(Bloomberg) — Monday’s Asia trading session took on a decisively risk-off tone: U.S. stock index futures fell, Treasuries gained and risk-sensitive currencies slid as investors fretted over fresh lockdowns to slow the new variant. Most Read from Bloomberg Senator Joe Manchin’s rejection of the U.S. spending package at the heart of President Joe Biden’s economic agenda heaped fresh fuel to the fire with market liquidity starting to thin as Christmas nears. “Markets this week and next… Source link

Read More »Stocks drift lower as traders look ahead to Fed decision

Stocks traded slightly lower Monday morning, with the S&P 500 steadying just below last week’s record level as traders awaited a Federal Reserve monetary policy decision later this week. The three major indexes were slightly in the red just after market open. U.S. crude oil prices dipped to trade near $71 per barrel. Treasury yields fell across the long end of the curve, and the benchmark 10-year yield held below 1.5%. Bitcoin prices ticked down to trade below $48,000. Shares of heavily… Source link

Read More »Oil prices have tanked so hard traders are assuming planes won’t fly for 3 months: Goldman Sachs

Oil prices have come down way too fast on Omicron variant concerns, says Goldman Sachs oil strategist Damien Courvalin. In fact, the price correction is borderline comical, per Courvalin’s calculations. “The lack of discretionary buying activity in the face of an uncertain new COVID variant has therefore left prices in free-fall and pricing in a dire demand outlook. We estimate based on our pricing model, that the market has now priced in a mammoth c.7 mb/d [millions of barrels per day]… Source link

Read More »Stock futures steady after reaching records as traders mull Fed taper

Stock futures opened little changed Wednesday evening to hold near record highs, with investors contemplating the the Federal Reserve’s decision to begin paring back some of its monetary policy support as the economic recovery progresses further. Earlier during the regular session, each of the S&P 500, Dow and Nasdaq set record intraday and closing highs yet again, with the Fed’s latest monetary policy decision compounding with optimism over a slew of stronger-than-expected quarterly… Source link

Read More »Stocks rise as traders extend gains into November

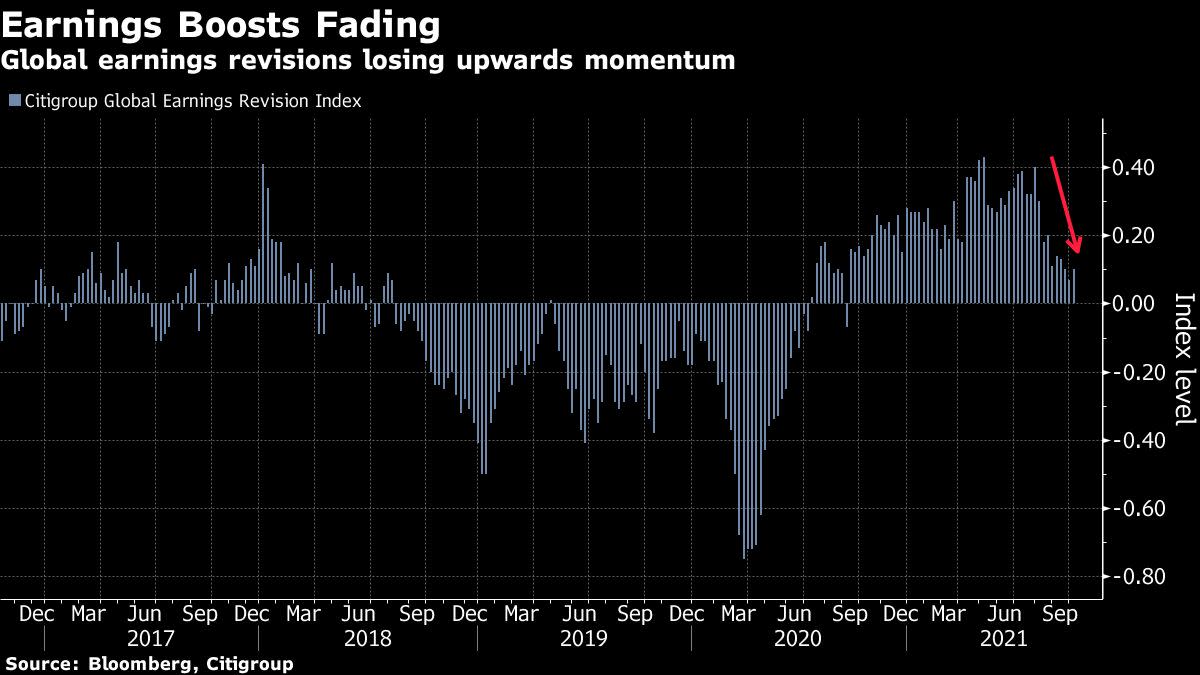

Stocks traded higher on Monday, with equities looking to build on gains after the S&P 500’s best month since November 2020. Contracts on the S&P 500, Dow and Nasdaq opened higher. Investors are heading into November trading with momentum from a record-setting October, when the S&P 500 logged its best monthly gain in nearly a year. Each of the S&P 500, Dow and Nasdaq had set all-time highs last week, powered higher by a combination of estimates-topping corporate profit results. And according… Source link

