This post was originally published on TKer.co Stocks fell last week, with the S&P 500 declining by 3.3%. The index is now up 5.4% from its October 12 closing low of 3,577.03 and down 21.3% from its January 3 closing high of 4,796.56. The market moves came amid confirmation that the labor market remains very tight and a reiteration from the Federal Reserve that it has a “ways to go” before the central bank could declare victory in its fight with inflation. All of last week’s developments… Source link

Read More »Russia tech group Yandex sees revenues rise

People walk outside the headquarters of Yandex company in Moscow, on September 14, 2015. File Photo / Reuters Moscow: Russian tech group Yandex said Thursday revenue continued to climb during the third quarter despite the country being under Western sanctions over its its invasion of Ukraine. The company’s revenues rose 46 percent compared to the July-September period last year to 113.2 billion rubles ($2.1bn at the current rate). Yandex — often dubbed “Russia’s Google” — employs around… Source link

Read More »Goldman Sees Some Bargains in US But Finds S&P 500 Expensive

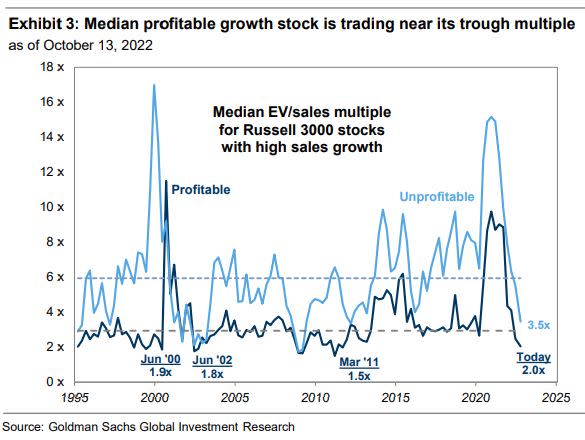

(Bloomberg) — Goldman Sachs Group Inc. sees attractive opportunities emerging in US stocks even as the S&P 500 benchmark remains expensive versus its history and accounting for interest rates. Most Read from Bloomberg The risk-reward for the S&P 500 Index remains unattractive but “the degree of valuation dispersion within the equity market is wide,” strategists including David J. Kostin wrote in a note dated Oct. 14. They see opportunities in stocks linked to quicker cash flow generation,… Source link

Read More »Wall Street Sees S&P 500 Falling Further After Bear-Market Bounce

(Bloomberg) — Some of Wall Street’s biggest banks aren’t buying this stock-market rally. Most Read from Bloomberg Firms from HSBC Holdings Plc to Credit Suisse Group AG are skeptical that the S&P 500 Index has reached its ultimate low and warning that US equity prices still don’t fully reflect the risks of higher interest rates on earnings and valuations. Aggressive tightening by the Federal Reserve in an attempt to fight the hottest US inflation in four decades can do further damage to… Source link

Read More »Fed hikes interest rate 0.75 percentage point to tame inflation, and sees aggressive increases ahead. What’s it mean for you?

WASHINGTON – The Federal Reserve barreled ahead with a third straight outsize interest rate hike Wednesday in an effort to squash high inflation – but economists worry the campaign is increasingly risking a recession by next year. The Fed raised its key short-term rate by three-quarters of a percentage point to a range of 3% to 3.25%, a higher-than-normal level designed to ease inflation by slowing the economy. It also significantly bumped up its forecast for what that rate will be at… Source link

Read More »JetBlue CEO sees ‘extremely strong’ demand, no ‘domination’ if it acquires Spirit

JetBlue CEO Robin Hayes sees no loss in altitude for consumer demand headed into the back half of the year, despite swirling recession fears and disappointing financial results from the airline. “Demand remains extremely strong,” Hayes said on Yahoo Finance Live Tuesday. “We continue to see extremely strong demand [into the fourth quarter.]” The bullish take from Hayes comes as JetBlue shares fell 6% on Tuesday’s session after higher costs for labor and fuel weighed on second quarter… Source link

Read More »Housing correction is ‘dead ahead,’ warns Moody’s chief economist Mark Zandi — here’s how he sees things playing out over the next several months

Housing correction is ‘dead ahead,’ warns Moody’s chief economist Mark Zandi — here’s how he sees things playing out over the next several months Existing home sales showed a 5.4% decline in June from May, but prices remain elevated, according to the National Association of Realtors. The median sale price of existing homes in the U.S. set a new record high of $416,000 in June, marking a 13.4% increase from a year ago. Yet for those continuing to watch these rising home prices, chief… Source link

Read More »Raises guidance, sees ‘healthy and high’ demand in all core markets

Mercedes-Benz Group (MBG) reported higher revenue and adjusted earnings before interest and taxes (EBIT) for the second quarter compared to last year, despite the effects of “semiconductor bottlenecks and supply-chain disruptions.” The supply disruptions led to a 7% drop in sales, Mercedes said, but revenue still rose 8% from a year ago, and adjusted EBIT spiked 20%. Better pricing and margins boosted both for Mercedes. The German automaker also upped its guidance for the year, now seeing… Source link

Read More »Little Caesars sees uptick in orders as pizza chain leans on value

Little Caesars is battling record-high inflation — and winning the fight, according to its CEO. “We’ve actually seen customer accounts and transactions increase,” Little Caesars CEO and President David Scrivano told Yahoo Finance Live, crediting the brand’s role as a “value player” in the pizza space. “Today, you can get a pepperoni pizza at Little Caesars for about half the price [compared to] our competitors,” Scrivano continued, shrugging off rising food cost concerns as the category rose… Source link

Read More »Why Google For Startups’ APAC Head Sees Huge Growth Potential For AI Startups In Asia

In his role overseeing Google’s startup support arm in Asia-Pacific, Mike Kim sees promising growth opportunities for AI startups in the region, thanks to government support for the increasingly important technology, a deep talent pool and in-a-hurry population, among other factors. The impatience of Asia’s Millennials and Gen Zers is one of many reasons why Mike Kim, the head of Google for Startups Asia-Pacific, sees strong growth potential for artificial intelligence startups in the… Source link

Read More »