Economic challenges abound, and equities will rally. It’s a seemingly paradoxical view, but one espoused by one of the biggest players in the market. Scott Minerd thinks stocks have bottomed, and will rally from here. Minerd is chief investment officer at Guggenheim Partners, helping oversee the firm’s $255 billion in assets. He told Yahoo Finance Live that stocks can rise at least 10% from current levels going into next year. “There’s an old saying that markets climb a wall of worry…. Source link

Read More »20 Safe Dividend Stocks to Quit Your 9 to 5 Job

In this article, we will be taking a look at 20 Safe Dividend Stocks to Quit Your 9 to 5 Job. To skip our detailed analysis of dividend investing, you can go directly to see the 5 Safe Dividend Stocks to Quit Your 9 to 5 Job. Whether you are a veteran dividend investor, or someone new to the investment strategy, early retirement and increased income are two of the main attractions offered by dividend stocks. Income investors tend to aim for increased monthly, quarterly, or yearly incomes by… Source link

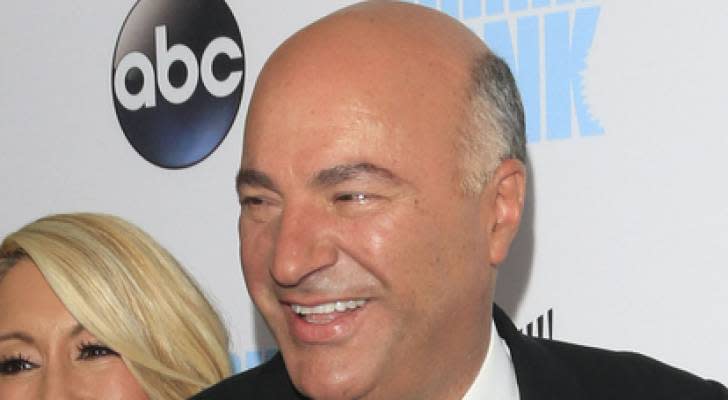

Read More »Kevin O’Leary sees ‘trillions’ coming to crypto — but he still loves these dividend stocks

Kevin O’Leary sees ‘trillions’ coming to crypto — but he still loves these dividend stocks “For the first time ever, my crypto exposure is greater than gold.” That’s what investment mogul and Shark Tank personality Kevin O’Leary told Stansberry Research in an interview earlier this month. In fact, Mr. Wonderful plans to double his crypto holdings to 7% of his portfolio by the end of this year, largely because he sees “trillions of dollars” of interest coming into the… Source link

Read More »Why stocks are suddenly back in rally mode: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Tuesday, October 19, 2021 Trash. That’s my word of the morning for you all. My golf game was in trash-like form on Sunday afternoon while catching a quick 18 holes with Yahoo Finance senior columnist Rick Newman (whose play was not trash). I doff my cap to you, Sir Rick. Trash was in my thoughts on the golf course (that led to trash play). I… Source link

Read More »Asia Stocks, U.S. Futures Fall as Bond Yields Jump: Markets Wrap

(Bloomberg) — Most Asian stocks and U.S. futures slid Monday as surging energy prices cemented worries about inflation, sending bond yields higher. Most Read from Bloomberg MSCI Inc.’s gauge of Asia Pacific shares was on track for its first decline in four sessions as equities dropped in Japan, Hong Kong and China. U.S. contracts dipped after American stocks advanced on Friday, with the S&P 500 chalking its best week since July as earnings buoyed sentiment. Bond yields in New Zealand and… Source link

Read More »Mark Cuban just tripled his stake in Dogecoin — but his bet on these 2 stocks is 667x larger

Mark Cuban just tripled his stake in Dogecoin — but his bet on these 2 stocks is 667x larger Mark Cuban just tripled his stake in popular cryptocurrency Dogecoin — from $500 to $1,500. Of course, for a billionaire shark and owner of the Dallas Mavericks, that’s not exactly a big chunk of change. While Cuban has been highly supportive of Dogecoin, calling it the “people’s way to pay” back in August, he recently told Fox Business that he owns the token just “for fun.” “I’ve… Source link

Read More »Why These 10 Stocks Are Trending on Wednesday

In this article we will take a look at the some of notable stocks trending today. You can skip our detailed analysis of these stocks and go to read Why These 5 Stocks Are Trending on Wednesday. Although earnings are now in full swing, the markets are relatively quiet this Wednesday with the Dow Jones and the S&P 500 just modestly higher. Among the stocks that are trending include Plug Power Inc. (NASDAQ:PLUG), QUALCOMM Incorporated (NASDAQ:QCOM), Apple Inc. (NASDAQ:AAPL), JPMorgan Chase & Co…. Source link

Read More »Michael Burry’s ‘mother of all crashes’ warning is still in play — but here are 3 stocks he’s bullish on

Michael Burry’s ‘mother of all crashes’ warning is still in play — but here are 3 stocks he’s bullish on “The Big Short” guy is sounding the alarm again. Michael Burry, the hedge fund manager who famously bet against the country’s housing market in 2008, recently proclaimed in a since-deleted tweet, “Bond & stock markets depend on a Fed stripped of all credibility.” It’s not his first warning. “All hype/speculation is doing is drawing in retail before the mother of all… Source link

Read More »Stocks, U.S. Futures Dip on Inflation, China Risks: Markets Wrap

(Bloomberg) — Stocks and U.S. equity futures fell Tuesday, hurt by concerns about elevated inflation stoked by energy costs and the possibility of a widening regulatory crackdown in China. Most Read from Bloomberg MSCI Inc.’s Asia-Pacific index snapped a three-day climb, with the technology sector leading losses and China underperforming. Signs that Beijing is widening its scrutiny of private and state enterprises soured the broader mood. S&P 500, Nasdaq 100 and European futures retreated… Source link

Read More »3 ‘Strong Buy’ Stocks Raymond James Predicts Will Rally Over 60%

As Q4 gets into full swing, we can take a moment to look back over our shoulders at where we’ve come from. The sustained upward trend of the markets is obvious from this view, and the recent downturn in the market appears as a bump against some otherwise solid gains. Even so, there are reasons for concern right now. The COVID pandemic hasn’t gone away – and it doesn’t look like it will go away either. The September jobs numbers were weak, and unemployment only fell because too many… Source link

Read More »