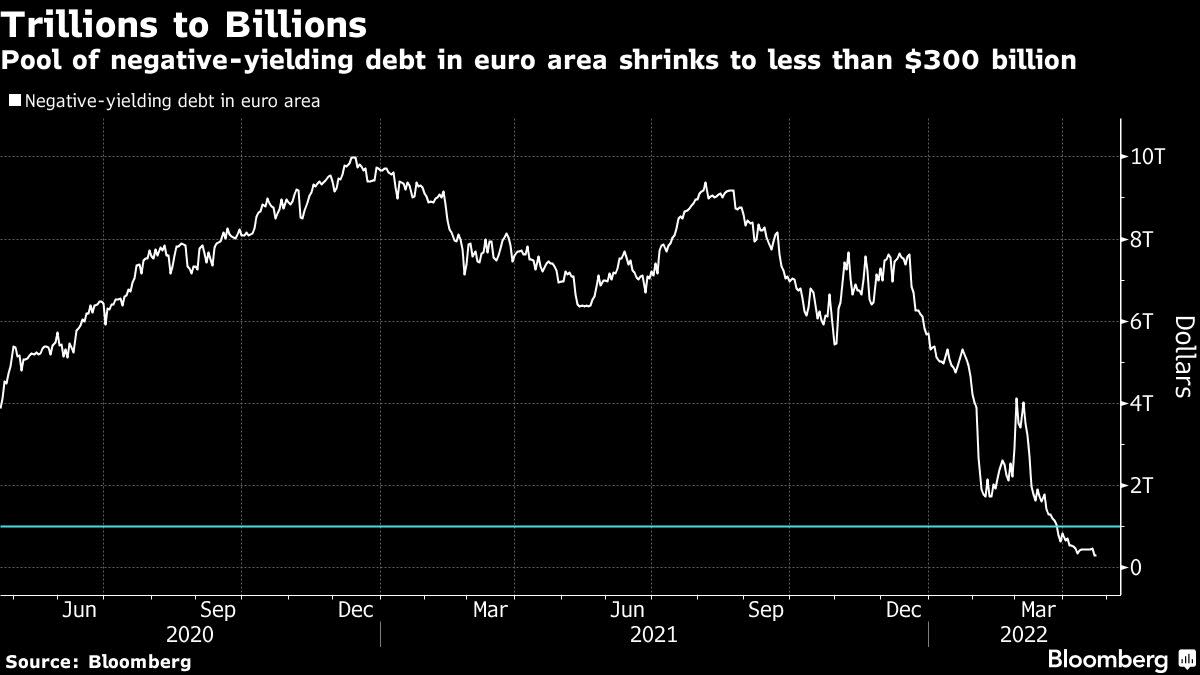

(Bloomberg) — After another wild week in global money markets, traders are betting big on the biggest regime shift in Europe in years: the end of the negative interest-rate era before 2022 is over.

Most Read from Bloomberg

Fueled by a flurry of hawkish monetary signals over the past week, the interest-rate swaps market now projects the European Central Bank will deliver three quarter-point hikes by December — winding down the eight-year experiment with sub-zero borrowing costs that’s…

Source link