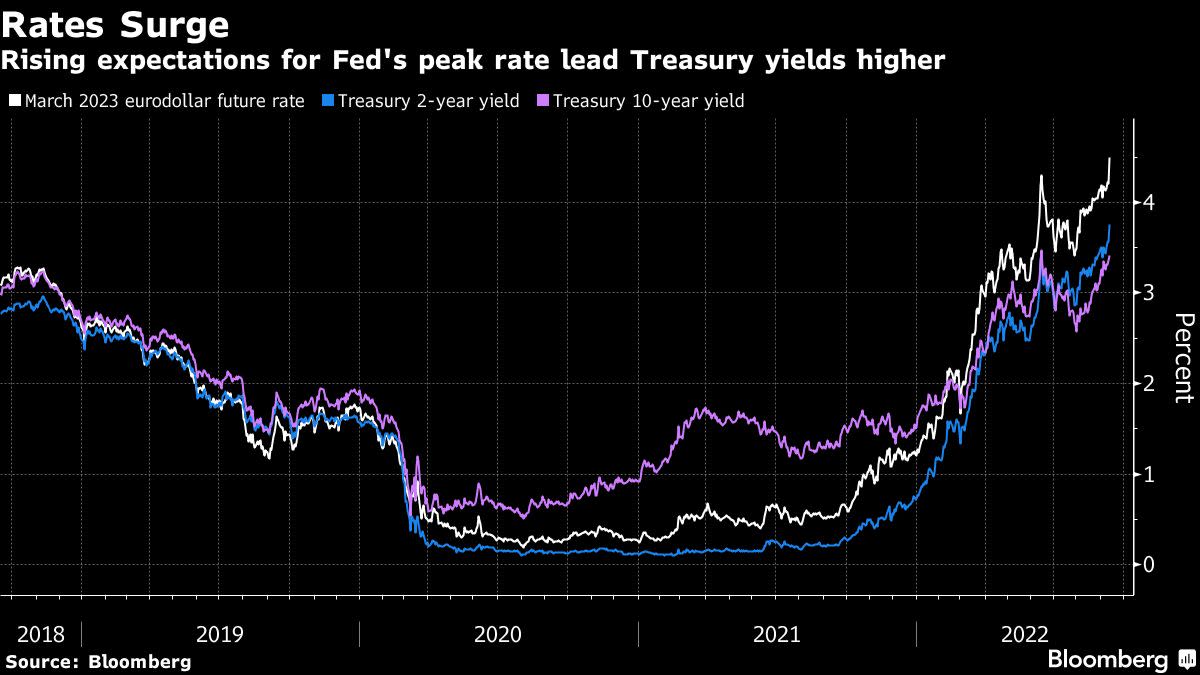

U.S. stocks slid Friday morning as fears of aggressive Federal Reserve policy had equity markets pace towards a big weekly loss and Treasury yields continue a perilous climb to fresh highs. The benchmark S&P 500 tumbled 1.2% early into the session. The Dow Jones Industrial Average plunged more than 300 points, or 1.1%, falling below the 30,000 level for the first time since June. The technology-heavy Nasdaq Composite off by 1.2%. Meanwhile, the 10-year U.S. Treasury note spiked above 3.7%,… Source link

Read More »Stocks fall for third day as investors mull rate hike, Powell remarks

U.S. stocks closed lower Thursday to cap a turbulent session after the Federal Reserve’s latest policy announcement and subsequent remarks from Chair Jerome Powell sent markets into disarray. The benchmark S&P 500 slid 0.9%, while the Dow Jones Industrial Average shed 100 points, or 0.4%. The technology-heavy Nasdaq Composite tumbled 1.4%. The moves extend a Fed-induced sell-off Wednesday that saw the S&P 500 and Dow each erase around 1.7% and the Nasdaq plummet 1.8%, and mark a third… Source link