Read More »Trump-tied SPAC soars more than 270%, retail traders pile on

Shares of Digital World Acquisition Corp (DWAC), the special purpose acquisition company which will merge with former President Trump’s social media company soared more than 270% on Thursday. Trading was briefly halted for volatility as retail investors piled on the stock. Digital World Acquisition is one of the top trending tickers on Yahoo Finance. It’s also the #1 stock on Fidelity’s orders by retail customers, behind Tesla (TSLA). It is also the most mentioned ticker on Stockwits in the… Source link

Read More »U.S. Futures Drop as Surging Oil Unsettles Traders: Markets Wrap – Yahoo Finance

(Bloomberg) — U.S. futures dropped with European stocks as the highest oil prices since 2014 stirred fears that a spreading energy crunch will derail the global pandemic recovery. Most Read from Bloomberg West Texas Intermediate crude rose past $80 a barrel and China’s coal futures reached a record as flooding shuttered mines. European equities were modestly lower, with declines led by travel companies. U.S. contracts also slipped, with those on the tech-heavy Nasdaq 100 underperforming the… Source link

Read More »Stock futures rise as traders await jobs report

Stock futures opened higher Thursday evening, extending gains as investors awaited a key report on the labor market’s recovery. Contracts on the S&P 500 ticked up after the index logged a third straight session of gains during Thursday’s regular trading day. The move to the upside came after Senate leaders said they reached an agreement on raising the government borrowing limit into December, helping avert a default as soon as this month. With concerns over the government debt ceiling… Source link

Read More »Retail traders follow Nancy Pelosi’s stock moves to find winners

When in doubt, pick the same stocks that lawmakers’ spouses are buying? That’s what young investors are doing when it comes to trades made by House Speaker Nancy Pelosi’s husband, Paul Pelosi, a businessman who owns a real estate and venture capital firm. Though Nancy Pelosi herself doesn’t trade stocks, her husband does. And that’s enough for some social traders, who see his trades as hers. “We’ve been tracking their performance and every single stock she has bought in the last two years has… Source link

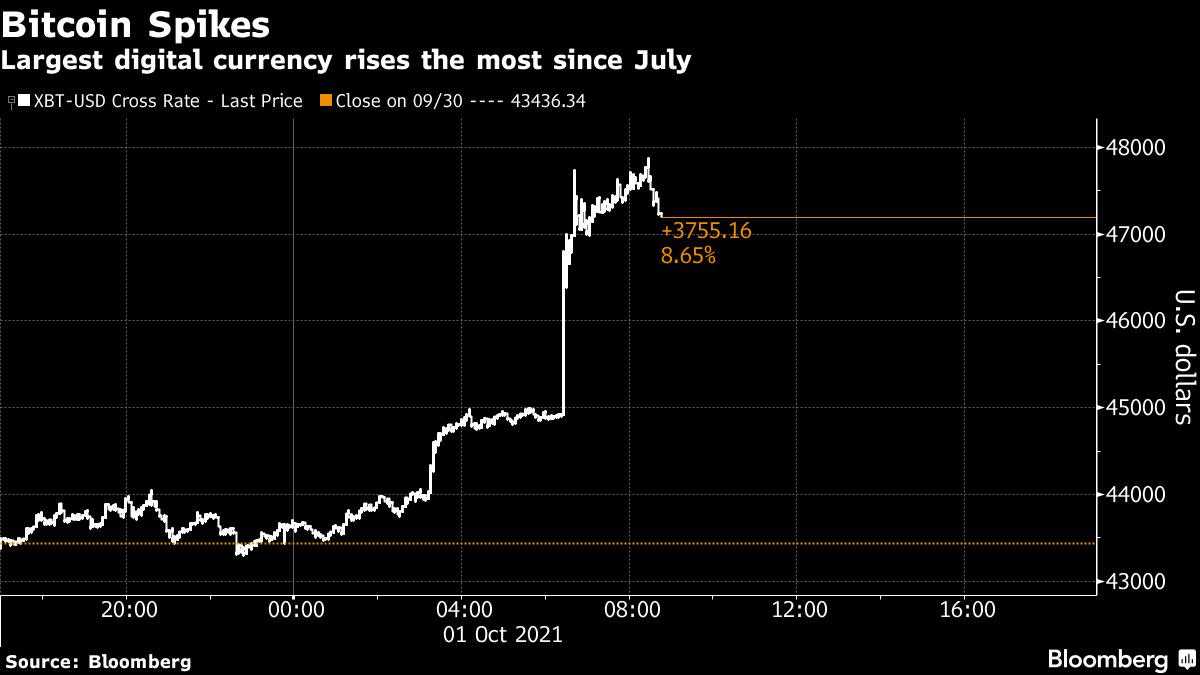

Read More »Bitcoin’s Biggest Jump Since July Leaves Traders Speculating Why

(Bloomberg) — Most Read from Bloomberg Bitcoin jumped, rising in a matter of minutes to its biggest daily gain since July, and other digital currencies surged in a shock rally that followed the largest monthly decline since May. The largest cryptocurrency by market value rose as much as 10% to $47,884 early in New York trading before paring gains. Ethereum, Litecoin and EOS also jumped, with the Bloomberg Galaxy Crypto Index rising as much as 8.9%. Bitcoin had slumped 7.6% in September amid… Source link

Read More »