The U.S. still remains ‘a ways away’ from reaching an international agreement to impose a price cap on Russian oil exports, with limited enthusiasm from the world’s largest energy buyers India and China, so far, a Senior Biden energy advisor said. But Amos Hochstein, Special Coordinator for International Energy Affairs for President Biden, said he remains optimistic that Russia would ultimately continue its output despite a price limit, in large part because ‘their economy has nothing… Source link

Read More »Biden’s adviser says oil reserve releases must end

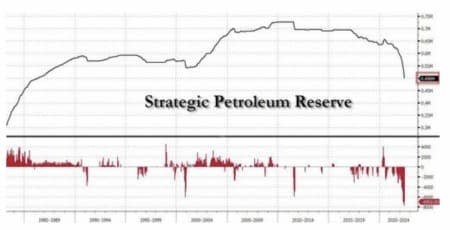

One of Biden’s top energy aides confirmed Friday the administration won’t extend the oil releases from the Strategic Petroleum Reserve that are scheduled to end this fall. The Strategic Petroleum Release “was really a stop-gap measure,” says Amos Hochstein, Biden’s Special Presidential Coordinator for International Energy Affairs. “We can’t be an oil supplier. It’s a reserve and so we have to keep that.” He vowed that ending the releases won’t spur supply shocks, noting that the… Source link

Read More »Saudis Say Oil Decisions Are for OPEC+ as Biden Leaves Kingdom

(Bloomberg) — Saudi ministers insisted that oil policy decisions would be taken according to market logic and within the OPEC+ coalition, just as US President Joe Biden wrapped up a landmark trip to the kingdom. Most Read from Bloomberg Biden said late Friday that the Saudis shared his “urgency” to increase oil supply and he expects “further steps in the coming weeks” to that end. Saudi officials stressed any decision to pump more would be made in the framework of OPEC+, which holds… Source link

Read More »Why Is The U.S. Sending Its Emergency Oil Reserves To China?

U.S. SPR release were exported to Europe and Asia last month, including top US geopolitical nemesis in the global arena, China, even as U.S. gasoline and diesel prices hit record highs. The export of crude and fuel is blunting the impact of the moves by U.S. President Joe Biden to lower record pump prices. In a call, Biden on Saturday renewed a call for gasoline suppliers to cut their prices, drawing rightful criticism from Amazon founder Jeff Bezos, because going after mom and pop gas stores… Source link

Read More »Oil Markets Could Face A Doomsday Scenario This Week

Global oil markets are going to be very volatile in the coming months if news emerging from OPEC’s main producers about production capacity constraints turns out to be true. OPEC will be meeting again in the coming days to discuss its export agreements, while today the oil group is presenting its Annual Statistical Bulletin (ASB) 2022. While the media is likely to be focused on rumors in the next 24 hours of a possible change in the export strategy of OPEC+, the real focus should be on… Source link

Read More »Here’s why Warren Buffett bought all the Occidental Petroleum shares he could, even with oil prices well above $100

Here’s why Warren Buffett bought all the Occidental Petroleum shares he could, even with oil prices well above $100 Warren Buffett kept a lot of cash on hand in recent years. At the end of 2021, the cash pile at his holding company Berkshire Hathaway had grown to a near-record $146.7 billion. That shouldn’t come as a surprise. Buffett is a value investor, after all, and valuations were bloated in the U.S. stock market after significant rallies in 2020 and 2021. “We find little that… Source link

Read More »The White House summons oil executives to Washington and say they are hoping for more than ‘just scolding’

As part of a range of actions this week on gas prices, the Biden administration has summoned the heads of seven top oil refining companies to Washington after a week of tense back-and-forth with industry leaders. The CEOs will meet with Energy Secretary Jennifer Granholm after the president blasted their high profits as “not acceptable” in a recent letter to the companies. In one response, Chevron (CVX) pushed back by saying that Washington’s approach was actually the culprit for high… Source link

Read More »Saudi Arabian Stocks Tumble as Oil, Rates Roil Mideast Equities

(Bloomberg) — Most Read from Bloomberg Saudi Arabian shares closed at the lowest level in about six months, leading declines in Middle East markets, following the global sell-off last week and oil’s plunge on Friday. The Tadawul All Share Index dropped 4.4% at close, with the index posting its longest losing streak since 2020. Aramco fell 4% to the lowest since March 15. Still, the state-controlled oil firm is the world’s biggest listed entity with a market value of $2.17 trillion compared… Source link

Read More »Biden and the oil industry are talking past each other

Remember the outrage when a handful of U.S. oil refineries closed in 2020? If you don’t, that’s because there wasn’t any outrage. Oil and gasoline prices were blissfully low and the COVID-19 pandemic dominated the news. Hardly anybody noticed. Energy investors certainly did, however, because 2020 was one of the worst years in history for energy producers. Exxon Mobil notched the first loss in its history, a gigantic $22 billion write-off. The five biggest U.S. oil refiners — Marathon… Source link

Read More »Why there’s no relief in sight for soaring oil and gas prices

Everybody’s frustrated. If somebody could do something about it, it would be done. But oil and gasoline prices are on a tear that for the time being seems unstoppable. U.S. gasoline prices have hit $5 per gallon for the first time ever, and Moody’s Analytics thinks they could hit $5.50 within a couple of weeks. There’s no mystery why. A confluence of forces, led by Russia’s invasion of Ukraine, has crimped oil supply and bumped up demand. There’s more that could go wrong, adding a… Source link

Read More »