[unable to retrieve full-text content]S&P 500 Falls 1% as Oil Jump Spurs Flight to Bonds: Markets Wrap Yahoo Finance Source link

Read More »Big Tech Gets Crushed, Bonds Gain in Run-Up to Fed: Markets Wrap

(Bloomberg) — Wall Street traders gearing up for the Federal Reserve decision scrambled to digest a selloff in big tech, the Treasury refunding plans and weaker-than-forecast data. Fresh concerns about regional lenders added to economic concerns that sent bond yields plunging, though banks pared losses as the session progressed. Most Read from Bloomberg The most-influential group in the S&P 500 got hammered on Wednesday after some of its biggest names failed to live up to high expectations… Source link

Read More »Nasdaq Futures Drop 1%, Bonds Retreat After Rally: Markets Wrap – Yahoo Finance

[unable to retrieve full-text content]Nasdaq Futures Drop 1%, Bonds Retreat After Rally: Markets Wrap Yahoo Finance Source link

Read More »Stocks and Bonds Churn as BOJ Rattles Traders: Markets Wrap – Yahoo Finance

[unable to retrieve full-text content]Stocks and Bonds Churn as BOJ Rattles Traders: Markets Wrap Yahoo Finance Source link

Read More »Stocks, Bonds Get 'Chillax' Moment After Rally: Markets Wrap – Yahoo Finance

[unable to retrieve full-text content]Stocks, Bonds Get ‘Chillax’ Moment After Rally: Markets Wrap Yahoo Finance Source link

Read More »Bonds Suddenly Look Like a Smart Hedge Again After 12% Loss

(Bloomberg) — A few brave souls in the investing world are starting to move back into bonds to ride out an oncoming economic storm. Most Read from Bloomberg While debt bulls on Wall Street have been crushed all year, market sentiment has shifted markedly over the past week from inflation fears to growth. That theme gathered more strength Monday, when data showing China’s economy contracted sharply in April set off fresh gains for Treasuries. Market-derived expectations of US price growth… Source link

Read More »Billionaire Paul Tudor Jones says you ‘can’t think of a worse environment’ for stocks and bonds — but here’s one simple strategy he’d employ right now

Billionaire Paul Tudor Jones says you ‘can’t think of a worse environment’ for stocks and bonds — but here’s one simple strategy he’d employ right now If you’re thinking about buying the dip in stocks, you might want to think again. According to Paul Tudor Jones, the billionaire founder of Tudor Investment Corporation, it’s still not the time to go on a shopping spree. “You can’t think of a worse environment than where we are right now for financial assets,” he told CNBC… Source link

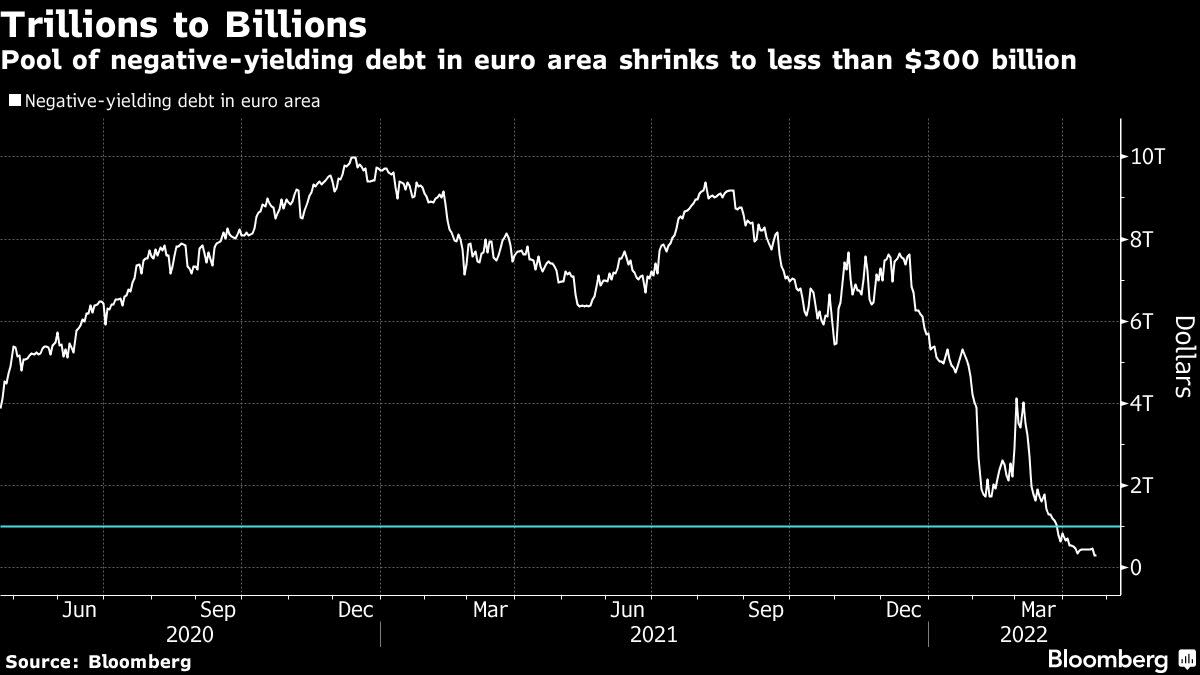

Read More »Trillions of Negative-Yielding Bonds Vanish

(Bloomberg) — After another wild week in global money markets, traders are betting big on the biggest regime shift in Europe in years: the end of the negative interest-rate era before 2022 is over. Most Read from Bloomberg Fueled by a flurry of hawkish monetary signals over the past week, the interest-rate swaps market now projects the European Central Bank will deliver three quarter-point hikes by December — winding down the eight-year experiment with sub-zero borrowing costs that’s… Source link

Read More »Stocks Waver in Choppy Session, Bonds Slip: Markets Wrap

(Bloomberg) — U.S. stocks ended little changed in thin afternoon trading Monday and Treasuries ticked lower as investors focused on corporate results and prospects for faster policy tightening by the Federal Reserve. Most Read from Bloomberg The S&P 500 closed down less than 0.1%, after swinging between narrow gains and losses on volumes almost 20% below the 30-day average in the first trading day following a long holiday weekend. Bank of America Corp. was poised for the biggest daily advance… Source link

Read More »Bonds Extend Drop After Fed Sparks One of Worst Days in Decade

(Bloomberg) — The U.S. bond market reeled further on Tuesday, extending Monday’s declines after Federal Reserve Chair Jerome Powell’s aggressive rate hike comments drove yields on short-dated Treasuries to one of their biggest daily jumps of the past decade. Most Read from Bloomberg The central bank chief’s hawkish tone led traders to rapidly ratchet up estimates for how aggressively the Fed will tighten monetary policy this year as rising commodity prices threaten to add fuel to the… Source link

Read More »