The World Bank warned Tuesday that the global economy faces the risk of dreaded “stagflation,” with this combination of high inflation and low growth tipping some countries into recession. “The war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation are hammering growth. For many countries, recession will be hard to avoid,” said World Bank President David Malpass. In its updated Global Economic Prospects report, the World Bank slashed its forecast for… Source link

Read More »The Fed ‘risks being too fast to act’ with more hikes going forward, tech investor says

Traders are betting the Federal Reserve’s 0.5% rate increase today is far from its last this year. Fed funds futures are pricing in hikes of varying sizes for the next five meetings, and Fed officials themselves have endorsed that view — and suggested again today in their statement — that increases will continue. But what if the U.S. economy isn’t strong enough to withstand those rate increases and the Fed is forced to stop? “The Fed was too slow to act when the economy was growing,… