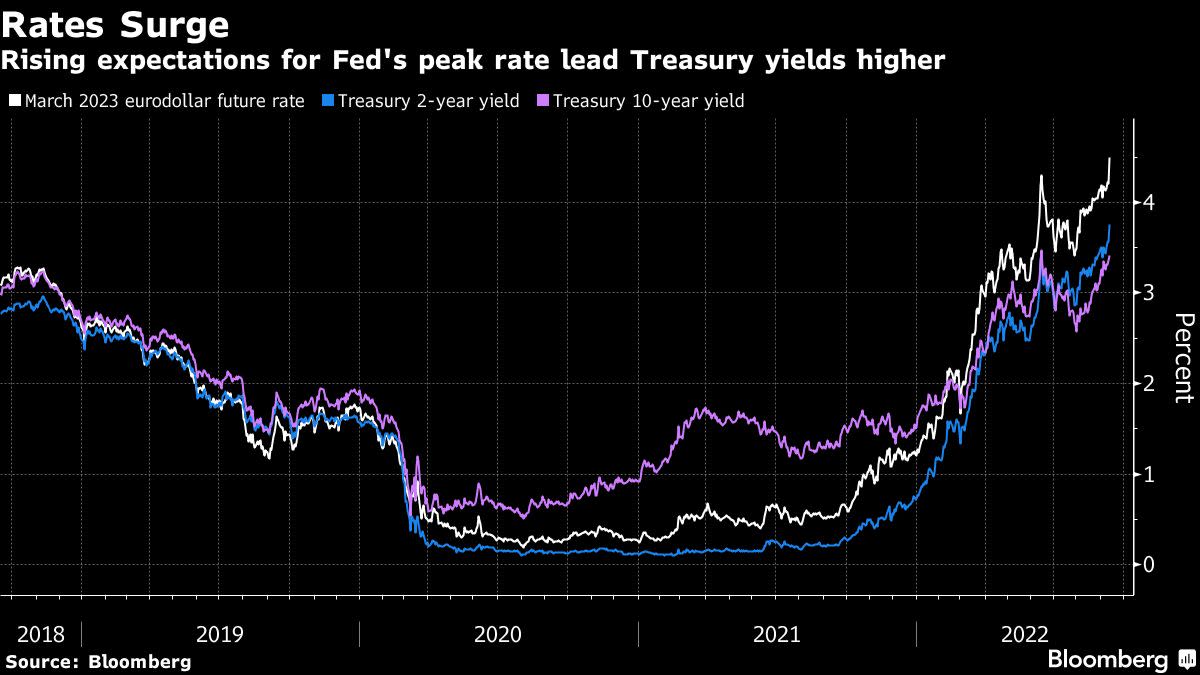

(Bloomberg) — Ray Dalio came out with a gloomy prediction for stocks and the economy after a hotter-than-expected inflation print rattled financial markets around the globe this week. Most Read from Bloomberg “It looks like interest rates will have to rise a lot (toward the higher end of the 4.5% to 6% range),” the billionaire founder of Bridgewater Associates LP wrote in a LinkedIn article dated Tuesday. “This will bring private sector credit growth down, which will bring private… Source link

Read More »Mortgage rates close in on 6%, highest since 2008

Mortgage rates hit their highest point since November 2008 this week, crushing homebuyer demand. The rate on the 30-year fixed mortgage jumped to 5.89% from 5.66% the week prior, according to Freddie Mac. Rates have surged nearly three-quarters of a point in just three weeks and are now over 2.5 percentage points higher than the start of this year. Elevated borrowing costs and inventory shortages have pushed inflation-struck homebuyers to the sidelines, while those who remain in the market are… Source link

