(Bloomberg) — The Federal Reserve delivered the biggest interest-rate increase since 2000 and signaled it would keep hiking at that pace over the next couple of meetings, unleashing the most aggressive policy action in decades to combat soaring inflation. Most Read from Bloomberg The U.S. central bank’s policy-setting Federal Open Market Committee on Wednesday voted unanimously to increase the benchmark rate by a half percentage point. It will begin allowing its holdings of Treasuries and… Source link

Read More »Fed raises interest rates by 0.50%, largest move since 2000

The Federal Reserve on Wednesday raised short-term interest rates by 0.50%, as part of an effort to tamp down the inflationary pressures weighing on Americans. The central bank suggested that it will further raise borrowing costs throughout this year as it attempts to undo its pandemic-era, easy money policies. The policy-setting Federal Open Market Committee also detailed plans on unwinding its nearly $9 trillion balance sheet. The decision to raise rates by 0.50% marked the most aggressive… Source link

Read More »Interest rates to move ‘expeditiously’ higher

San Francisco Fed President Mary Daly said Thursday that she sees the case for quickly moving to raise interest rates this year as inflation remains high. “I like to think of it as expeditiously marching towards neutral. It’s clear the economy doesn’t need the accommodation we’re providing,” Daly told Yahoo Finance in an exclusive interview Thursday. The Fed hopes that raising borrowing costs will dampen the consumption and spending that has pushed prices higher. The central banker told Yahoo… Source link

Read More »Bitcoin Risk-Reward Calculation is Being Upended by Rising Rates

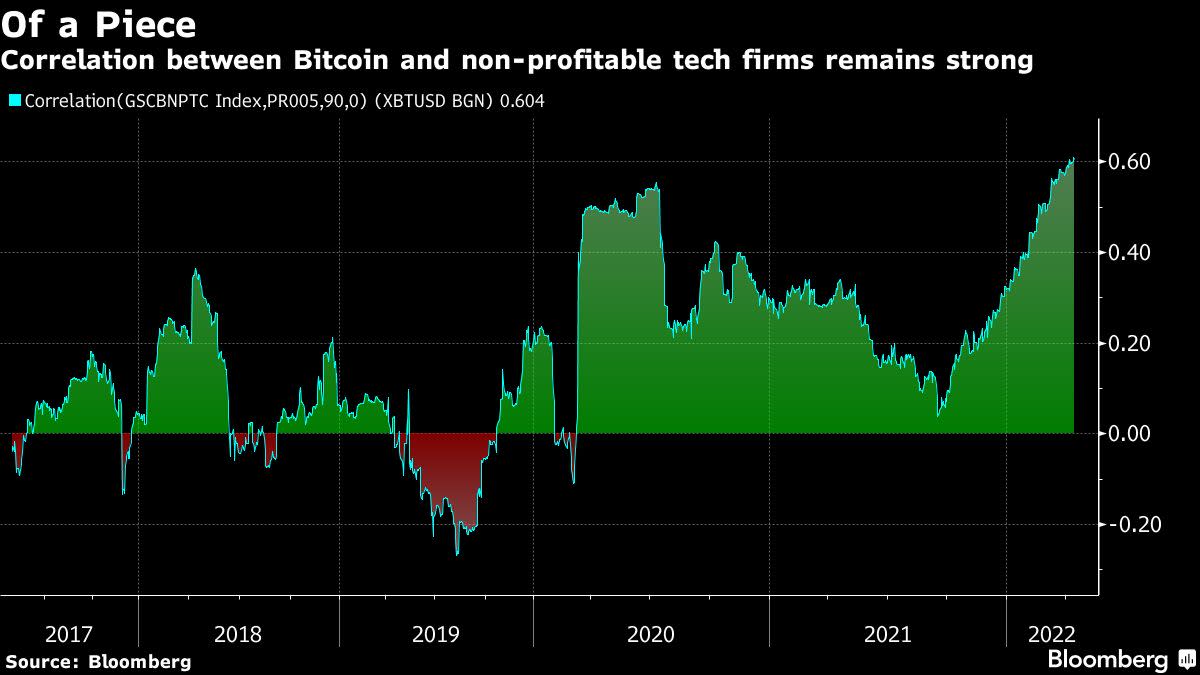

(Bloomberg) — A funny thing happened to Bitcoin as interest rates started to rise: trading volumes went way down. Now market-watchers are grappling with the implications and what a world of less-loose monetary policy means for digital assets. Most Read from Bloomberg The aggregate 30-day moving-average volume for Bitcoin across Coinbase, Bitfinex, Kraken and Bitstamp is at its lowest level since August 2021, according to data compiled by Strahinja Savic at FRNT Financial. Over the last month,… Source link

Read More »Single mom sues coding boot camp over job placement rates

A single mom who signed up for a $30,000 income-share agreement at a for-profit coding bootcamp has filed a lawsuit in California, alleging she entered the agreement under “false pretenses.” Redmond, Washington-based Emily Bruner is suing Bloom Institute of Technology, formerly known as Lambda School, and its head Austen Allred, alleging they misrepresented job placement rates, operated without a license during her course of study, and hid the “true nature” of the school’s financial… Source link

Read More »Economic slowdown has to be ‘dramatic’ as Fed raises interest rates: top economist

Seth Carpenter, Morgan Stanley chief economist and former Federal Reserve deputy director of monetary affairs, thinks there is no way around a sharp slowing of the economy as the Federal Reserve embarks deeper into its rate hiking cycle. “If you think about what the Fed itself thinks is the long-run sustainable growth rate of the economy, they think that rate of growth is below 2%. And so if you take a growth rate in the economy that’s above 5% or 6%, and you’re going to try to bring it down… Source link

Read More »Fed to hike rates ‘higher than the markets expect’

The head of the largest U.S. bank said markets are underestimating the speed by which he expects the Federal Reserve to raise interest rates. In a letter to shareholders released Monday, JPMorgan Chase CEO Jamie Dimon added that short-term borrowing costs need to be “substantially” higher to address the rapid pace of price increases. “The stronger the recovery, the higher the rates that follow (I believe that this could be significantly higher than the markets expect),” Dimon penned in… Source link

Read More »When will interest rates on savings accounts finally go up?

U.S. consumers have begun to feel reverberations from the Federal Reserve’s interest rate hike earlier this month in some areas of their lives, but not in others. Unfortunately for those consumers, it’s all the wrong places — their savings accounts haven’t budged. Mortgage rates jumped immediately from 4.16% to around 4.5%, and are now ticking up close to 5%. This sent the number of applications down 8.1% the following week, according to the Mortgage Bankers Association. The average… Source link

Read More »Rising interest rates may be a good thing for home prices: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Tuesday, March 22, 2022 Home prices are soaring and later this morning we will find out by how much, when the latest S&P CoreLogic Case-Shiller national home price index is released. On top of exorbitant home prices, mortgage rates are on the rise — the 30-year fixed mortgage (most common among homebuyers) topped 4% earlier this month for the… Source link

Read More »Fed has ‘lost a lot of credibility’ by not raising rates sooner: Strategist

The Federal Reserve announced that it would raise its benchmark Federal Funds Rate target range to between 0.25% and 0.50% last Wednesday in a long-awaited move seeking to combat decades-high inflation. The move is long overdue, Marketgauge.com Partner and Director of Trading Research & Education Michele Schneider told Yahoo Finance Live in a recent segment. “I think it should have happened already, quite honestly,” she said. “I think they should have been less concerned [with market… Source link

Read More »