This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Thursday, June 30, 2022 Today’s newsletter is by Jared Blikre, a reporter focused on the markets on Yahoo Finance. Follow him on Twitter @SPYJared. The Nasdaq (^IXIC) and Russell 2000 (^RUT) are having their worst year ever. The Dow Jones Industrial Average (^DJI) is off to its worst start since 1962. And you’d have to travel back to 1970 for a… Source link

Read More »Stocks mixed as inflation, growth concerns linger

US stocks fell Wednesday morning, extending Tuesday’s losses as investors remained focused on mounting signs of a slowdown in US economic growth. The S&P 500 traded lower shortly after market open, following a 2% slide in the index a day earlier. The Dow Jones Industrial Average edged lower, while the Nasdaq Composite underperformed as technology stocks remained under pressure. Bitcoin also fell, and prices briefly fell below $20,000. West Texas intermediate crude oil futures rose above $112… Source link

Read More »Stocks pace towards worst start since 1970

The week ahead will bring to an end the second quarter and the first half of what has been a challenging 2022 for investors. Several key economic reports, including core PCE inflation – the Federal Reserve’s preferred measure of consumer prices – are on tap, along with earnings from Nike (NKE), Jefferies (JEF), Micron Technology (MU), and Bed Bath & Beyond (BBBY). The S&P 500 rose by more than 3% on Friday and gained over 6% for the week, its second-best week this year and its first weekly… Source link

Read More »Insiders Are Flashing a Strong Buy Signal for These 2 Stocks

Downturns can bring a lot of pain, but they can also bring on plenty of opportunities, as lower stock prices start making costs of entry more attractive. Before taking advantage of these opportunities, however, investors need to find a recognizable signal that will set them apart. One popular signal to follow is the insider buying, the trades made by high-ranking company officers whose positions give them the ‘inside’ track on their company’s likely prospects – and therefore, of the… Source link

Read More »‘A cold dark place’ — Michael Burry thinks the market has plenty of room to plunge. But he finally sees value in these 4 stocks

‘A cold dark place’ — Michael Burry thinks the market has plenty of room to plunge. But he finally sees value in these 4 stocks Michael Burry — the hedge fund manager depicted by Christian Bale in The Big Short — has been aggressively investing during this market downturn. Burry’s latest 13F filing for the first quarter of 2022 shows a broad range of new investments and some interesting strategic moves with options. That’s a significant shift from the previous quarter when Burry… Source link

Read More »Seeking at Least 8% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

With gasoline prices through the roof at record highs, inflation running at 40-year record levels, and last year’s bullish stock market turn down into a genuine bear, it’s no wonder that the financial and economic worlds are looking like reruns of ‘That 70s Show.’ Market watchers remember that the bad times of the late 70s and early 80s were tamed only when Fed Chair Paul Volker sparked a recession with near-20% interest rates – and for investors under 45, just take note that Q1… Source link

Read More »Stocks rise after S&P 500’s worst week since March 2020

U.S. stocks rose Tuesday as traders returned from a long weekend, with equities recouping some losses following the S&P 500’s worst week since March 2020. The S&P 500 advanced by 2.45% in its best day in three weeks, ending at 3,764.84 and recovering some declines after plunging by 5.8% last week. The Nasdaq Composite gained 2.5% to end at 11,069.30, and the Dow added more than 643 points, or 2.2%, to end at 30,531.77 and post its best single-day gain since May 4. Bitcoin (BTC-USD) rose back… Source link

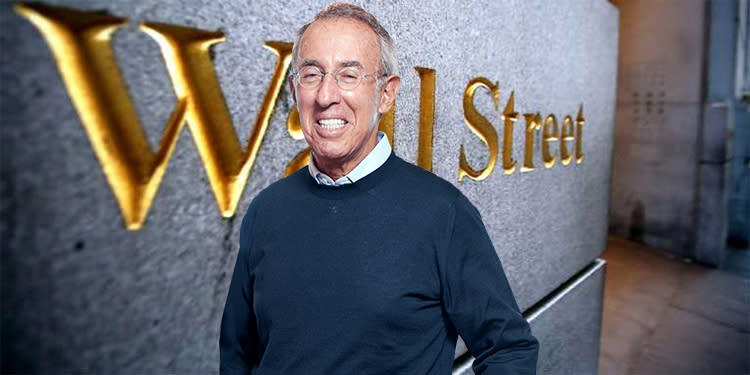

Read More »Billionaire Ron Baron Says Recent Market Weakness Offers Huge Buying Opportunity; Here Are 3 Beaten-Down Stocks Analysts Like

Last month, the annualized rate of inflation hit 8.6%, the highest in more than 40 years. Last week, in response, the Federal Reserve bumped up its benchmark interest rate by 75 basis points, the largest such hike since 1994. The combination of high inflation and aggressive tightening action by the central bank sent an already jittery stock market to its worst single week since the onset of the COVID crisis, and has economists talking gloomily about a repeat of the late 1970s and early… Source link

Read More »Saudi Arabian Stocks Tumble as Oil, Rates Roil Mideast Equities

(Bloomberg) — Most Read from Bloomberg Saudi Arabian shares closed at the lowest level in about six months, leading declines in Middle East markets, following the global sell-off last week and oil’s plunge on Friday. The Tadawul All Share Index dropped 4.4% at close, with the index posting its longest losing streak since 2020. Aramco fell 4% to the lowest since March 15. Still, the state-controlled oil firm is the world’s biggest listed entity with a market value of $2.17 trillion compared… Source link

Read More »For All Their Worries, Investors Are Piling Into US Stocks

(Bloomberg) — For all the talk of bear markets and a possible recession, investors continue to pile into American equities. Most Read from Bloomberg US stocks attracted $14.8 billion in the week to June 15, their sixth consecutive week of additions, according to Bank of America Corp. strategists, who cited EPFR Global data. In total, $16.6 billion flowed into equities globally in the period, while bonds had the largest redemptions since April 2020 and just over $50 billion exited cash, the… Source link

Read More »