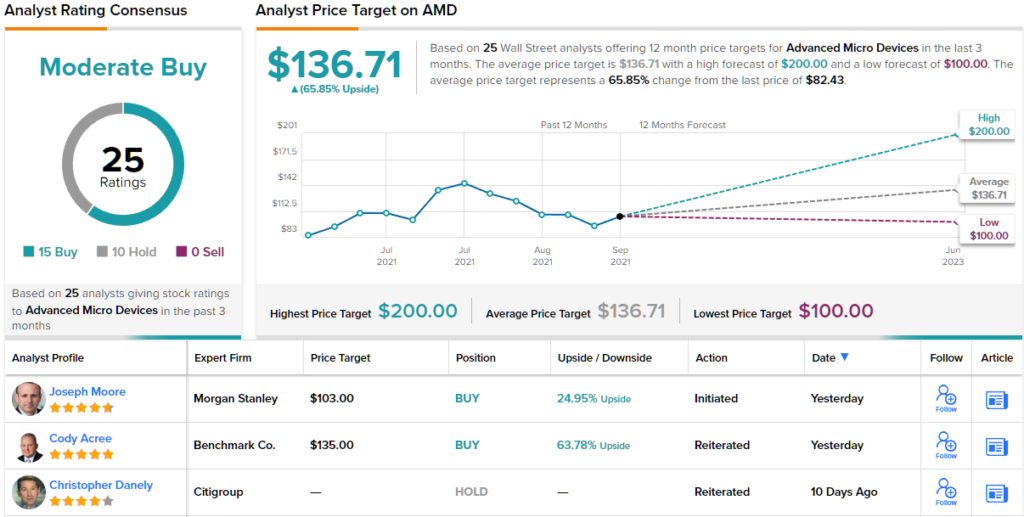

With the seemingly endless selection of headwinds plaguing 2022, this year is panning out like no other in recent times. Just ask investors in Advanced Micro Devices (AMD). After making a habit of consistently outperforming the market, AMD shares have been on the backfoot in 2022 (down 43%) – a highly irregular occurrence. Yet, according to Morgan Stanley’s Joseph Moore, despite the macro uncertainty, it is now time investors cotton on to the opportunity following the stock’s… Source link

Read More »J.P. Morgan Says There’s Room for at Least 50% Gains in These 2 Stocks

Despite the modest rally that we’ve seen since late May, volatility still rules the markets. The overall trend for the year has been down – to the tune of 14% on the S&P 500 and 23% on the NASDAQ. It’s not exactly an environment that would encourage large-scale buying. But Marko Kolanovic, global market strategist from JPMorgan, takes the contrarian view, explaining why, in his view, current low prices represent opportunities. “As the market got into oversold conditions, it didn’t… Source link

Read More »Morgan Stanley executive warns of a recession and even bigger ‘paradigm shift’

The economy is likely to blow hot and cold for the immediate future, Morgan Stanley’s copresident says, as the economy swings between fears of inflation and fears of contraction. Last week, Ted Pick, head of institutional securities at investment bank Morgan Stanley, joined bankers and investors from Jamie Dimon to Carl Icahn in warning that chances of a recession are steadily rising, marked by periods of a hot and cold economy. “There is a fire narrative, and that fire narrative is… Source link

Read More »J.P. Morgan Sees an ‘Attractive Entry Point’ in These 2 Stocks

Did markets hit a turning point? The past couple of months brought us a seven-week losing streak in stocks, the longest such streak in over a decade, but the week before the Memorial Day holiday weekend saw strong gains. The S&P 500 wiped out its May losses. Post-holiday trading shows that some of these gains are continuing. If so, then it makes this the ideal time to ‘buy the dip,’ to get in while stocks remain at low cost, with attractive entry points. That’s the view from investment… Source link

Read More »Piers Morgan reacts to Texas shooting, calls for US gun control

In a new essay, Piers Morgan shares why he fears American gun violence will continue. (Photo: Dominic Lipinski/PA Images via Getty Images) Piers Morgan fears that American gun violence will continue due to the nation’s “religion” of guns. In an essay for , the English television personality reflected on the Tuesday , which . The massacre was the seventh deadliest shooting in the United States and the second deadliest at an elementary school, . It also came 10 days after a , which claimed… Source link

Read More »J.P. Morgan Makes 2 Bottom-Fishing Bets for Over 90% Upside Potential

Stock markets have been bearing the brunt of multiple headwinds in recent months. Persistently high inflation, slowing GDP growth, and a jobs market that, while expanding in absolute terms, is still down from pre-pandemic levels are feeding fears that we’re facing a round of ‘70’s-style stagflation. And these have combined with geopolitical factors – the Russia-Ukraine war, the resumption of severe lockdown policies in China – to ratchet up worries about recession in the near… Source link

