There’s plenty of talk around about the dreaded ‘R’ word, recession, as the markets are obviously cooling off following the prolonged bull runs of late 2020 and 2021. With inflation running at 40-year highs, and GDP growth slipping in Q1, it’s no wonder that people are talking about a return to the late ‘70s, and Carter-era economic malaise. But have we taken the pessimism too far? Covering the market situation for Wells Fargo, senior equity analyst Chris Harvey believes so. He sums… Source link

Read More »Recession warning sign flashes as yield curve inverts

The market’s most closely watched part of the yield curve inverted Friday, and if its record over the last half-century is any indicator, the U.S. could be headed for a recession soon. But others say the Federal Reserve’s unprecedented firefight with high inflation makes this yield curve inversion different from those of decades’ past. On Friday, the yield on the 10-year U.S. Treasury bond ended the day at 2.38%, 6 basis points below the 2-year U.S. Treasury yield of 2.44%. This… Source link

Read More »Yield curve briefly inverted for first time since 2019

The market’s most closely watched part of the yield curve inverted very briefly on Tuesday. At 1:33 p.m. ET on Tuesday afternoon, Bloomberg data showed the yield on the 10-year U.S. Treasury note (^TNX) briefly dipping below the yield on the 2-year U.S. Treasury. The inversion lasted only a few seconds, and by 3:00 p.m. ET (the settlement time for U.S. government bond futures) the curve remained un-inverted with about 0.05% separating the two securities’ yields. Over the last half-century… Source link

