(Bloomberg) — Oil was stable amid signs that continued coronavirus lockdowns in China are weighing on the economy, countering bullish news that protests are shutting in supplies from Libya. Most Read from Bloomberg West Texas Intermediate traded just below $107 a barrel after rallying last week by the most since early March. China reported its biggest decline in consumer spending and worst unemployment rate since the first months of the pandemic, while Shanghai reported its first deaths from… Source link

Read More »What $100 per barrel oil means for risk of recession

Oil prices have come down below $100/barrel after staying above that level for much of last month. The Ukraine-Russia war worsened the upward trend costs for energy across the globe. Yahoo Finance asked several experts what sustained prices above $100/barrel means for a risk of a recession in the U.S. and in other parts of the world. Most agree oil would have to stay closer to $130 in order to create enough demand destruction to spur a recession in this country. But some parts of the world… Source link

Read More »China’s Covid Lockdowns, Surging Oil Add to Inflation Risks

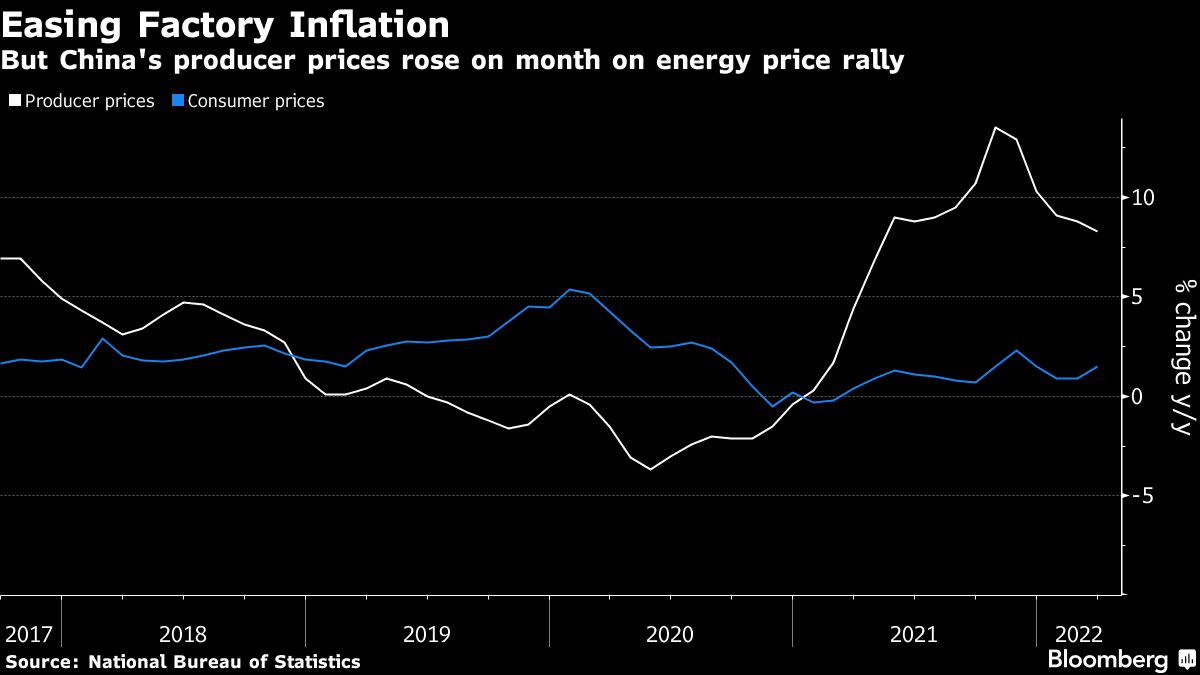

(Bloomberg) — China’s factory gate prices rose more than expected in March as oil prices climbed, while disruptions from Covid lockdowns drove up food costs, threatening the inflation outlook in the world’s second-largest economy. Most Read from Bloomberg The producer price index gained 8.3% from a year earlier, official data showed Monday, down from 8.8% in February and above the median estimate of an 8.1% increase in a Bloomberg survey of economists. Consumer-price growth accelerated to… Source link

Read More »Putin’s former chief economic adviser says Russia would likely halt the Ukraine war ‘within a month or two’ if the West slapped a full embargo on Russian oil and gas

Russian President Vladimir Putin.Pool Sputnik, AP Andrei Illarionov, Putin’s former chief economic adviser, was interviewed by the BBC. He said Putin would likely halt the Ukraine war if the West stopped buying Russian oil and gas. Many Western nations remain heavily reliant on Russian energy exports. Vladimir Putin’s former chief economic adviser has suggested that Russia would halt military operations in Ukraine “within a month or two” if Western countries stopped buying Russian oil and gas. In… Source link

Read More »How Biden could lower oil and gas prices

Biden administration officials have been publicly and privately cajoling energy executives to increase production and help lower gasoline prices, which are well above $4 per gallon. Asking won’t work, however. Even if they ask nicely. Oil and natural gas producers base drilling decisions on economic factors and profitability estimates, not on requests from politicians. If President Biden wanted to, his administration could adjust federal policy in ways that would make fossil fuel… Source link

Read More »What President Biden releasing oil from reserves may mean for gas prices

President Biden signing off on an oil release from the Strategic Petroleum Reserve (SPR) to cool elevated prices may have some effect, but not a ton, warns Goldman Sachs. “Conceptually, such a release would help the oil market rebalancing in 2022, increasing supply by 1 millions barrels per day for six months, for example. This would reduce the amount of necessary price-induced demand destruction, the sole oil rebalancing mechanism currently available in a world devoid of inventory buffers… Source link

Read More »Why you should fear oil prices at $90, $100, $150, or $200: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Monday, March 28, 2022 Almost any direction you look, it points to higher oil prices and a potentially damaging effect on the global economy — one the market will have to factor in once and for all. To be sure, the stage is set for a renewed push higher in oil prices after a momentary relief sell-off. President Biden’s “cannot remain in power”… Source link

Read More »Oil at ‘$150 isn’t outside the realm of possibility’: energy trader

Oil at $150 a barrel is not “outside the realm” of possibilities, says one energy trader. “It’s hard to take anything off the table right now. Russia is starting to retaliate with its own response to U.S. sanctions, whether that’s demanding payments in rubles or potentially not allowing crude to flow through a very prominent pipeline through Kazakhstan,” Rebecca Babin, senior equity trader for CIBC Private Wealth, told Yahoo Finance Live. “As we’ve seen this escalate in ways that were very low… Source link

Read More »Stocks mixed, oil prices resume advances

Stocks traded mixed Monday to steady after last week’s gains, while energy prices resumed a march higher. The S&P 500 edged slightly higher, while the Dow and Nasdaq dipped. Trader’s paused after last week’s gains, when the S&P 500 posted its first weekly advance in three weeks and its largest since November 2020. The Treasury yield curve steepened, and the benchmark 10-year yield rose to top 2.2%. Energy and commodity prices spiked amid the latest developments in Russia’s war in Ukraine. As… Source link

Read More »Why billionaire Warren Buffett is buying this oil stock

Warren Buffett is right to be devouring shares of oil giant Occidental Petroleum (OXY), says one long-time oil markets strategist. The billionaire investor’s Berkshire Hathaway (BRK-A, BRK-B) scooped up another 18.1 million shares of Occidental for close to $1 billion this week. The latest purchases come hot on the heels of Berkshire spending $6 billion or so in the prior two weeks to buy up Occidental shares. Berkshire now owns nearly 14.6% of Occidental Petroleum through his roughly 140… Source link

Read More »