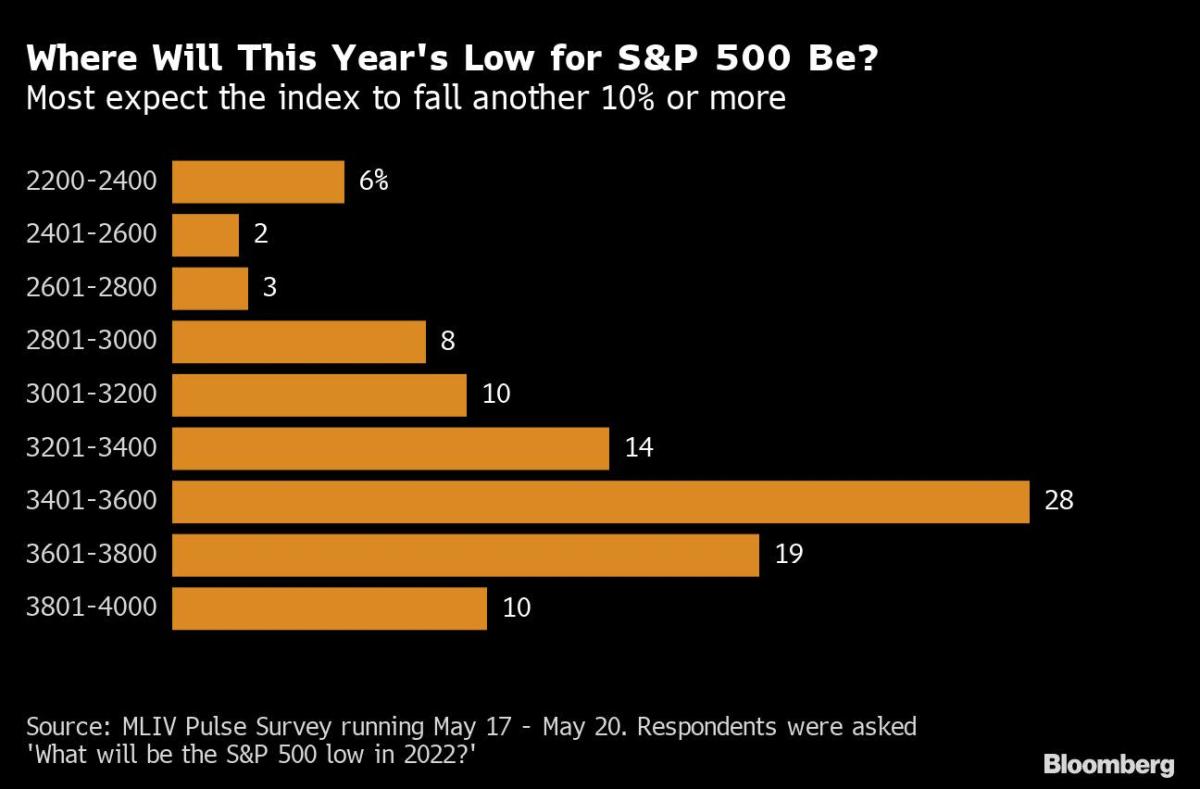

(Bloomberg) — Get ready for a fresh slump in the world’s most-watched stock index, as economic growth fears spiral and the Federal Reserve embarks on its biggest policy-tightening campaign in decades. Most Read from Bloomberg With the S&P 500 flirting with a bear market last week and notching more than $1 trillion in losses, participants in the latest MLIV Pulse survey reckon there’s more pain to come. The gauge is likely to keep falling this year before bottoming at around 3,500,… Source link

Read More »Suze Orman says you can avoid 5 common mistakes people make in a stock market crisis

Suze Orman says you can avoid 5 common mistakes people make in a stock market crisis Alarm bells are ringing out on the stock market, and personal finance expert Suze Orman has heard them along with you and has advice as you warily watch your investments lose value. The Women & Money podcast host fears people will make dire mistakes out of panic in a shaky market, with predictions of a recession. “I know that your tendencies right here and right now are to start selling everything,” Orman… Source link

Read More »Stock Market Is Near Capitulation As Market Rotation Out From This Sector

