The government spending bill that was just passed through the Senate and awaits approval from Congress is estimated to total nearly $1.7 trillion. While it will fund a variety of initiatives like aid to Ukraine and enhanced retirement savings, it will not extend “accelerated depreciation” tax breaks, which were initiated during the Trump administration and seen by many as corporate tax cuts. Read more. Source link

Read More »Mets will pay roughly $111M, more than 10 MLB teams’ payrolls, in luxury tax penalties after offseason splurge

You can criticize New York Mets owner Steve Cohen’s approach. You can bemoan his seemingly unlimited budget and post a thread on Twitter about how this is “bad for the game.” But you can’t deny one thing: Cohen desperately wants to win. After signaling in March that he didn’t care about the luxury tax, Cohen has backed up that assertion this offseason. With the reported signing of Carlos Correa on Wednesday, the Mets’ offseason spending splurge jumped to an unfathomable $806.1 million. As a… Source link

Read More »Democratic lawmakers vote to release former President Trump’s tax returns

Democrats on the House Ways and Means committee voted Tuesday to release former President Donald Trump’s tax returns in a move that opponents say will have “severe consequences.” The vote was 24-16 on a party-line basis. The six years of returns — spanning from 2015-2020 — will be released to the public in the coming days after the documents are prepared by staffers to redact information like Social Security numbers, street addresses, and other identifying data. The returns will be… Source link

Read More »Why Tesla, GM to benefit from Treasury’s EV tax credit rule delay

Big news out of the federal government could be a big boon for certain automakers. The Treasury Department said yesterday it would delay releasing proposed guidance regarding the sourcing of EV batteries that are part of the Inflation Reduction Act’s (IRA) new $7,500 EV tax credit. The IRA’s rules regarding the EV tax credit require that $3,750 of the credit is only eligible if 40% of the value of the critical minerals in the battery have been “extracted or processed” in the U.S., or a… Source link

Read More »Why Tesla, GM to benefit from Treasury’s EV tax credit rule delay

Big news out of the federal government could be a big boon for certain automakers. The Treasury Department said yesterday it would delay releasing proposed guidance regarding the sourcing of EV batteries that are part of the Inflation Reduction Act’s (IRA) new $7,500 EV tax credit. The IRA’s rules regarding the EV tax credit require that $3,750 of the credit is only eligible if 40% of the value of the critical minerals in the battery have been “extracted or processed” in the U.S., or a… Source link

Read More »Privacy-Focused Alternatives to Google Services for Tax Pros

Google, which started as a simple search engine in 1997, is now a major player in just about every facet of our digital lives. A commensurate increase in scrutiny has followed. From data privacy issues to antitrust claims, the “Do No Evil” company has been accused of myriad unsavory practices. On top of that, it has been known to somewhat abruptly cancel services and products. Owing in part to these trials and tribulations, there are several services now seeking to draw customers away… Source link

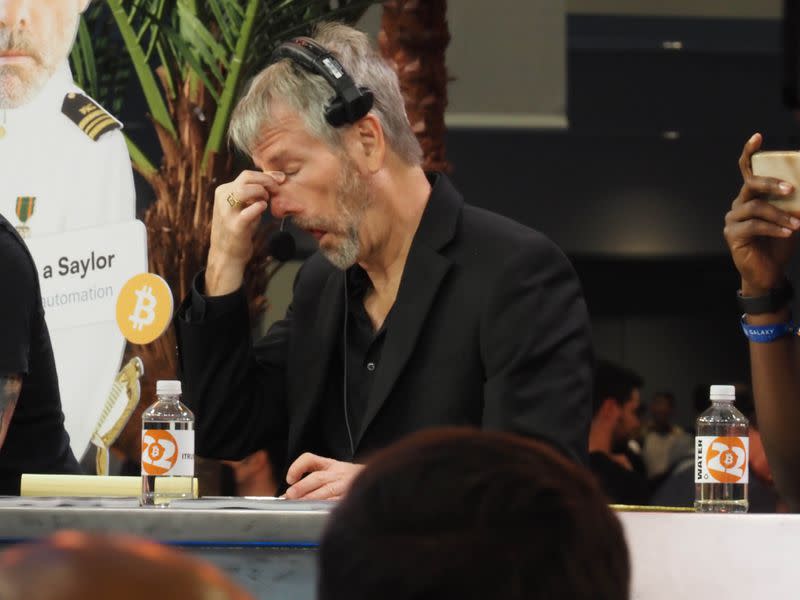

Read More »District of Columbia Suing MicroStrategy Founder Michael Saylor for Tax Fraud

The District of Columbia is suing MicroStrategy (MSTR) founder and Executive Chairman Michael Saylor for allegedly never paying any income taxes in the district in the more than 10 years he has lived there, Attorney General Karl A. Racine announced in a tweet on Wednesday. In addition, Racine tweeted that his office is suing MicroStrategy “for conspiring to help him evade taxes he legally owes on hundreds of millions of dollars he’s earned while living” in Washington. In a follow-up Source link

Read More »We’re going after tax evaders, not honest Americans: Op-Ed

This is an op-ed from Charles P. Rettig, the 49th Commissioner of the IRS. As the nation’s tax administrator, the IRS plays a unique role in our nation. It can be a difficult job. After all, does anyone really like paying taxes? Of course not. But they’re essential to fund the roads we drive on, the schools our children attend, support our military and so much more. Unfortunately, given the nature of this work and historical stereotypes, the IRS is often perceived as an easy target for… Source link

Read More »At a glance: tax law enforcement in Austria & More Latest News Here

Enforcement Verification of compliance with tax laws How does the tax authority verify compliance with the tax laws? Does this vary for different taxpayers or taxes? Tax returns are usually subject to a plausibility check before a tax assessment is filed. A review is normally only undertaken if certain aspects of the tax return are unclear to the tax office. It is also possible that a certain number of tax returns are randomly chosen for a comprehensive review. The duration of a review… Source link

Read More »How top-selling electric vehicles will be affected by new tax credit

In a big win for Democrats, Senate passage of the Inflation Adjustment Act brings the bill to the House, where the bill is expected to pass. If all goes as planned, the legislation could be in front of President Biden to sign in as little as a couple weeks. For the automotive industry, a big piece of the legislation is the expansion of the $7,500 federal tax credit for EVs (electric vehicles), in which the cap on automakers to qualify for the credit — which currently is at 200,000 vehicles… Source link

Read More »