The economy is likely to blow hot and cold for the immediate future, Morgan Stanley’s copresident says, as the economy swings between fears of inflation and fears of contraction. Last week, Ted Pick, head of institutional securities at investment bank Morgan Stanley, joined bankers and investors from Jamie Dimon to Carl Icahn in warning that chances of a recession are steadily rising, marked by periods of a hot and cold economy. “There is a fire narrative, and that fire narrative is… Source link

Read More »Morgan Stanley Says These 3 Stocks Could Surge Over 60% From Current Levels

Investors are facing a confusing environment, with long- and short-term signals sending different messages. Inflation remains stubbornly high, above an 8% annualized rate, and the Federal Reserve has made it clear that additional interest rate hikes are in the offing. Stocks are well off their highs, and despite last Friday’s gains, the S&P 500 and the Nasdaq posted their sixth consecutive weekly loss. But there are positives, too. The 1Q22 earnings season gave an upbeat vibe, as more than… Source link

Read More »Arizona State’s Stanley Lambert charged with DUI in fatal crash

Arizona State defensive lineman Stanley Lambert. (AP Photo/Matt York) Police in Scottsdale, Arizona have charged Arizona State football player Stanley Lambert with driving under the influence after a pedestrian was struck by a car and later died from her injuries, according to local reports. Police say that a car struck a 23-year-old woman as she crossed a road in Old Town Scottsdale around 1:38 a.m. on Saturday. The car’s driver was allegedly identified as Lambert. Scottsdale police arrested… Source link

Read More »Morgan Stanley analyst breaks down the ‘fire and ice’ recession indicators

As the earnings season gets underway, all eyes are on companies’ performance as markets will be gauging how big names across various sectors have been navigating inflation, rising interest rates, and the Russia-Ukraine war. According to Morgan Stanley (MS) Chief U.S. Equity Strategist and CIO Mike Wilson, there are two things that investors should focus on during this critical earnings season. “It’s really about, I think, two things. Number one, what did the companies guide to for 2Q and… Source link

