Billionaire Paul Tudor Jones says you ‘can’t think of a worse environment’ for stocks and bonds — but here’s one simple strategy he’d employ right now If you’re thinking about buying the dip in stocks, you might want to think again. According to Paul Tudor Jones, the billionaire founder of Tudor Investment Corporation, it’s still not the time to go on a shopping spree. “You can’t think of a worse environment than where we are right now for financial assets,” he told CNBC… Source link

Read More »Trillions of Negative-Yielding Bonds Vanish

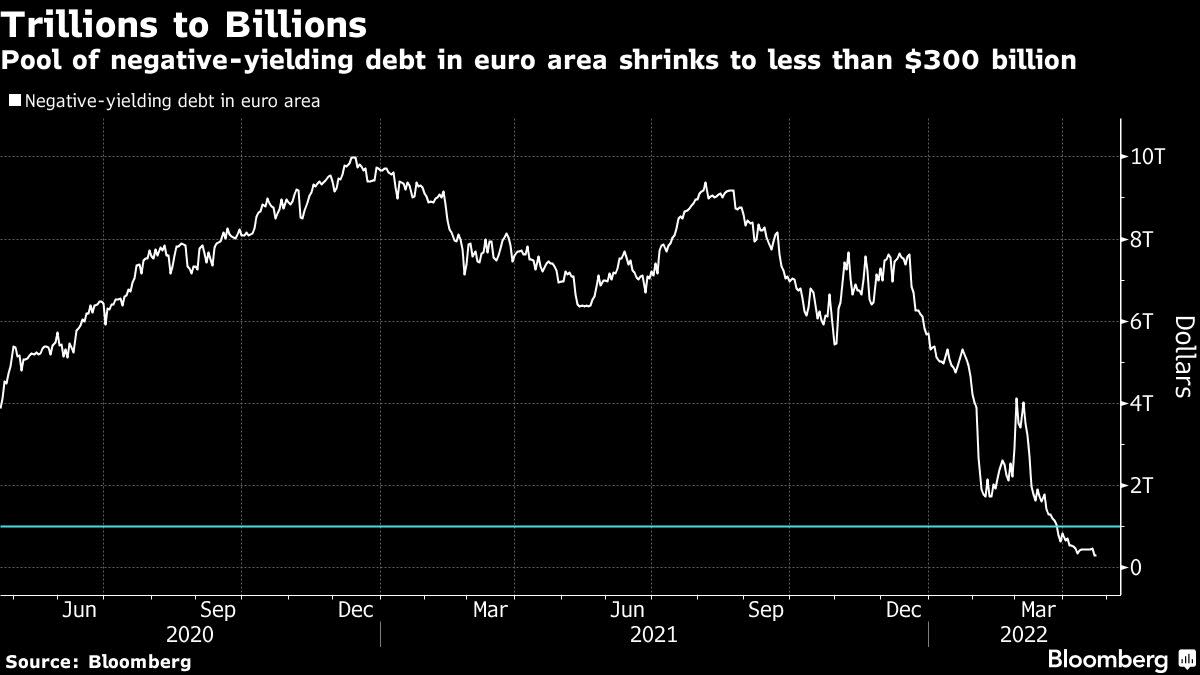

(Bloomberg) — After another wild week in global money markets, traders are betting big on the biggest regime shift in Europe in years: the end of the negative interest-rate era before 2022 is over. Most Read from Bloomberg Fueled by a flurry of hawkish monetary signals over the past week, the interest-rate swaps market now projects the European Central Bank will deliver three quarter-point hikes by December — winding down the eight-year experiment with sub-zero borrowing costs that’s… Source link

Read More »Stocks Waver in Choppy Session, Bonds Slip: Markets Wrap

(Bloomberg) — U.S. stocks ended little changed in thin afternoon trading Monday and Treasuries ticked lower as investors focused on corporate results and prospects for faster policy tightening by the Federal Reserve. Most Read from Bloomberg The S&P 500 closed down less than 0.1%, after swinging between narrow gains and losses on volumes almost 20% below the 30-day average in the first trading day following a long holiday weekend. Bank of America Corp. was poised for the biggest daily advance… Source link

