There are a multiple headwinds buffeting the markets right now, pushing stocks, bonds, and commodities in various directions. Between stubbornly high inflation, the war in Ukraine, the persistence of COVID, and even the developing instability in Chinese real estate, the possible shocks that can hit the market are enough to make any investor’s head spin. They are also a strong inducement to start taking a defensive stance on an investment portfolio. At least, that’s the bottom line from… Source link

Read More »A Morgan Stanley investing chief says the Russia/Ukraine conflict is ‘a big deal’ for markets and anyone trying to trade it on a short-term basis will likely get it wrong

Russia invaded Ukraine Thursday, shelling key strategic targets.Vadim Zamirovsky/AP Morgan Stanley Wealth Management CIO Lisa Shalett said the Russia-Ukraine conflict will keep markets in risk-off mode for weeks. She said a rapidly-changing situation often results in a flight out of risk assets, but this isn’t a good strategy in the longer run. Russia invaded Ukraine on Thursday in the region’s largest military operation since World War 2. Financial markets have been roiled this week after… Source link

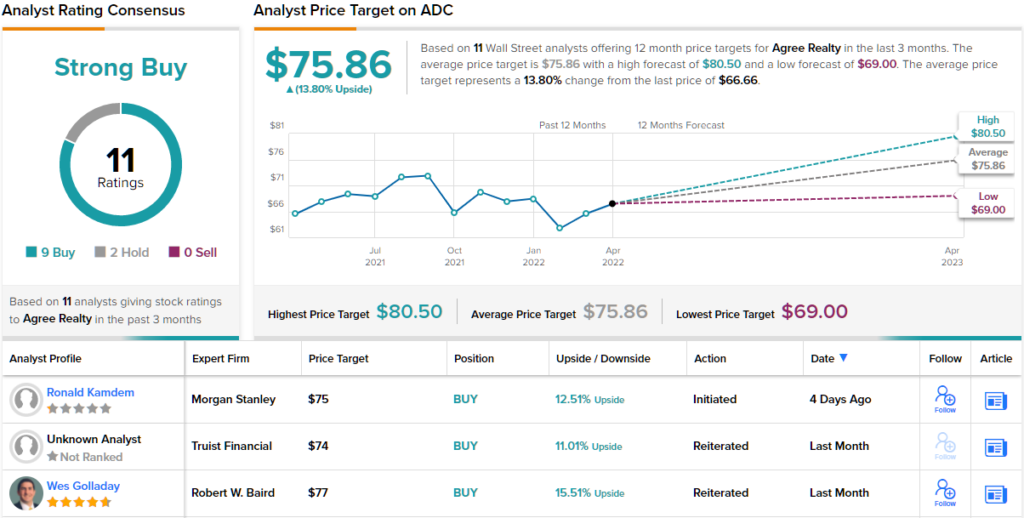

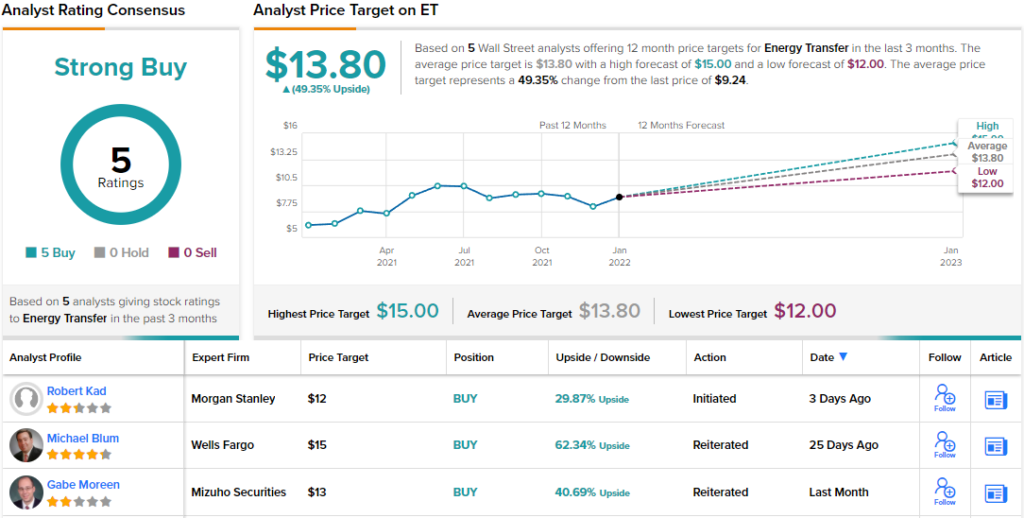

Read More »Seeking at Least 6% Dividend Yield? Morgan Stanley Suggests 2 Dividend Stocks to Buy