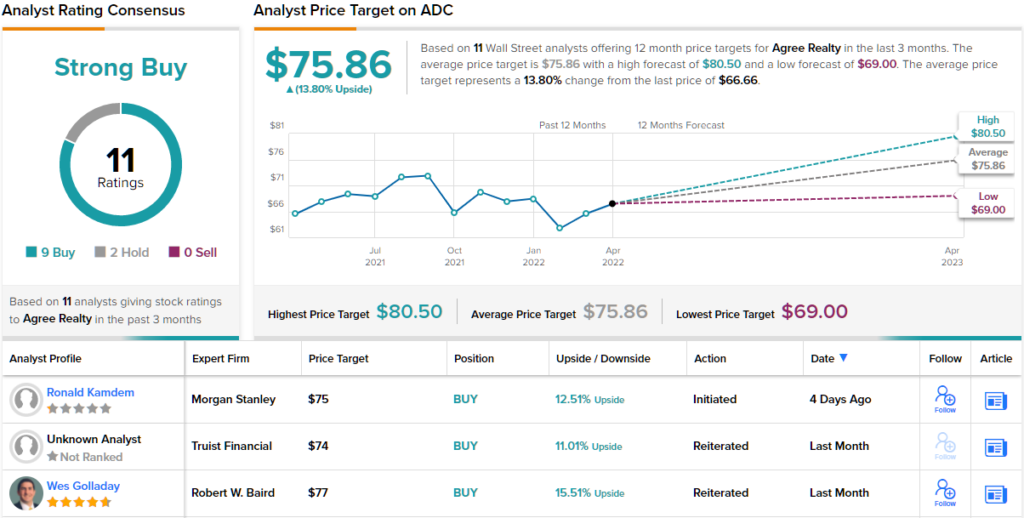

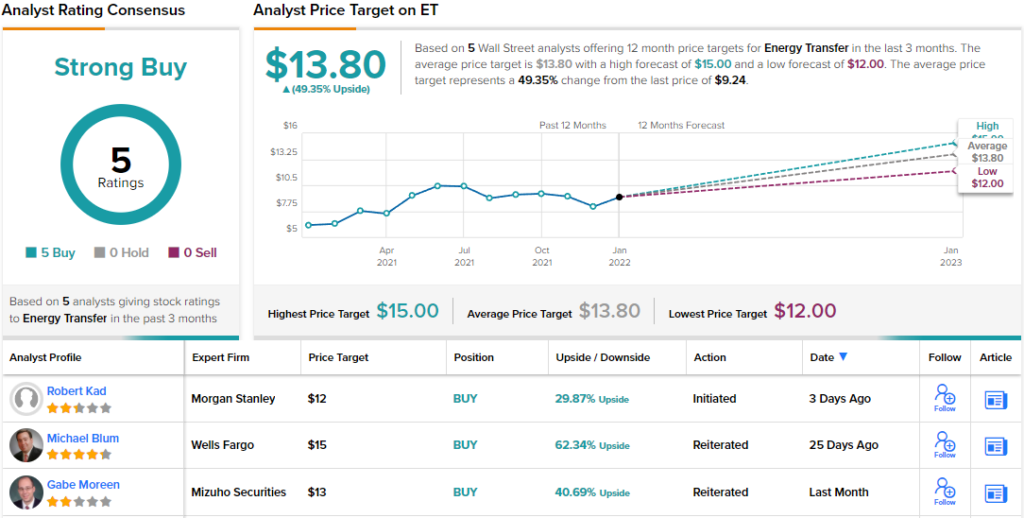

Read More »Morgan Stanley Pounds the Table on These 2 Reliable Dividend Stocks

There are a multiple headwinds buffeting the markets right now, pushing stocks, bonds, and commodities in various directions. Between stubbornly high inflation, the war in Ukraine, the persistence of COVID, and even the developing instability in Chinese real estate, the possible shocks that can hit the market are enough to make any investor’s head spin. They are also a strong inducement to start taking a defensive stance on an investment portfolio. At least, that’s the bottom line from… Source link

Read More »A Morgan Stanley investing chief says the Russia/Ukraine conflict is ‘a big deal’ for markets and anyone trying to trade it on a short-term basis will likely get it wrong

Russia invaded Ukraine Thursday, shelling key strategic targets.Vadim Zamirovsky/AP Morgan Stanley Wealth Management CIO Lisa Shalett said the Russia-Ukraine conflict will keep markets in risk-off mode for weeks. She said a rapidly-changing situation often results in a flight out of risk assets, but this isn’t a good strategy in the longer run. Russia invaded Ukraine on Thursday in the region’s largest military operation since World War 2. Financial markets have been roiled this week after… Source link

Read More »Seeking at Least 6% Dividend Yield? Morgan Stanley Suggests 2 Dividend Stocks to Buy

One thing is certain already: the market environment for 2022 will not be the same as that in 2021. This may or may not be good for investors, per se, but like every shift in market conditions, it will present opportunities for those prepared to grasp them. Some factors are just reruns. COVID is rearing its ugly head again, threatening us with lockdowns and shutdowns. That’s running against the grain of a resurgent economy, an economy that is trying to gain more traction – but it’s… Source link

Read More »Amazon Target Cut at Morgan Stanley on Impact From Rising Wages

(Bloomberg) — Amazon.com’s price target was cut at Morgan Stanley, which wrote that the online retailer’s profits could come under pressure as a result of a rising headcount and higher wages. Most Read from Bloomberg The firm lowered its target from $4,300 to $4,100, putting it below the average analyst target of $4,157. The new view still points to upside of almost 20% from Amazon’s last close. Morgan Stanley, along with every other firm tracked by Bloomberg, recommends buying the… Source link

Read More »Morgan Stanley Sees Growing Risk of 20% Drop in S&P 500

(Bloomberg) — A plunge of more than 20% in U.S. stocks is looking more like a real possibility, according to Morgan Stanley strategists led by Michael Wilson. Most Read from Bloomberg While it’s still a worst-case scenario, the bank said that evidence is starting to point to weaker growth and falling consumer confidence. In a note on Monday, the strategists laid out two directions for U.S. markets, which they dubbed as “fire and ice.” In the fire outcome, the more optimistic view, the… Source link

Read More »Stocks could be due for a correction of up to 20% ‘by fire or ice’: Morgan Stanley strategist

Morgan Stanley’s Chief Investment Officer Mike Wilson says investors should always be positioned for a market correction of 10%, but warned that investors may not be ready for a harsher correction that could be coming soon. “You should always be expecting a 10% correction. If you’re investing in equities, you should be prepared for that at any time,” Wilson told Yahoo Finance on Friday. “A 20% correction, which is really more disruptive, where people might want to try and position… Source link

Read More »