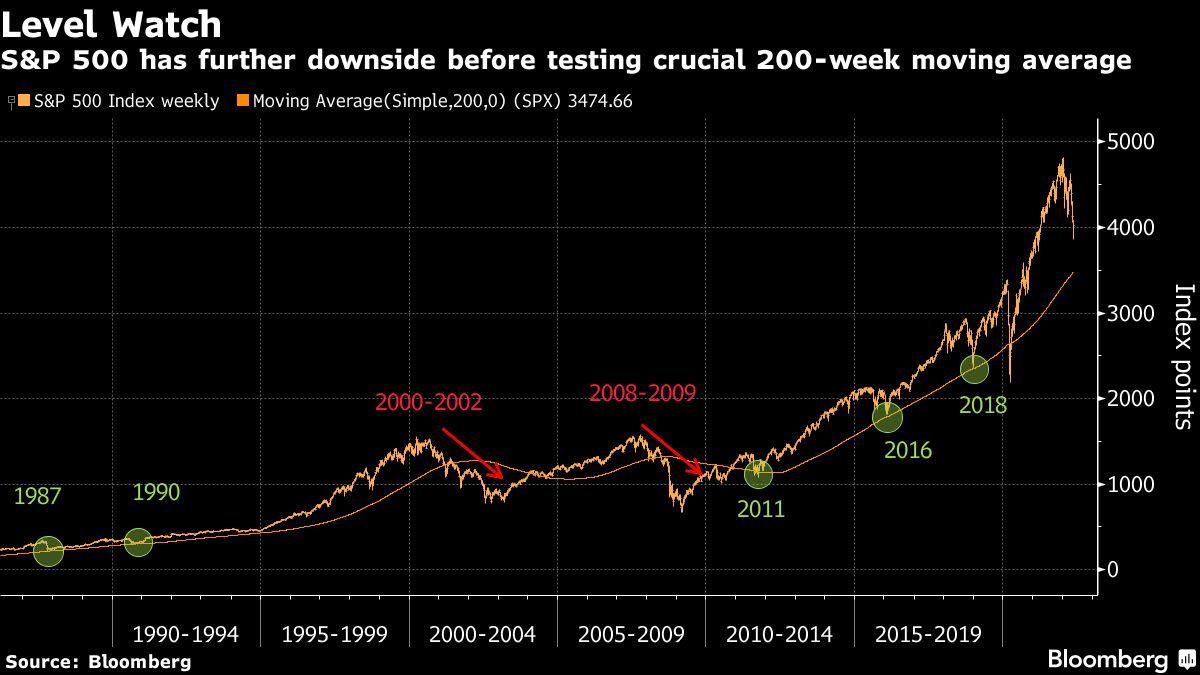

Read More »Morgan Stanley’s Wilson Sees S&P 500 Losses After Bear Rally

(Bloomberg) — The latest bounce in US stocks is a bear market rally and more declines lie ahead, according to Morgan Stanley strategists. Most Read from Bloomberg “With valuations now more attractive, equity markets so oversold and rates potentially stabilizing below 3%, stocks appear to have begun another material bear market rally,” strategists led by Michael Wilson wrote in a note on Monday. “After that, we remain confident that lower prices are still ahead.” READ: $11 Trillion and… Source link

Read More »Morgan Stanley Says These 3 Stocks Could Surge Over 60% From Current Levels

Investors are facing a confusing environment, with long- and short-term signals sending different messages. Inflation remains stubbornly high, above an 8% annualized rate, and the Federal Reserve has made it clear that additional interest rate hikes are in the offing. Stocks are well off their highs, and despite last Friday’s gains, the S&P 500 and the Nasdaq posted their sixth consecutive weekly loss. But there are positives, too. The 1Q22 earnings season gave an upbeat vibe, as more than… Source link

Read More »Morgan Stanley analyst breaks down the ‘fire and ice’ recession indicators

As the earnings season gets underway, all eyes are on companies’ performance as markets will be gauging how big names across various sectors have been navigating inflation, rising interest rates, and the Russia-Ukraine war. According to Morgan Stanley (MS) Chief U.S. Equity Strategist and CIO Mike Wilson, there are two things that investors should focus on during this critical earnings season. “It’s really about, I think, two things. Number one, what did the companies guide to for 2Q and… Source link

Read More »J.P. Morgan Says There’s Room for Over 90% Gains in These 2 Stocks

We’ve wrapped up the first week of April, and it feels like the April Fools’ pranks are still with us. Market headwinds have multiplied and receded, all at once. Covering the macro situation from banking giant JPMorgan, global market strategist Marko Kolanovic writes: “Equities risk-reward is not as poor as it is currently fashionable to believe… While the exogenous geopolitical crisis continues to present a binary set of outcomes, the activity momentum ahead of this shock was… Source link

Read More »