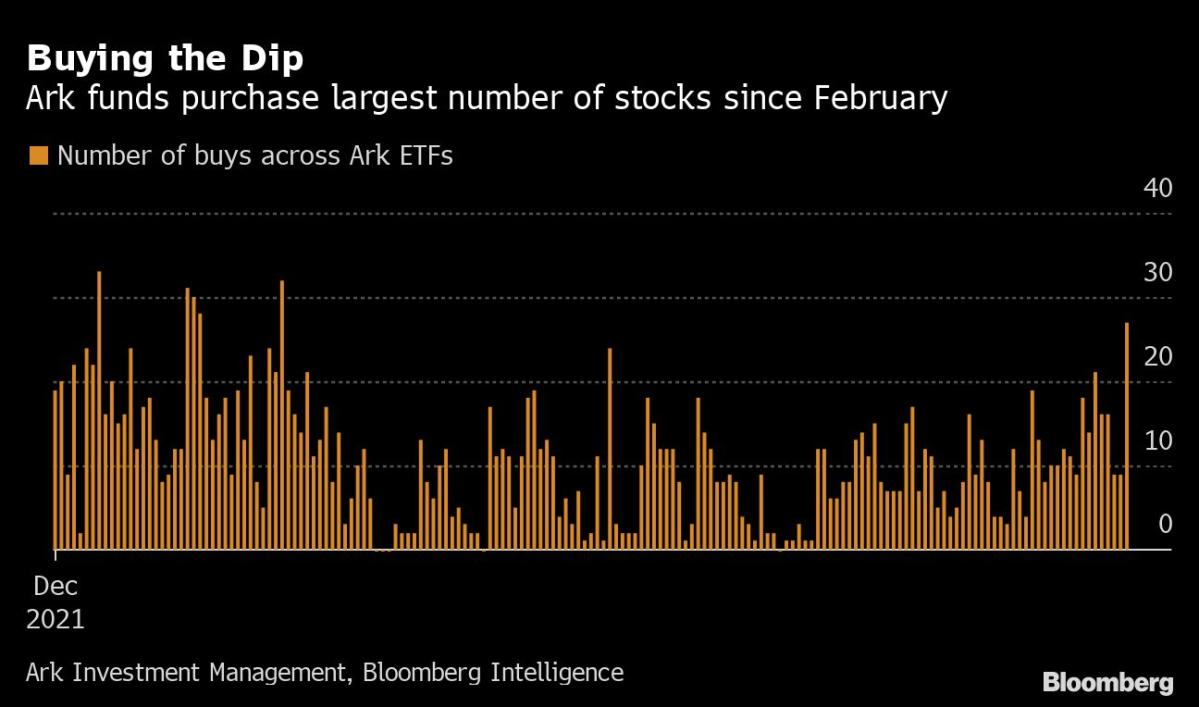

(Bloomberg) — Tuesday’s brutal selloff in the aftermath of August’s hotter-than-expected inflation print looked like opportunity to Cathie Wood’s Ark Investment Management. Most Read from Bloomberg The firm bought 27 stocks across its eight exchange-traded funds on Tuesday, according to data compiled by Bloomberg. The largest buy was Roku Inc., which is already the third biggest holding in the firm’s flagship $8 billion ARK Innovation ETF (ticker ARKK). The purchases came on a day when… Source link

Read More »Long-time bull Cathie Wood warns investors about the ‘big problem’ in the economy. Here’s what she likes today

‘We are in a recession’: Long-time bull Cathie Wood warns investors about the ‘big problem’ in the economy. Here’s what she likes today The official GDP estimate for Q2 won’t be available until later next month, but many experts – including Ark Invest’s Cathie Wood – are calling for a recession. “We think we are in a recession,” Wood says in a recent CNBC interview. “We think a big problem out there is inventories — the increase of which I’ve never seen this large in… Source link

Read More »Cathie Wood warns the Fed are ignoring dangerous signals as it plows ahead with draconian rate hikes

