(Bloomberg) — A former hedge fund manager who shot to fame for a $2.7 billion volatility trading gain during the global financial crisis is buying the pound on a day when the currency slumped to an all-time low. Most Read from Bloomberg Stephen Diggle on Monday used 10% of the assets of a “small fund” to buy sterling to finance investments in the UK, especially stocks of companies that have earnings in the greenback but costs in the British currency, he said in an email. He didn’t… Source link

Read More »How the US Toppled the World’s Most Powerful Gold Trader

(Bloomberg) — In December 2018, a man in his early 30s was intercepted on arrival at Fort Lauderdale airport and taken to a room where two FBI agents sat waiting. Most Read from Bloomberg The target was scared and already on high alert — one of his associates had recently admitted to crimes he knew he’d also committed. Christian Trunz wasn’t a terrorist or a drug trafficker, but a mid-level trader of precious metals returning from his honeymoon. Crucially: he was also a longstanding… Source link

Read More »Demand destruction is the only way to stop increases, says trader

Gasoline prices will stop rising once consumer demand destruction kicks in, according to one energy trader. “It’s become really evident that the only thing that is going to alleviate these price rises is demand destruction,” CIBC Private Wealth U.S senior energy trader Rebecca Babin told Yahoo Finance Live. Gasoline keeps hitting record highs as the national average now sits at $4.59 per gallon. Some states are seeing even higher numbers at the pump — $5 or even $6 per… Source link

Read More »One veteran trader is calling an end to ‘crypto winter’

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Wednesday, May 18, 2022 Today’s newsletter is by Jared Blikre, a reporter focused on the markets on Yahoo Finance. Follow him @SPYJared It’s been a frosty year for crypto, which turned bitter cold during last week’s stablecoin meltdown. As bitcoin (BTC-USD) flirts with levels not seen since late 2020, one institutional trader is making a bold call… Source link

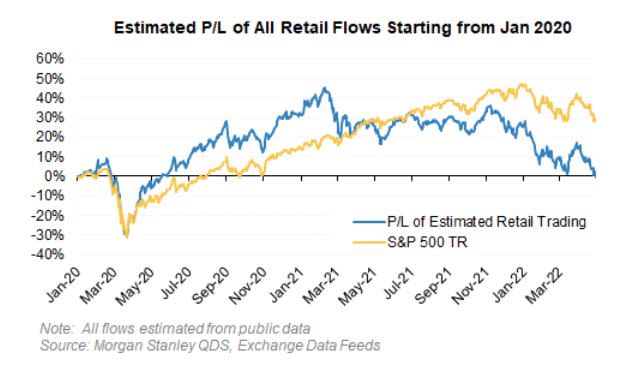

Read More »Day Trader Army Loses All the Money It Made in Meme-Stock Era

(Bloomberg) — It’s ending as fast as it began for retail day traders, whose crowd-sourced daring was the pre-eminent story of pandemic equities. Most Read from Bloomberg Nursing losses in 2022 that are worse than the rest of the market’s, amateur investors who jumped in when the lockdown began have now given back all of their once-prodigious gains, according to an estimate by Morgan Stanley. The calculation is based on trades placed by new entrants since the start of 2020 and uses… Source link

Read More »Robinhood stock is in a ‘dumpster fire of a situation’ right now, says retail trader

Robinhood (HOOD) stock has been on a downtrend since its IPO in July of last year. The financial services company, which aims to “democratize finance for all,” also recently produced a lackluster earnings report for Q1 2022. Amid Robinhood’s financial woes, finance YouTube channel host and retail trader Matt Kohrs believes the outlook is bleak for the company’s stock. “At least from the retail trading community, which I’m happily a member of, I don’t really think the sentiment has… Source link

Read More »Here’s why the Fed’s inflation fighting is doomed, per one veteran trader

Investors are warming to the fact the Federal Reserve is about to throw ice cold water on the hot U.S. economy where inflation is surging to four-decade highs. But whether the Fed hikes 50 basis points next week — or even a previously-unfathomable 75 points — Jerome Powell and company are unlikely to achieve the proverbial (and rare) soft landing, according to one veteran trader. Bill Smead, chief investment officer at Smead Capital Management, compared the present bout of persistently… Source link

Read More »Oil at ‘$150 isn’t outside the realm of possibility’: energy trader

Oil at $150 a barrel is not “outside the realm” of possibilities, says one energy trader. “It’s hard to take anything off the table right now. Russia is starting to retaliate with its own response to U.S. sanctions, whether that’s demanding payments in rubles or potentially not allowing crude to flow through a very prominent pipeline through Kazakhstan,” Rebecca Babin, senior equity trader for CIBC Private Wealth, told Yahoo Finance Live. “As we’ve seen this escalate in ways that were very low… Source link

Read More »Be an ‘investor, not a trader’ amid turbulent market, BMO’s Belski says

The first quarter of 2022 has been marked by continued surging inflation, geopolitical risks, and now, concerns of a looming recession. In light of these headwinds, however, BMO Capital Markets Chief Investment Strategist Brian Belski has a word of advice for investors to navigate the current market environment. “You know, the market does not like uncertainties. And [the market] cleared up one uncertainty when the Fed came out and was very clear about raising interest rates during its… Source link

Read More »Bill banning stock trading by lawmakers more ‘fair for everyday people’: Retail trader

Momentum is growing to restrict stock trading by members of Congress and their spouses, as retail traders have been tracking politician trades and their performance. On Wednesday, Senators Jon Ossoff (D-GA) and Mark Kelly (D-AZ) introduced a bill, barring members of Congress and their immediate families from trading while in office. On the same day, Senator Sen. Josh Hawley (R-MO) announced he is introducing a similar measure. “It’s awesome to see Republicans and Democrats on both sides… Source link

Read More »