Farewell, July, it’s been a pleasure. Sentiment might finally be turning on Wall Street after the stock market recorded its best month since November 2020, buoyed by the tech giants better-than-expected quarterly results and the prospect of the Fed easing on future rate hikes. The major indexes are still down for the year, but we’re clearly in the midst of a rally. Where this rally will go is anyone’s guess. For now, Wall Street’s analysts are busy selecting the stocks they see as best… Source link

Read More »Tech stocks: What Wall Street experts recommend in a bear market

Tech stocks have gotten some of their mojo back — at least for now. Some of the beaten down tech-related names have rebounded since the market’s most recent bottom on June 16. In our series “What to do in a bear market,“ Yahoo Finance examines Wall Street analysts’ recommendations on tech related holdings — against a backdrop of a slowing economy and the Federal Reserve’s moves to bring down inflation. On Wednesday, the central bank announced a 75 basis point rate hike. Fed Chairman Jerome… Source link

Read More »Stocks surge as Fed hikes rates by 75 basis points

U.S. stocks surged Wednesday as investors mulled a major decision from Federal Reserve policymakers to raise interest rates by 0.75% and remarks from Chair Jerome Powell hinting the central bank may slow the pace of its rate-hiking cycle. Better-than-expected earnings from tech giants also helped lift sentiment. The S&P 500 jumped 2.6%, while the Dow Jones Industrial Average gained 430 points, or roughly 1.4%. The tech-heavy Nasdaq Composite soared 4.1%. The Fed on Wednesday issued another 75… Source link

Read More »Google gives jittery stocks a lift ahead of Fed

A man wearing a protective face mask, amid the coronavirus disease (COVID-19) pandemic, walks past a screen showing Shanghai Composite index, Nikkei index and Dow Jones Industrial Average outside a brokerage in Tokyo, Japan, February 14, 2022. REUTERS/Kim Kyung-Hoon Register now for FREE unlimited access to Reuters.com Register SINGAPORE, July 27 (Reuters) – Better-than-expected results at Microsoft and Google helped soothe a nervous mood in stock markets on Wednesday, while a cut in Russian… Source link

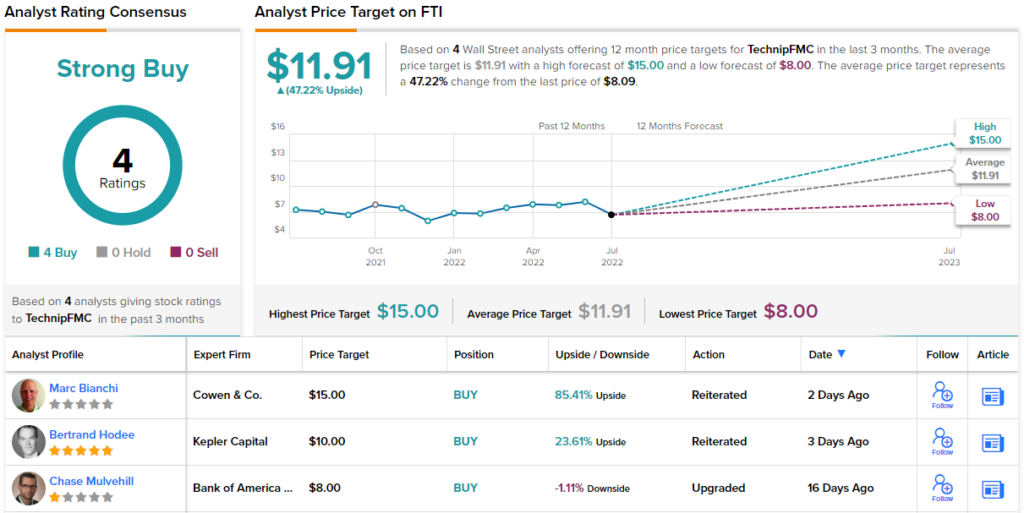

Read More »2 ‘Strong Buy’ Dividend Stocks Under $10 With at Least 10% Dividend Yield

Dividend stocks are the Swiss army knives of the stock market. When dividend stocks go up, you make money. When they don’t go up — you still make money (from the dividend). Heck, even when a dividend stock goes down in price, it’s not all bad news, because the dividend yield (the absolute dividend amount, divided by the stock price) gets richer the more the stock falls in price. Knowing all this, wouldn’t you like to own find great dividend stocks? Of course you would! Using the Source link

