U.S. stocks sank Thursday following a rebound rally in the prior trading session that helped all three major averages log gains of well above 1%. The S&P 500 tumbled 0.8% at the start of trading, while the Dow Jones Industrial Average slid 220 points, or about 0.7%. The technology-heavy Nasdaq Composite led the way down — declining about 0.8%. On Wednesday, the S&P 500 surged 1.8%, the Dow Jones Industrial Average about 1.4%, and the Nasdaq Composite 2.1% – snapping a seven-day streak of… Source link

Read More »Stock market news live updates: September 7, 2022

U.S. stock futures inched higher Wednesday morning as Wall Street clawed back from a three-week selloff across equity markets. Futures tied to the S&P 500 index ticked up 0.2%, while futures on the Dow Jones Industrial Average added roughly 30 points, or 0.1%. Contracts on the tech-heavy Nasdaq Composite advanced 0.3%. “The difficult 2022 for stocks may not get much easier because as we now wait for better news on the inflation front, we have to contend with a seasonally weak month of… Source link

Read More »LIVE: Stock Market Coverage – Wednesday September 7 Yahoo Finance – Yahoo Finance

LIVE: Stock Market Coverage – Wednesday September 7 Yahoo Finance – Yahoo Finance Source link

Read More »The stock market has been in free fall since the Fed said ‘pain was coming.’ Morgan Stanley says buckle up for another drop

“Fire and ice” isn’t just a show about dragons and zombies on HBO. It’s been Michael J. Wilson’s vision of the stock market throughout 2022. Wilson, the chief investment officer at Morgan Stanley, has argued that stocks are fighting a toxic combination of economic headwinds—which he calls “fire” and “ice”—that are set to keep equity prices subdued until late 2023. The stock market’s summer rally was cut short last month as investors digested a reaffirmation of the… Source link

Read More »Has the stock market hit bottom yet? Bank of America says 6 of 10 signs point to no

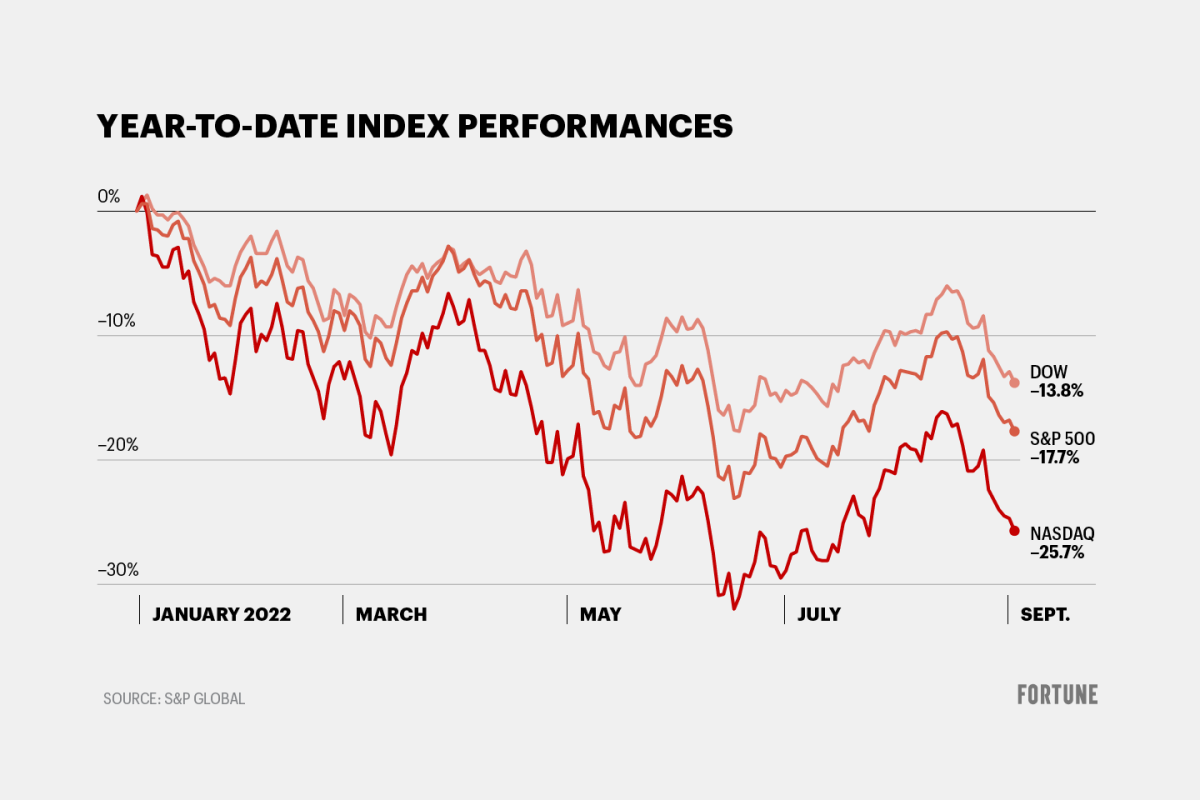

The S&P 500’s decline this year—it’s down nearly 18% since January—accelerated last week after Federal Reserve Chair Jerome Powell indicated more “pain” was ahead. Has the market hit bottom? Bank of America Research, based on its new list of 10 signals showing whether the stock market has hit bottom, says no. View this interactive chart on Fortune.com The bank came up with the list, released on Friday, after analyzing “macro and bottom-up data encompassing policy, valuation,… Source link

Read More »Stock futures higher after August jobs report

U.S. stocks opened Friday’s trading session higher following an in-line August jobs report. Shortly after the opening bell, the S&P 500 was up 0.7%, the Nasdaq up 0.7%, and the Dow was up about 150 points, or 0.5%. This jump follows a volatile trading session on Thursday that saw all three major indexes sink before paring losses, with the S&P 500 and Dow finishing September’s first trading session in the green. Data from the Labor Department published Friday morning showed nonfarm payrolls grew… Source link

Read More »LIVE: Stock Market Coverage – Tuesday August 30 Yahoo Finance – Yahoo Finance

LIVE: Stock Market Coverage – Tuesday August 30 Yahoo Finance – Yahoo Finance Source link

Read More »Stock market news live updates: August 26, 2022

Stock futures slipped Friday morning as Wall Street awaited a highly-anticipated speech by Federal Reserve Chair Jerome Powell at the U.S. central bank’s economic symposium in Jackson Hole. Futures tied to the S&P 500 fell 0.4%, while futures on the Dow Jones Industrial Average shed roughly 100 points, or 0.3%. Nasdaq futures were off by 0.6%. The moves come after all three major averages rallied in the previous session to log gains of more than 1%. Powell is scheduled to deliver remarks… Source link

Read More »Stock Market Coverage – Wednesday August 24 Yahoo Finance – Yahoo Finance

Stock Market Coverage – Wednesday August 24 Yahoo Finance – Yahoo Finance Source link

Read More »Meme Stock Hero Ryan Cohen Used Retail Investors To Pump ‘Extremely Underwater’ Bed Bath & Beyond Position, Strategist Says

Retail traders were quick to flock to the side of Chewy Inc (NYSE: CHWY) founder and GameStop Corp (NYSE: GME) chair Ryan Cohen when he purchased a stake in Bed Bath & Beyond Inc (NASDAQ: BBBY) in March. Less than six months later, Cohen has filed intent to sell his stake in the embattled retailer and accusations are flying. One institutional investor has suggested that Cohen used retail investors to pump the stock for his own benefit. What To Know: Luke Lloyd, wealth advisor… Source link

Read More »