Wall Street has known its share of legends, but few of them have made as big a splash as “the Man Who Broke the Bank of England.” That nickname belongs to George Soros who earned the tag after famously betting against the British Pound in 1992; following the Black Wednesday crash, the hedge fund manager pocketed a $1 billion in a single day. This is the stuff that Wall Street legends are made of. By then Soros was already incredibly successful and in the midst of steering his Quantum Fund to… Source link

Read More »Cathie Wood Pulls the Trigger on These 3 “Strong Buy” Stocks

The billionaire investors stand in a league of their own. It’s not necessarily their wealth that puts them there – rather, it’s their success in the markets, in establishing themselves at the highest level of the financial world, that built their wealth. Cathie Wood, the founder and CEO of $75 billion asset manager Ark Invest, is one of Wall Street’s most influential investors due to her stock-picking power and her company’s impressive returns. Looking at the current market situation,… Source link

Read More »Nvidia easily beats earnings expectations on strong gaming and data center sales

Nvidia CEO Jensen Huang. (MANDEL NGAN/AFP via Getty Images) Nvidia (NVDA) reported its Q3 earnings after the bell on Wednesday beating analysts’ predictions on the top and bottom line as revenue jumped 50% year-over-year. Here are the most important numbers from the report compared to what Wall Street was expecting from the company, as compiled by Bloomberg. Revenue: $7.1 billion versus $6.81 billion expected. Earnings per share: $1.17 versus $1.11 expected. Gaming revenue: $3.22 billion versus… Source link

Read More »Billionaire Ray Dalio Picks Up These 3 ‘Strong Buy’ Stocks

We had some serious economic news this month, when October’s inflation rate came in at 6.2% annualized. It was the sixth consecutive month +5% year-over-year inflation gains – and the highest inflation rate seen in the US since 1990. Billionaire Ray Dalio, founder of Bridgewater Associates, reminds investors that the worst asset to hold in this environment is cash. “Some people make the mistake of thinking that they are getting richer because they are seeing their assets go up in price… Source link

Read More »2 “Strong Buy” Dividend Stocks With 8% Dividend Yield

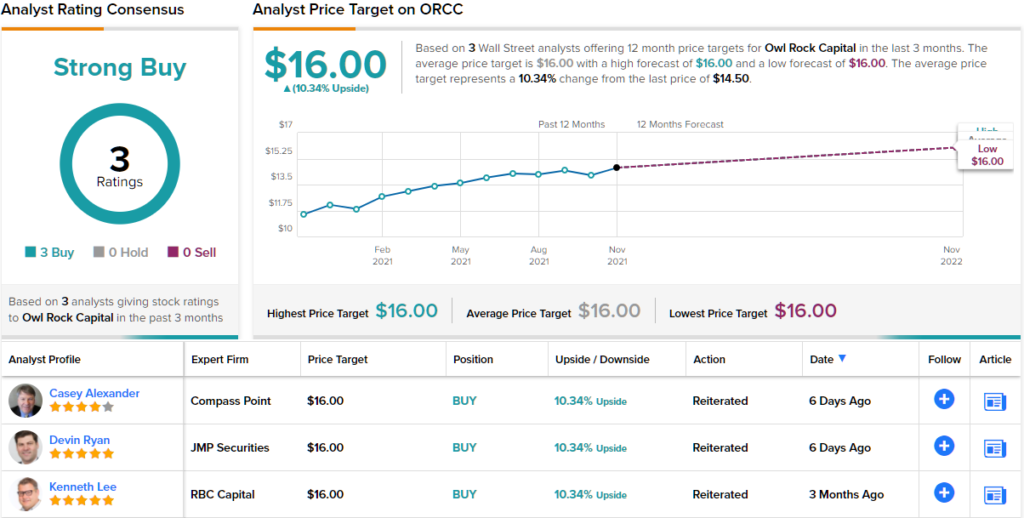

Let’s talk about rising markets, and whether or not to buy in. That’s the question that investors need to consider right now, as the major indexes have hit record highs – but the economy is flashing signs of concern for those who care to look. Inflation continues to rise, and the 10-year Treasury bond yield, which had risen above 1.5%, has slipped to 1.4% and is trending down. Investors are seeking returns, and so are drawn to the stock markets; they’re banking that central banks will… Source link

Read More »Yandex NV (YNDX) gains 2.28% on Strong Volume October 27

Last Price $ Last Trade Change $ Change Percent % Open $ Prev Close $ High $ low $ 52 Week High $ 52 Week Low $ Market Cap PE… Source link

Read More »Google Reports Strong Third-Quarter Advertising Revenue, Shrugging Off Apple Privacy Changes

Google’s advertising business brought in $53.1 billion during the third quarter, up from $37.1 … [+] billion during the same period last year. Getty Images While some advertising-funded internet giants like Facebook and Snap Inc. are feeling the brunt of Apple’s recent data privacy changes, Google seems less worried. Today, Google parent Alphabet Inc. reported a record $65.1 billion in revenue during the third quarter of 2021, with the company’s… Source link

Read More »Microsoft smashes earnings expectations with strong cloud performance

Microsoft (MSFT) reported its fiscal Q1 2022 earnings after the closing bell on Tuesday, easily beating analysts’ expectations on the top and bottom line, with cloud revenue up 36% year-over-year. The stock was flat on the news. Here are the most important numbers from the report compared with what analysts were expecting, as compiled by Bloomberg. Revenue: $45.3 billion versus $43.93 billion expected Earnings per share: $2.71 versus $2.07 expected Intelligent Cloud: $16.98 versus $16.58 billion… Source link

Read More »Bitcoin ETF demand so strong we could bring ‘2 or 3’ new ones to market: Valkyrie CEO

A milestone week that began with the introduction of the first Bitcoin-based exchange traded fund (ETF) ended just as it began — with a new fund based on the world’s leading cryptocurrency. On Friday, digital asset manager Valkyrie launched its Bitcoin Strategy ETF (BTF) on the Nasdaq exchange. The company anticipates its fund will be the first of at least a couple more, as big and small investors flock to crypto investments. Valkyrie’s Bitcoin ETF followed the debut of the Proshares… Source link

Read More »TSMC Forecasts Bullish End to 2021 on Strong Chip Demand

(Bloomberg) — Taiwan Semiconductor Manufacturing Co. forecast fourth-quarter sales and margins that exceeded some analysts’ estimates, as demand for chips stayed robust in the face of worsening snarls in the supply chain. Most Read from Bloomberg The world’s No. 1 foundry said Thursday it expects revenue of as much as $15.7 billion in the three months ended December, helping full-year sales grow by about 24% in dollar terms. Gross margin may be as high as 53%, with executives reiterating… Source link

Read More »

/https://specials-images.forbesimg.com/imageserve/61788a93a89067ce2efc3336/0x0.jpg)