This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Thursday, February 10, 2022 ‘The Lord of the Rings’ wizard has nothing on yields that refuse to pass 2% Bond yields have been on the march, testing their highest levels since before the onset of COVID-19, just as the Federal Reserve embarks on a rate hike campaign to tame inflation. Yet with data Thursday morning expected to show the highest U.S…. Source link

Read More »Stocks, Futures Fall as Treasury Yields Surge: Markets Wrap

(Bloomberg) — Most stocks fell Tuesday amid a jump in global bond yields as investors girded for the removal of central bank support to quell high inflation. Most Read from Bloomberg Europe’s Stoxx 600 Index declined, with energy the only sector to advance. U.S. equity futures slipped before the market reopens later from a holiday. Asian shares struggled. Treasuries dropped across the curve, pushing two-year and 10-year yields up to levels last seen before the pandemic roiled markets. Even… Source link

Read More »Barclays is betting these 3 dividend stocks will beat the S&P 500 — if you’re looking for income, snag yields as high as 10.3%

Barclays is betting these 3 dividend stocks will beat the S&P 500 — if you’re looking for income, snag yields as high as 10.3% In the current market frenzy, with rabid investors chasing after the hottest tickers, dividend stocks often get ignored. But a steadily growing stream of dividends will help anyone sleep better at night. And besides, with savings accounts paying next to nothing these days, who wouldn’t want a better way to earn passive income? Recent studies prove once again that… Source link

Read More »Asia Stocks, U.S. Futures Fall as Bond Yields Jump: Markets Wrap

(Bloomberg) — Most Asian stocks and U.S. futures slid Monday as surging energy prices cemented worries about inflation, sending bond yields higher. Most Read from Bloomberg MSCI Inc.’s gauge of Asia Pacific shares was on track for its first decline in four sessions as equities dropped in Japan, Hong Kong and China. U.S. contracts dipped after American stocks advanced on Friday, with the S&P 500 chalking its best week since July as earnings buoyed sentiment. Bond yields in New Zealand and… Source link

