(Reuters) – Kansas City Federal Reserve Bank President Esther George on Monday said she expects the U.S. central bank to lift its target interest rate to about 2% by August, with further action dependent on how both supply and demand are affecting inflation. “Fed policymakers have emphasized a commitment to act expeditiously to restore price stability, and I expect that further rate increases could put the federal funds rate in the neighborhood of 2% by August, a significant pace of change in… Source link

Read More »Morgan Stanley’s Wilson Sees S&P 500 Losses After Bear Rally

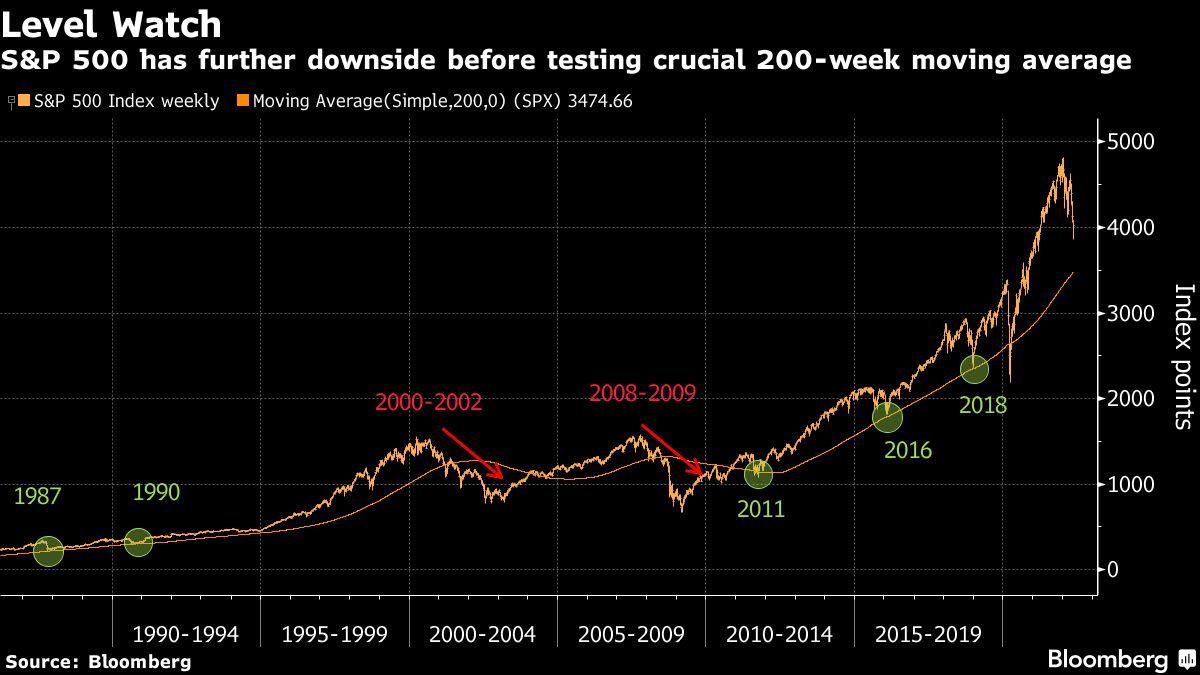

(Bloomberg) — The latest bounce in US stocks is a bear market rally and more declines lie ahead, according to Morgan Stanley strategists. Most Read from Bloomberg “With valuations now more attractive, equity markets so oversold and rates potentially stabilizing below 3%, stocks appear to have begun another material bear market rally,” strategists led by Michael Wilson wrote in a note on Monday. “After that, we remain confident that lower prices are still ahead.” READ: $11 Trillion and… Source link