Read More »Bonds Extend Drop After Fed Sparks One of Worst Days in Decade

(Bloomberg) — The U.S. bond market reeled further on Tuesday, extending Monday’s declines after Federal Reserve Chair Jerome Powell’s aggressive rate hike comments drove yields on short-dated Treasuries to one of their biggest daily jumps of the past decade. Most Read from Bloomberg The central bank chief’s hawkish tone led traders to rapidly ratchet up estimates for how aggressively the Fed will tighten monetary policy this year as rising commodity prices threaten to add fuel to the… Source link

Read More »David Ortiz elected to Hall of Fame as Bonds, Clemens miss out

Longtime Boston Red Sox slugger David Ortiz was the lone former player to hear his name called during Tuesday’s BBWAA Hall of Fame election announcement, rewarding a career that saw a curse broken three times over. In his first year of eligibility, Ortiz received 307 out of 397 votes (77.9 percent), putting him over the required 75 percent threshold. Here’s video of him finding out he had been elected, with Hall of Fame teammate Pedro Martinez by his side: Ortiz’s Hall of Fame case was simple…. Source link

Read More »Stocks Rebound, Bonds Dip as Omicron Turmoil Eases: Markets Wrap

(Bloomberg) — Stocks in Europe rebounded and U.S. equity futures rose along with Treasury yields as a semblance of calm returned to global markets while investors reconsidered their worst-case scenarios for the omicron coronavirus strain. Most Read from Bloomberg The Stoxx Europe 600 index jumped more than 1%, recovering some of their worst drop in more than a year, with travel and energy stocks leading the advance. S&P 500 and Nasdaq 100 contracts climbed, WTI oil rallied back above $71 a… Source link

Read More »Futures, Stocks Fall With Bonds on Inflation Worry: Markets Wrap

(Bloomberg) — U.S. futures fell with stocks as surging energy prices stoked inflationary pressures ahead of a key U.S. employment report. Treasury yields extended an advance. Most Read from Bloomberg S&P 500 and Nasdaq 100 contracts declined, with tech giants such as Apple Inc. and Facebook Inc. down in premarket trading. European equities slid to a two-month low, with natural gas prices soaring even as the European Union pledged swift action to ensure the spiking costs don’t stifle the… Source link

Read More »UPDATE 1-Belarus bonds slump amid talk of new sanctions

(Updates prices, adds quote and details) LONDON, June 21 (Reuters) – Belarus sovereign dollar bonds tumbled on Monday amid talk of new EU sanctions in an attempt to put more pressure on President Alexander Lukashenko over last month’s forced landing of a Ryanair passenger plane in Minsk. The benchmark 2030 bond slumped some 4 cents in its biggest fall since the peak of global market COVID angst in March last year, while the 2031 bond issued in June last year matched the decline and hit a… Source link

Read More »Bonds Rebound; Asia Stocks, U.S. Equity Futures Up: Markets Wrap

TipRanks Billionaire Steven Cohen Picks Up These 3 “Strong Buy” Stocks Last week, the NASDAQ slipped below 13,200, making the net loss from its all-time peak, reached earlier this month, 6.4%. If this trend keeps up, the index will slip into correction territory, a loss of 10% from its peak. So what exactly is going on? At bottom, it’s mixed signals. The COVID-19 pandemic is starting to fade and the economy is starting to reopen – strong positives that should boost markets. But an… Source link

Read More »Curt Schilling wants off ballot, attacks Bonds, Clemens

After falling 16 votes shy of Cooperstown in his ninth year on the ballot, controversial pitcher Curt Schilling is requesting his name be removed from Hall of Fame consideration and lashing out at various people involved in the process. Shortly after this year’s Hall of Fame tallies were announced Tuesday and Schilling finished at 71.1 percent, below the necessary 75 percent, he published a letter to the Hall of Fame on his Facebook page. In it, he took aim at fellow candidates Barry Bonds… Source link

Read More »