The U.S. Federal Reserve risks weak economic growth throughout this year due to its backward-looking, “draconian” rate hikes, warned Wall Street’s best-known tech sector bull. ARK Invest founder Cathie Wood, who became famous for her prescient bets on disruptive technologies led by companies such as Tesla, argued the Fed must temper its policy given leading economic indicators were flashing red. These included speculative bets indicating an expectation for rising bankruptcies via… Source link

Read More »Investors still love Cathie Wood, but hate the best sector of the year

The bloodbath in the markets this past week wrecked retail stocks, as Walmart (WMT) posted its worst week ever, falling 20%. Amid the carnage, investors piled into beaten-down names like the Ark Innovation ETF (ARKK) while shunning the best performing sector of the year. The energy sector’s stunning 47% return this year stems from soaring oil and gas prices, as WTI crude oil futures (CL=F) surged 56% this year. Still, investors have yanked $705 billion from the iShares U.S. Energy ETF (XLE)… Source link

Read More »Cathie Wood Says Fed Won’t Hike as Much as Market Priced In

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast. Most Read from Bloomberg The Federal Reserve isn’t going to hike rates as much as markets are currently betting, according to Cathie Wood. The strategies of ARK Investment Management LLC, where Wood is founder and chief executive officer, have struggled recently amid fear of inflation, she said via video to the Seedly Personal Finance Festival in Singapore. The firm’s flagship ARK… Source link

Read More »Cathie Wood ‘keeping open mind’ on investing in General Motors as carmaker scales EV plans

General Motors (GM) has been revving up its electric vehicle business. And Cathie Wood is taking notice. The innovation-focused, Tesla (TSLA)-loving Ark Invest CEO — a vocal critic of legacy automakers who predicted not long ago that GM will go bankrupt — is changing her tune on the Detroit-based car manufacturer as it commits to an electric future, Wood signaled in an interview with Yahoo Finance. She also revealed that her investment management firm recently met with General Motors CEO… Source link

Read More »Cathie Wood pins Ark’s Twitter sell-off on departure of CEO Jack Dorsey

Ark Invest has been steadily trimming its stake in Twitter and appears to be ready to ditch holdings in the microblogging platform altogether — at least for now. The tech-focused investment management firm’s Chief Executive Officer Cathie Wood told Yahoo Finance in an interview Tuesday that Ark is moving out of social media platforms amid increased competition and chalked up its sales of Twitter (TWTR) stock in particular to the departure of former CEO Jack Dorsey. “Jack’s leadership was… Source link

Read More »Leigh Wood dramatically KOs Michael Conlan to retain title

Michael Conlan had the WBA featherweight title in the bag on Saturday in Nottingham, England, until he didn’t. Leigh Wood staged a remarkable late comeback and stopped Conlan at 1:25 of the 12th round to retain the title that throughout the fight seemed destined to go to Conlan. Conlan dropped Wood hard at the end of the first round with a sweeping left hand. He hurt him several times in the second round and then again at points in the first eight rounds. Wood was behind badly on all three… Source link

Read More »Cathie Wood rejects Fed’s inflation “jawboning,” pivots back to deflation narrative

Wall Street’s rate-hike jitters have wreaked havoc on high-growth tech stocks — and Cathie Wood’s Ark ETFs were front and center for the damage yet again. Still, Wood dismissed concerns over inflationary pressures, reaffirming an earlier assertion that deflation remains the focus for her firm during a webcast on Tuesday. The Ark Invest CEO also said that price increases were likely to ease as supply chain issues resolve. Wood’s remarks come amid Federal Reserve Chair Jerome Powell’s… Source link

Read More »Cathie Wood was put to the test in 2021 and next year won’t be any easier

Like many of us, Cathie Wood has had a crazy 2021. Investors in her flagship fund might argue that the year was even crazier. Ark Innovation (ARKK), Wood’s main ETF, is poised to end 2021 down by nearly 25%, even as the S&P 500 is up by about the same amount. But the Ark Invest CEO is staying the course with bold bets on high-flying tech companies and chiding critics who commit to benchmarks “unlikely to generate even average returns during the next 10 years” — even as her own… Source link

Read More »