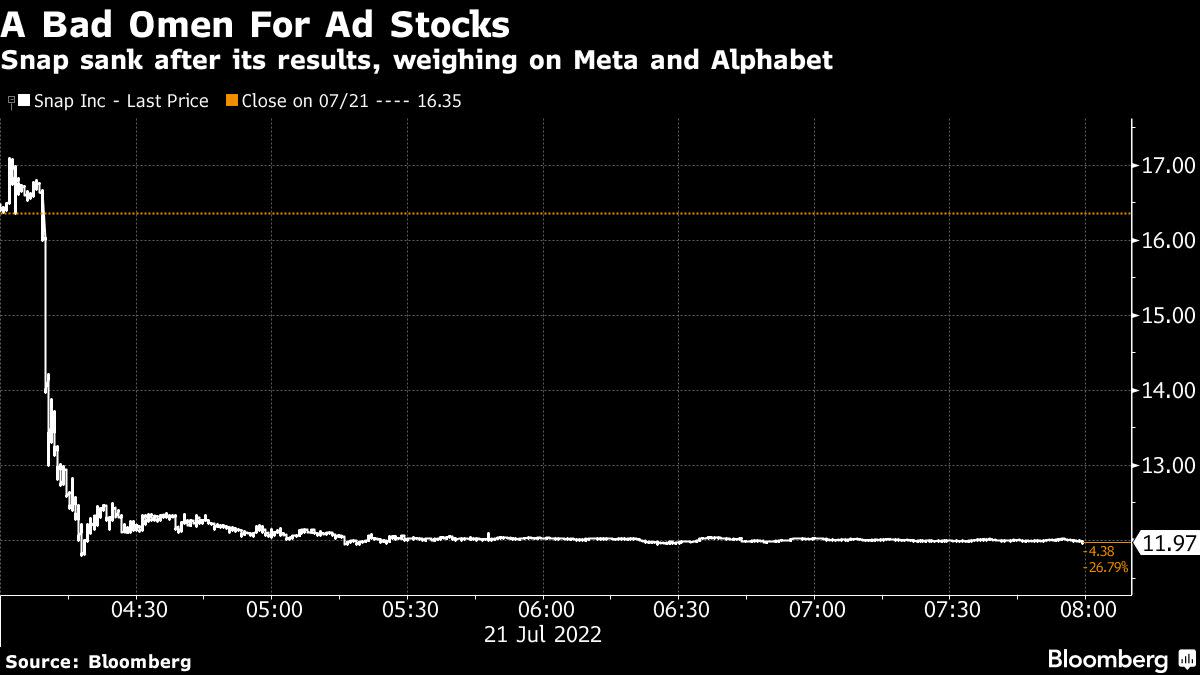

Read More »‘Awful’ Snap Sales Wipe $76 Billion From Social Media Stocks

(Bloomberg) — US social-media giants were poised to see more than $76 billion wiped off their stock-market values Friday after disappointing revenue from Snap Inc. raised concerns about the outlook for online advertising. Most Read from Bloomberg The Snapchat parent plummeted as much as 30% in premarket trading. Meanwhile, Facebook parent Meta Platforms Inc. fell 4.8%, Google owner Alphabet Inc. declined 2.8%, Twitter Inc. slipped 2.5% and Pinterest slumped 7.2%. The losses mark the second… Source link

Read More »Tech leads stocks higher as earnings rush in, ECB hikes rates

Technology stocks led markets higher for a third straight session Thursday as investors mulled a slew of mixed earnings and a surprise rate hike from the European Central Bank. The tech-heavy Nasdaq Composite gained 1.3%, while the benchmark S&P 500 index rose 1%. The Dow Jones Industrial Average added 160 points, or 0.5%. Shares of Amazon (AMZN) pushed higher for a seventh straight day, placing the e-commerce giant on pace for its longest winning streak since June 2020. The stock climbed 13%… Source link

Read More »2 “Strong Buy” Stocks That Are Too Cheap to Ignore

The last few days’ trading have been enough to make our heads spin. Markets have shifted up and down, showing both volatility and a short-term upward trend, a pattern that has investors wondering if this is the start of a sustained run of gains, or just a bear-market rally. Stiffel Chief Equity Strategist Barry Bannister believes that there’s less reason for fear and lays out a strong case for upside. “We forecast the S&P 500 up to 4,200 in 3Q22E and recommend Cyclical Growth groups…… Source link

Read More »Congress deliberates a $52 billion semiconductor bill — Here are 2 stocks that could benefit

In today’s world, the markets cannot be separated from politics. Case in point – the semiconductor subsidy bill currently before Congress. The bill, which holds the promise of some $52 billion worth of subsidies for the US semiconductor industry, was stalled in the Congressional processes for several months but last week got a boost from House Speaker Nancy Pelosi. In a move not sees as particularly coincidental, Pelosi’s husband just last month exercised a call option to purchase more… Source link

Read More »Stocks waver as earnings season picks up

U.S. stocks turned lower Monday following a report Apple (AAPL) plans to slow hiring and spending growth next year to prepare for a possible recession. Bloomberg News reported Monday afternoon that the hiring slowdown and cuts to spending will take place across certain divisions and stem from a move to “be more careful during uncertain times,” citing people familiar with the matter who asked to remain anonymous. Shares slid roughly 1.5%. The S&P 500 dipped 0.2%, while the Dow Jones Industrial… Source link

Read More »

/cloudfront-us-east-2.images.arcpublishing.com/reuters/L4SVGK2BRJP4PHBTJ3YGTDAJW4.jpg)