Read More »Mortgage rates jump over a half-point in two weeks

Mortgage rates jumped again this week, giving no relief to the price-weary homebuyers still in the market. The rate on the 30-year fixed mortgage increased to 5.66% from 5.55% the week prior, according to Freddie Mac, and is up more than a half-point from two weeks ago. While lower than the 5.81% registered in June, the rate remains over 2 percentage points higher than the start of the year. Higher borrowing costs have left cash-strapped homebuyers at a divide. Some folks have opted to put off… Source link

Read More »Rates will rise until the ‘job is done’ bringing down inflation

Federal Reserve Chairman Jerome Powell on Friday said the central bank’s job on lowering inflation is not done, suggesting that the Fed will continue to aggressively raise interest rates to cool the economy. “We will keep at it until we are confident the job is done,” Powell said in remarks delivered at the Fed’s annual conference in Jackson Hole, Wyoming. “While the lower inflation readings for July are welcome, a single month’s improvement falls far short of what the Committee… Source link

Read More »Mortgage rates surpass 5% again

Mortgage rates jumped back above 5%, after briefly and barely falling below that level last week. The rate on the 30-year fixed mortgage increased to 5.22% from 4.99% the week prior, according to Freddie Mac. While the rate remains lower than the 5.81% registered in June, it’s still 2 percentage points higher than the start of the year. The jump in rates is discouraging news for sidelined, price-shocked buyers, who are contending with tough affordability conditions. Meanwhile, homeowners are… Source link

Read More »Stocks surge as Fed hikes rates by 75 basis points

U.S. stocks surged Wednesday as investors mulled a major decision from Federal Reserve policymakers to raise interest rates by 0.75% and remarks from Chair Jerome Powell hinting the central bank may slow the pace of its rate-hiking cycle. Better-than-expected earnings from tech giants also helped lift sentiment. The S&P 500 jumped 2.6%, while the Dow Jones Industrial Average gained 430 points, or roughly 1.4%. The tech-heavy Nasdaq Composite soared 4.1%. The Fed on Wednesday issued another 75… Source link

Read More »Federal Reserve to raise rates again at 2 pm ET

The Federal Reserve on Wednesday raised interest rates by 0.75% as the central bank attempts to avoid a deep recession. The decision to move by 0.75% matched the magnitude of the Fed’s last move in June, which was its largest single-meeting rate increase since 1994. Wednesday’s decision was unanimously agreed upon by voting members of the Federal Open Market Committee. The Fed has now moved in four consecutive meetings to increase borrowing costs in America, extending its effort to dampen… Source link

Read More »Tech leads stocks higher as earnings rush in, ECB hikes rates

Technology stocks led markets higher for a third straight session Thursday as investors mulled a slew of mixed earnings and a surprise rate hike from the European Central Bank. The tech-heavy Nasdaq Composite gained 1.3%, while the benchmark S&P 500 index rose 1%. The Dow Jones Industrial Average added 160 points, or 0.5%. Shares of Amazon (AMZN) pushed higher for a seventh straight day, placing the e-commerce giant on pace for its longest winning streak since June 2020. The stock climbed 13%… Source link

Read More »Mortgage rates jump after two weeks of declines

Mortgage rates are back up again following two weeks of declines that did little to boost homebuyer demand. The rate on the 30-year fixed mortgage jumped to 5.51% from 5.30% the week prior, according to Freddie Mac. While lower than the 5.81% registered in late June, the average rate is still more than 2 percentage points higher than the beginning of the year. Rates add to the challenging affordability conditions homebuyers are facing that include persistently high inflation and now newfound… Source link

Read More »Homeownership just got 5% cheaper as mortgage rates fall off a cliff

Homeownership just got 5% cheaper as mortgage rates fall off a cliff U.S. mortgage rates fell sharply and for the second straight week as monetary policies meant to slow the economy take hold of the housing market. The rate on the popular 30-year fixed mortgage hasn’t fallen this much since December 2008, a new report shows. Though rates have been rising for most of this year, the recent dips provide a sliver of hope for buyers. Purchasing a home is now about 5% more affordable than it was a… Source link

Read More »