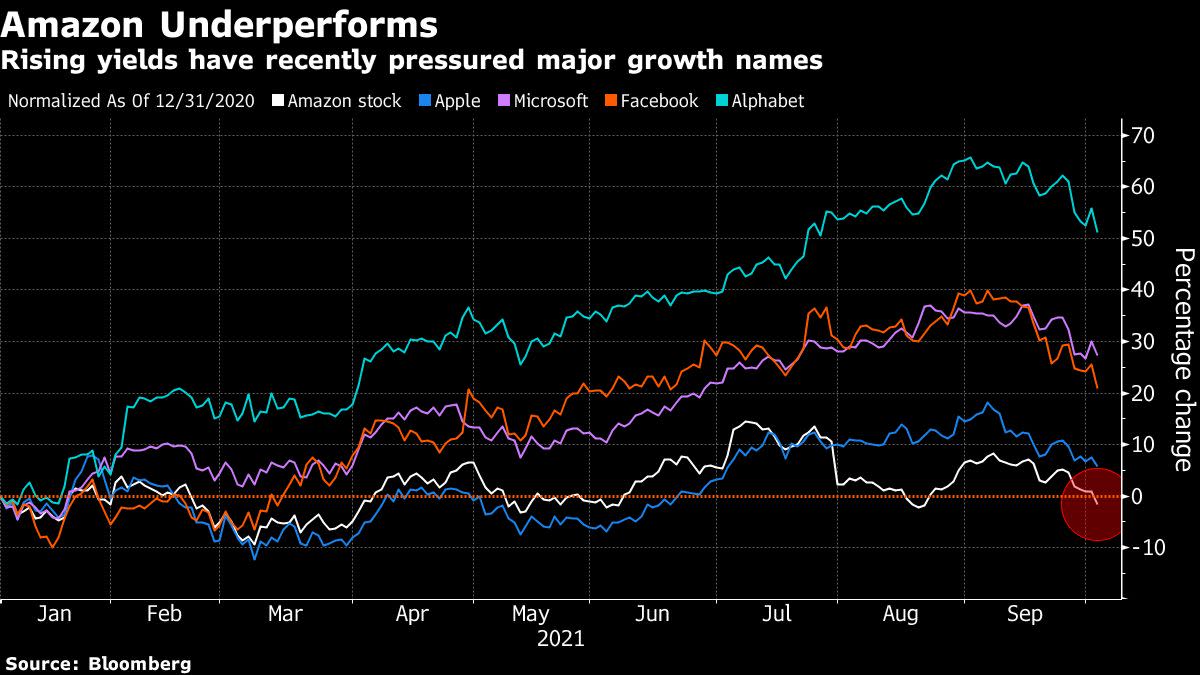

Read More »Amazon Turns Negative for 2021 as Higher Yields Add to Pressure

(Bloomberg) — Amazon.com Inc. shares fell sharply on Monday, taking the e-commerce giant into negative territory for the year, as a sustained rise in Treasury yields is hurting the earnings outlook for companies with high valuations. Most Read from Bloomberg Amazon shares fell as much as 2.5% on Monday and were on track for a sixth straight negative session, the longest such streak for Amazon since an eight-day drop that ended in August 2019. With the decline, the stock is now down 1.4% for… Source link

Read More »Stock futures drop, Nasdaq sinks as Treasury yields climb

Stock futures sank Tuesday morning, with technology stocks leading the way lower as investors nervously eyed a swift rise in U.S. Treasury yields. Futures on the Nasdaq, a proxy for technology and growth stocks, underperformed against the other two major stock indexes, dropping 1.5% ahead of the opening bell. The rapid rotation away from growth and technology stocks came as Treasury yields added to recent gains. The yield on the benchmark 10-year note jumped more than 5 basis points to top… Source link

Read More »Bond yields rip as Fed prepares to turn spigot on monetary stimulus

Longer-dated U.S. government bond yields jumped after the Federal Reserve signaled that it would likely start pulling back on its monetary stimulus in November. Since the Fed’s announcement on Wednesday afternoon, the yield on the U.S. 10-year (^TNX) climbed 10 basis points to as high as 1.41%, a figure not seen since July. The yield on the U.S. 30-year (^TYX) similarly rose as much as 10 basis points, to 1.92%. Polaris Wealth Advisory Group Managing Partner Jeff Powell said that he expects… Source link

Read More »Treasury Yields’ Grip on Emerging Markets Keeps Traders on Guard

(Bloomberg) — Slowing economic recovery amid a resurgent pandemic is leaving emerging-market currencies vulnerable to a selloff if Treasury yields rise again. While the influence of U.S. borrowing costs on developing-nation currencies has waned in recent months, it may return to prominence for riskier assets as the cushioning effects from China’s growth rebound and low inflation weaken, according to money managers including Fidelity International and Credit Agricole CIB. “A very sharp,… Source link

Read More »Stocks Snap Rally; Yields Drop to February Lows: Markets Wrap

(Bloomberg) — U.S. stocks fell, snapping a streak of seven consecutive closing record highs, as a plunge in Treasury yields to the lowest since February weighed on banks and small caps. A gauge of the dollar strengthened and crude oil dropped from a six-year high. The benchmark S&P 500 was led lower by the energy and financial sectors, ending the rally of record closes that was the longest since 1997. Amazon.com pushed the Nasdaq 100 to another all-time high. Ride-hailing firm Didi Global… Source link

Read More »U.S. Equities Rise, Yields Steady After CPI: Markets Wrap

(Bloomberg) — U.S. equities rose and government bonds held around the lowest level since March as investors assessed data that showed consumer prices rose more than forecast last month. The S&P 500 was trading around its all-time high as all the main American equity indexes advanced. The tech-heavy Nasdaq 100 was headed toward its highest level since late April as megacap technology stocks rallied. The 10-year Treasury yield eased back below 1.5% following an initial surge in the wake of the… Source link

Read More »