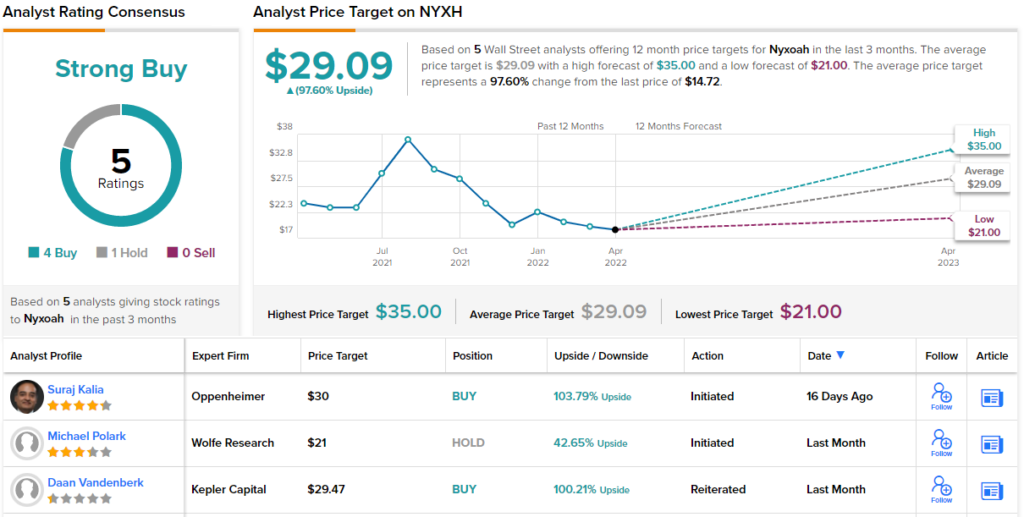

Read More »2 ‘Strong Buy’ Stocks Oppenheimer Sees Surging Over 80%

The markets went into bloodbath mode on Thursday as all the main indexes tumbled by at least 3%, with the NASDAQ’s 5% drop the most acute. That represented the tech-heavy index’s biggest one-day dive since June 2020. The force of the plunge confirms what we all know by now – the market headwinds are piling up, one upon the other. At its base, the issue is simple: there are too many problems, coming in too fast, and both the impersonal markets and the individual investors are finding it… Source link

Read More »Airbnb Q1 results top estimates as company sees ‘strong sustained pent-up demand’ for travel

Airbnb (ABNB) reported first-quarter results that exceeded estimates, as virus-related restrictions eased further and helped lift business. The company also reported its first quarter of positive adjusted EBITDA even as it navigated a jump in Omicron cases at the beginning of this year and international disruptions due to Russia’s invasion of Ukraine. Shares of Airbnb rose 6.5% in after-hours trading immediately following the results. Here’s what the lodging company posted in fiscal… Source link

Read More »Bank of America’s Hartnett Sees ‘Pain and Exit’ If S&P 500 Dips Below 4,000

(Bloomberg) — A drop below 4,000 index points for the S&P 500 will be a “tipping point,” which could potentially trigger a mass exodus from equities, according to Bank of America Corp. strategists. Most Read from Bloomberg Investors have already started fleeing stocks, with outflows from equity funds over the past three weeks adding up to the worst since March 2020, the strategists led by Michael Hartnett said, citing EPFR Global data. The average S&P 500 entry point for the “huge”… Source link

Read More »Wells Fargo Sees a $1.5 Trillion Opportunity for Fintech Companies; These 2 Stocks Are Set to Benefit

The digital revolution has changed the world in just the last decade and a half, spawning new technologies, new ways of using technologies, and bringing old businesses into the 21st century. Nowhere is this more obvious than in the financial sector. Banking and financial services have benefited enormously from bringing tech into the mix – and their gains have given us a new word to describe it, fintech. 5-star analyst Jeff Cantwell, of Wells Fargo, lays out the upside case for fintech in no… Source link

Read More »Why Nvidia’s CEO sees auto chips and tech as the company’s next big business

Nvidia introduced a new version of its autonomous-driving platform at its GTC developers conference this week. Automotive is a small segment of the company’s business. But it’s getting a lot of attention from Nvidia founder and CEO Jensen Huang. At the conference, Huang touted the company’s $11 billion vehicle-tech order pipeline over the next six years. But he says that’s only one slice of the potential market for autonomous-driving technologies and their importance to Nvidia ( Source link

Read More »Stock futures rises after Putin sees ‘positive’ developments in Ukraine talks

Stock futures headed for a higher open Friday morning after Russian President Vladimir Putin at least momentarily struck an upbeat tone about diplomatic discussions with Ukraine. Contracts on the S&P 500, Dow and Nasdaq each rose more than 1% in pre-market trading. The S&P 500 and Dow were on track to still post weekly losses, while the Nasdaq Composite aimed for a slight weekly gain if advances hold through market close. Crude oil prices edged higher after tumbling on Thursday, when U.S. West… Source link

Read More »Goldman Sachs sees the risk of US entering a recession

A recessionary storm could be forming off into the distance amid a host of inflationary and geopolitical concerns, warns strategists at Goldman Sachs. “We now see the risk that the U.S. enters a recession during the next year as broadly in line with the 20-35% odds currently implied by models based on the slope of the yield curve,” said Goldman Sachs Chief Economist Jan Hatzius. The top Wall Street strategist cut his 2022 U.S. GDP forecast to a growth of 1.75% from 2% previously. Consensus… Source link

Read More »Google’s CTO of Android tablets sees tablet sales passing laptops ‘in the not too distant future’

After seemingly forgetting that Android tablets existed for a while, Google is suddenly very invested in the market. Android 12L is in development to support larger-screened devices, and one of the platform’s co-founders, Rich Miner, has rejoined the team with the title “CTO of Android tablets.” Now, speaking to developers during an episode of Google’s The Android Show, Miner explained the opportunity the company is seeing (via 9to5Google). Miner references the introduction of… Source link

Read More »