With Tax Day 2022 on April 18 fast approaching, young or inexperienced traders and investors may have questions about reporting gains on so-called “meme stocks” — stocks that become popular with retail investors through social media or other online platforms. According to private wealth advisor Rocco Carriero, tax reporting for meme stocks should be treated the same as any other equity investment. “Well, most financial institutions would be sending you out some type of a 1099 document… Source link

Read More »Stock futures open higher ahead of earnings reports

U.S. stock futures opened higher Tuesday evening after a choppy day in markets, as investors digested another hot print on inflation and looked ahead to a busy day of earnings on Wednesday. Contracts on the S&P 500 were flat to slightly positive. The index closed lower for a third straight session during the regular trading day on Tuesday, and both the Dow Jones Industrial Average and Nasdaq Composite also declined. Investors on Wednesday are set to receive a number of quarterly reports from… Source link

Read More »A new world order for the stock market is coming, explains BlackRock CIO

Making money in the stock market will likely look different over the next few years compared to the low interest rate era seen from the end of the Great Financial Crisis, says BlackRock’s CIO of U.S. fundamental equities Tony DeSpirito. “It’s a really big deal,” says DeSpirito on Yahoo Finance Live. DeSpirito explains that since the end of the financial crisis, the economy has experienced very low growth, very low inflation and very low rates. But those factors largely ended during the… Source link

Read More »Stock futures point to higher open as investors weigh inflation data

U.S. stock futures jumped in pre-market trading Tuesday as investors assessed fresh inflation data out of Washington that showed prices in March further accelerated to a new 40-year high. Contracts on the S&P 500 popped 0.7%, and the Dow jumped nearly 130 points ahead of the open. Futures tied to the Nasdaq Composite surged 1.3%. Meanwhile, Treasury yields slightly retreated, but the benchmark 10-year yield remained above 2.7%, the highest level since January 2019. The moves follow a down day… Source link

Read More »Stock futures drop, Treasury yields spike as traders await inflation, earnings data

U.S. stock futures pointed to a lower open Monday morning as investors looked ahead to the start of corporate earnings season this week and a bevy of new economic data as the Federal Reserve prepares to accelerate its moves to counter inflation. Contracts on the S&P 500 declined and added to last week’s losses. Nasdaq futures dropped as technology stocks came under renewed pressure. Treasury yields climbed, and the benchmark 10-year yield rose above 2.7% to reach the highest level since… Source link

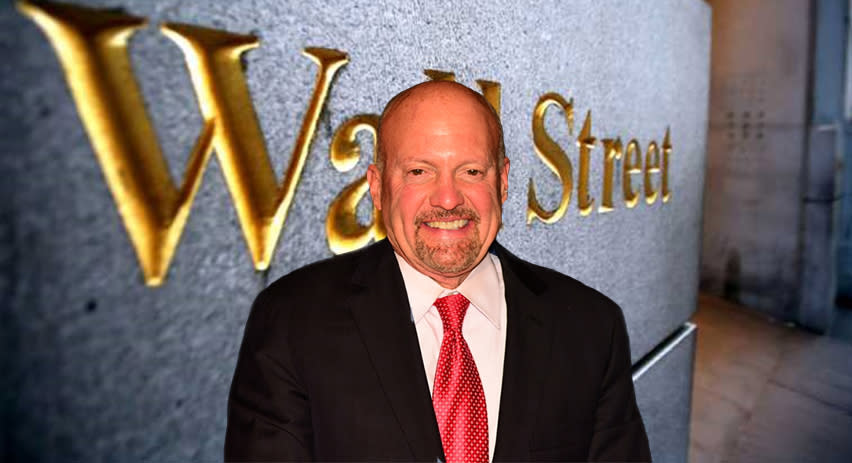

Read More »Are These 3 Jim Cramer’s Stock Picks a Buy? Here’s What Analysts Think

The one good thing about a market downturn? You get lots of opportunities to load up on shares at a discount entry point. And who doesn’t like a discount? With the way the markets have performed so far this year, there are stocks in every segment which could potentially offer plenty of rewards. CNBC’s Jim Cramer thinks there are several names in the retail sector which look particularly enticing right now, ones for which the term “beaten-down” readily applies. Some rallied nicely… Source link

Read More »Stock futures extend gains, with Fed in focus

U.S. stock futures gained Friday morning, with investors continuing to contemplate the next policy moves by the Federal Reserve. Contracts on the S&P 500 pointed to a higher open to build on Thursday’s gains and further shake off volatility from earlier this week. Still, as of Thursday’s close, the S&P 500 was on track to post a weekly loss that would end a three-week winning streak, if levels hold through Friday’s close. Fresh commentary from Fed officials remained in focus, as another set of… Source link

Read More »The most bullish story in the stock market right now: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Friday, April 8, 2022 Today’s newsletter is by Sam Ro, the author of TKer.co. Follow him on Twitter at @SamRo. Before tensions escalated between Ukraine and Russia in February, a bullish stock market story had been unfolding: Wall Street analysts were revising up their forecasts for 2022 and 2023 corporate earnings. Since then, geopolitical risks… Source link

Read More »Lawmakers worry ‘time is running out’ to regulate Congressional stock trading

While U.S. lawmakers have offered at least a dozen overlapping bills to regulate their own stock trades, it wasn’t until Thursday that a senator detailed plans for a final push to pass the legislation this year. “We need to be able to come back two weeks from now and have a consolidated vision in the Senate,” Sen. Jeff Merkley (D-OR) said of work to be done during the upcoming Easter recess. “Otherwise we are going to miss this opportunity.” With election season right around the corner, he… Source link

Read More »‘Time Correction’ Will Maximize Stock Anguish, Top Manager Says

(Bloomberg) — Don’t be fooled by the stock market’s rapid-fire reaction to the news. It’s just the beginning of the first real slog in years, one that will hand a comeuppance to passive investors who once thought the only way for prices to go was up. Most Read from Bloomberg That’s the view of James Abate, whose Centre American Select Equity Fund (DHAMX) has beaten 97% of its peers during the past three years according to data compiled by Bloomberg. He says shares are getting less… Source link

Read More »