Read More »Stocks plunge after rate hike, Powell comments

U.S. stocks tumbled in volatile trading Wednesday afternoon as the Federal Reserve dealt another outsized interest rate hike in its fight against stubborn inflation. The U.S. central bank lifted its benchmark policy rate by 0.75% for a third consecutive time, bringing the federal funds rate to a new range of 3.0% to 3.25% — its highest level since 2008 — from a current range between 2.25% and 2.5%. The S&P 500 and Dow Jones Industrial Average each shed around 1.7%, while the… Source link

Read More »“Dr. Doom” Roubini Expects a ‘Long, Ugly’ Recession and Stocks Sinking 40%

(Bloomberg) — Economist Nouriel Roubini, who correctly predicted the 2008 financial crisis, sees a “long and ugly” recession in the US and globally occurring at the end of 2022 that could last all of 2023 and a sharp correction in the S&P 500. Most Read from Bloomberg “Even in a plain vanilla recession, the S&P 500 can fall by 30%,” said Roubini, chairman and chief executive officer of Roubini Macro Associates, in an interview Monday. In “a real hard landing,” which he expects, it… Source link

Read More »Stocks on the move after hours: Ford, Cognex and more

Ford (F): Shares fell in extended trading after the company warned of larger costs due to inflation and supply chain challenges. Ford now sees inflation related supply costs to be about $1 billion higher during the quarter compared to its previous estimate and sees supply shortages to affect about 40,000 to 45,000 vehicles, shifting some revenue to the fourth quarter. Ford sees 3Q adjusted EBIT of $1.4 billion to $1.7 billion but reaffirmed its adjusted full-year EBIT guidance. Bitcoin ( Source link

Read More »Stocks fall as Wall Street braces for Fed meeting

U.S. stocks were firmly lower early Monday after all three major indexes logged their worst week in three months. The S&P 500, Dow Jones Industrial Average, and tech-heavy Nasdaq were each off by roughly 0.6% at the start of the trading session. Meanwhile in the bond market, the benchmark U.S. 10-year Treasury note spiked to 3.49%, its highest level since 2011, while the 2-year Treasury note inched past a 15-year high of 3.9%. Investors are gearing up for the Federal Reserve’s two-day policy… Source link

Read More »Stocks plummet on heels of FedEx earnings warning

Stocks tumbled Friday morning, deepening a sell-off across U.S. equity markets that placed all three major averages on pace for a weekly loss. The moves came as traders weighed an ominous warning from FedEx about the global economy. The S&P 500 slid 1.2% at the start of trading as the Dow Jones Industrial Average shed 350 points, or 1.1%. The technology-heavy Nasdaq Composite led losses, plunging 1.6%. FedEx (FDX) withdrew its full-year guidance late Thursday and delivered messaging around its… Source link

Read More »Rates at 4.5% Would Sink Stocks by 20%

(Bloomberg) — Ray Dalio came out with a gloomy prediction for stocks and the economy after a hotter-than-expected inflation print rattled financial markets around the globe this week. Most Read from Bloomberg “It looks like interest rates will have to rise a lot (toward the higher end of the 4.5% to 6% range),” the billionaire founder of Bridgewater Associates LP wrote in a LinkedIn article dated Tuesday. “This will bring private sector credit growth down, which will bring private… Source link

Read More »Morgan Stanley expects the S&P 500 to plunge another 17%-27% within the next four months — use these 3 top recession-resistant stocks for protection

Morgan Stanley expects the S&P 500 to plunge another 17%-27% within the next four months — use these 3 top recession-resistant stocks for protection If you think the stock market selloff has come to an end, Morgan Stanley has some bad news. The S&P 500 is already down 14% year to date, but the Wall Street juggernaut believes the market has yet to hit a bottom. “Our ’22/’23/’24 base case estimates are now 3%/13%/14% below consensus, respectively,” a team of Morgan Stanley analysts led by… Source link

Read More »