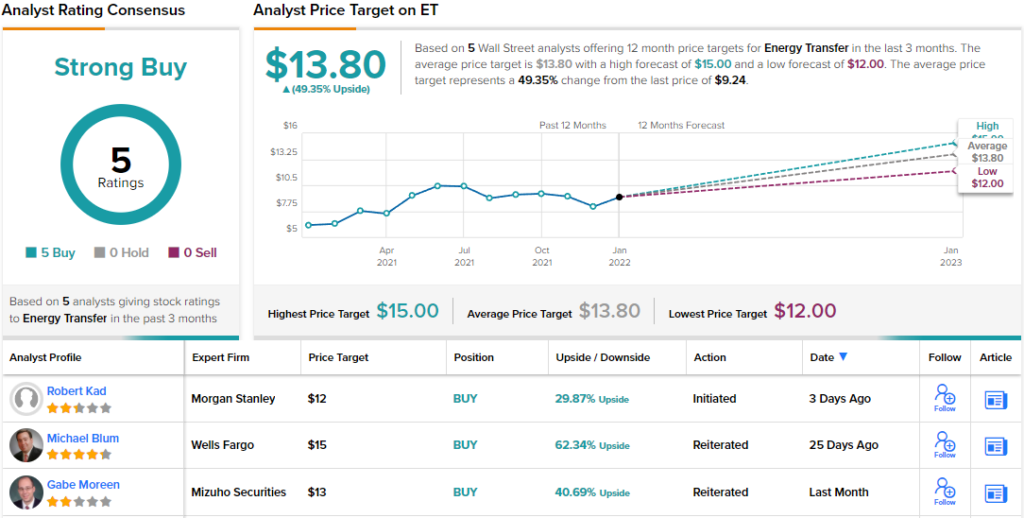

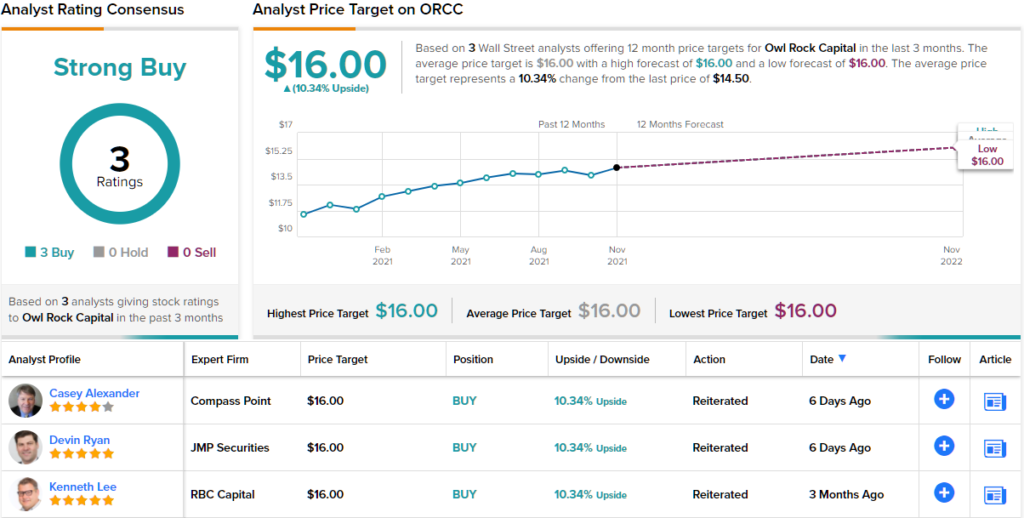

Read More »Seeking at Least 6% Dividend Yield? Morgan Stanley Suggests 2 Dividend Stocks to Buy

One thing is certain already: the market environment for 2022 will not be the same as that in 2021. This may or may not be good for investors, per se, but like every shift in market conditions, it will present opportunities for those prepared to grasp them. Some factors are just reruns. COVID is rearing its ugly head again, threatening us with lockdowns and shutdowns. That’s running against the grain of a resurgent economy, an economy that is trying to gain more traction – but it’s… Source link

Read More »The yield curve may be sending a recessionary signal

Bond king Jeffrey Gundlach has a lot on his mind as it pertains to markets when Yahoo Finance sits down with the DoubleLine founder at length inside his California estate on the first trading day of 2022. China isn’t a great market to be investing in, contends Gundlach. Stock valuations as measured by the DoubleLine favorite the CAPE ratio appear too rich, says Gundlach. But it’s Gundlach’s warning on the path of the U.S. economy — in part caused by looming interest rate hikes by the… Source link

Read More »2 “Strong Buy” Dividend Stocks With 8% Dividend Yield

Let’s talk about rising markets, and whether or not to buy in. That’s the question that investors need to consider right now, as the major indexes have hit record highs – but the economy is flashing signs of concern for those who care to look. Inflation continues to rise, and the 10-year Treasury bond yield, which had risen above 1.5%, has slipped to 1.4% and is trending down. Investors are seeking returns, and so are drawn to the stock markets; they’re banking that central banks will… Source link

Read More »Bond Yield Spike Spurs Growth-Into-Value Rotation: Markets Wrap

(Bloomberg) — As Treasury yields pushed higher after a hawkish tilt from the Federal Reserve last week, some of the world’s largest technology companies continued to sell off. Most Read from Bloomberg A slide in bonds sent the rate on the benchmark 10-year note briefly above 1.5% — a level not seen since June. That’s prompted the tech-heavy Nasdaq 100 to underperform major equity benchmarks. Meantime, economically sensitive companies — like energy, financial and smaller firms –… Source link

Read More »Treasury, U.K. Yield Curves Weighed Down by Rethink on Reflation

(Bloomberg) — The pressure on long bond yields is going global, led by Treasuries and U.K. gilts, as investors reconsider reflation expectations and brace for an eventual pullback of central bank stimulus. The Treasury five- to 30-year yield spread, which reflects the balance between the interest-rate outlook and inflation expectations, narrowed to the smallest gap since August. Its U.K. counterpart narrowed the least since December. That compression was driven by 30-year yields’ decline… Source link

Read More »What is yield curve control: Yahoo U

For more business and finance explainers, check out our Yahoo U page. The market for U.S. government debt is among the largest, most liquid markets in the world. When yields on U.S. Treasuries move, so does everyone else. Because investors generally perceive U.S. Treasuries to be risk-free assets, their yields serve as proxies for interest rates. When the U.S. 10-year (^TNX) or 30-year bond yield (^TYX) rises, so do loans (business loans, mortgages) of comparable duration. For a central bank,… Source link

Read More »What is yield curve control: Yahoo U

For more business and finance explainers, check out our Yahoo U page. The market for U.S. government debt is among the largest, most liquid markets in the world. When yields on U.S. Treasuries move, so does everyone else. Because investors generally perceive U.S. Treasuries to be risk-free assets, their yields serve as proxies for interest rates. When the U.S. 10-year (^TNX) or 30-year bond yield (^TYX) rises, so do loans (business loans, mortgages) of comparable duration. For a central bank,… Source link

Read More »