Many traders and investors speculated about a potential market bottom or at least a meaningful rally could be around the corner as S&P 500 rallied from the oversold condition below 3900 to almost 4100 just within 4 days. The rally was expected to be short-lived as explained in the video at the bottom of the post using multiple scenarios focusing on the characteristics of the price action in order to differentiate a bull trap from a market bottom. This was further supported by the bearish… Source link

Read More »Stock market news live updates: May 19, 2022

U.S. stock futures plunged ahead of market open Thursday, extending losses from a weeks-long sell-off on Wall Street that intensified in the previous trading session as disappointing retail earnings reignited concerns about the impact of inflation. Futures tied to the S&P 500 fell 1% following the index’s worst decline since June 2020. Contracts on the Dow erased 300 points after the benchmark logged a nearly 1,200-point drop on Wednesday to close at its lowest level since March 2021, and… Source link

Read More »Stock market news live updates: May 19, 2022

U.S. stock futures edged lower ahead of the overnight session Wednesday after a weeks-long sell-off on Wall Street deepened in earlier trading as disappointing retail earnings reignited concerns about the impact of inflation. Futures tied to the S&P 500 fell 0.5% following the index’s worst decline since June 2020, as all but eight stocks in the benchmark closing in negative territory during Wednesday’s session. Contracts on Dow futures erased 0.4% after the index logged a nearly 1,200-point… Source link

Read More »Stock futures rise to extend gains after Powell comments

U.S. stock futures opened higher Tuesday afternoon after rallying during the regular trading day, as investors took in reassurances from Federal Reserve Chair Jerome Powell that the central bank was set on using its policies to bring down inflation still running at multi-decade highs. Contracts on the S&P 500 edged higher. The blue-chip index ended Tuesday’s regular trading day higher by 2% to settle at at 4,088.85. Technology and growth stocks that had been beaten down over the past month… Source link

Read More »If Elon Musk scraps Twitter deal, here’s what may happen to the stock

Twitter investors should brace for an all-out crash in the stock price if Tesla CEO Elon Musk abandons his bid for the social media platform, warns one veteran tech analyst. “In the absence of a bid, we would not be surprised to see the stock find a floor at $22.50,” said Jefferies analyst Brent Thill said Tuesday in a new note to clients. Such a price would be about 40% lower than Twitter’s current trading level. Musk’s outstanding deal for Twitter is for $54.20 a share. The path is being cut… Source link

Read More »Stock market news live updates: May 17, 2022

U.S. stock futures surged in pre-market trading Tuesday, extending a streak of gyrations in equity markets as the indexes attempt a comeback from intense selling last week amid worries around persistent levels of inflation and the prospect of an economic slowdown. Futures tied to the S&P 500 jumped 1.6%, and Dow futures climbed 400 points. Contracts on the Nasdaq gained 2%. The moves follow six straight weeks of declines for the S&P 500, its longest span of losses in more than a decade, and… Source link

Read More »Stock market news live updates: Stocks end mixed as tech shares come under renewed pressure: Nasdaq drops 1.2%

U.S. stocks ended mixed on Monday, with equities struggling for direction as concerns over the growth outlook persisted amid elevated inflation. The S&P 500 ended a choppy session lower, dropping 0.4% to close at 4,008.01.The Nasdaq dropped by 1.2% to end at 11,662.79, as mega-cap technology companies including Apple (AAPL) fell and dragged the index lower. The Dow Jones Industrial Average closed slightly higher to reach 32,223.42. U.S. crude oil prices (CL=F) erased earlier losses and rose… Source link

Read More »Stock Markets Are Overpricing Recession Risk, JPMorgan Strategist Says

(Bloomberg) — Equity investors’ anxiety about a potential recession isn’t showing up in other parts of the market, which is giving JPMorgan Chase & Co. strategist Marko Kolanovic confidence in his pro-risk stance. Most Read from Bloomberg US and European stock markets are pricing in a 70% chance that the economy will slide into recession in the near-term, according to estimates by JPMorgan’s top-ranked strategist. That compares with a 50% chance priced into the investment-grade debt… Source link

Read More »