One thing is certain already: the market environment for 2022 will not be the same as that in 2021. This may or may not be good for investors, per se, but like every shift in market conditions, it will present opportunities for those prepared to grasp them. Some factors are just reruns. COVID is rearing its ugly head again, threatening us with lockdowns and shutdowns. That’s running against the grain of a resurgent economy, an economy that is trying to gain more traction – but it’s… Source link

Read More »Unemployment rate will drop to nearly 3% in 2022: J.P. Morgan economist

Down goes the U.S. unemployment rate in 2022, contends J.P. Morgan chief U.S. economist Michael Feroli. “I think by the end of the year [2022] we could see the unemployment rate around 3%,” said Feroli on Yahoo Finance Live. “It’s stunning to see how much the rate has fallen in the last five months. We expect that pace of decline to slow, but it doesn’t take much to get below 4%. Even with a tick up in the labor participation rate which has been depressed over the last year and a half.” To… Source link

Read More »Amazon Target Cut at Morgan Stanley on Impact From Rising Wages

(Bloomberg) — Amazon.com’s price target was cut at Morgan Stanley, which wrote that the online retailer’s profits could come under pressure as a result of a rising headcount and higher wages. Most Read from Bloomberg The firm lowered its target from $4,300 to $4,100, putting it below the average analyst target of $4,157. The new view still points to upside of almost 20% from Amazon’s last close. Morgan Stanley, along with every other firm tracked by Bloomberg, recommends buying the… Source link

Read More »Morgan Stanley Sees Growing Risk of 20% Drop in S&P 500

(Bloomberg) — A plunge of more than 20% in U.S. stocks is looking more like a real possibility, according to Morgan Stanley strategists led by Michael Wilson. Most Read from Bloomberg While it’s still a worst-case scenario, the bank said that evidence is starting to point to weaker growth and falling consumer confidence. In a note on Monday, the strategists laid out two directions for U.S. markets, which they dubbed as “fire and ice.” In the fire outcome, the more optimistic view, the… Source link

Read More »Stocks could be due for a correction of up to 20% ‘by fire or ice’: Morgan Stanley strategist

Morgan Stanley’s Chief Investment Officer Mike Wilson says investors should always be positioned for a market correction of 10%, but warned that investors may not be ready for a harsher correction that could be coming soon. “You should always be expecting a 10% correction. If you’re investing in equities, you should be prepared for that at any time,” Wilson told Yahoo Finance on Friday. “A 20% correction, which is really more disruptive, where people might want to try and position… Source link

Read More »J.P. Morgan Says These 2 Stocks Are Ready to Rip Higher

Year-to-date, the market trends are highly positive. The S&P 500 is up ~18%, while the tech-heavy NASDAQ, has put up a 14.5% year-to-date gain. There are potential headwinds – inflation is a worry, as is the possibility of further COVID-related restriction policies. But for now, the economy is mostly open, consumers are starting to spend, and investors seem optimistic. As J.P. Morgan’s chief US strategist Dubravko Lakos-Bujas recently put it, the economic gains are “not an event but… Source link

Read More »Morgan Stanley Buys Over 28,000 Shares of Grayscale Bitcoin Trust

Megabank Morgan Stanley has purchased 28,289 shares of Grayscale Bitcoin Trust through its Europe Opportunity Fund, according to an SEC filing. Grayscale is owned by CoinDesk parent company Digital Currency Group. Morgan Stanley has been increasingly active in the cryptocurrency space in recent months to meet growing demand from its clients. In April, the firm allowed a handful of its funds to invest indirectly in bitcoin through cash-settled futures contracts and Grayscale’s Bitcoin Trust,… Source link

Read More »Morgan State receives $6.25M in grants from Apple and Google

Northeast Baltimore’s Morgan State University received grants from Apple and Google totaling $6.25 million that aim to create equity in tech by building a STEM pipeline at Historically Black Colleges and Universities (HBCUs), the university announced last week. These initiatives from Apple and Google are designed to curb trends that have led to racial disparities on tech teams. The number of U.S. technical employees who are Black or Latinx rose by less than a percentage point at Google and… Source link

Read More »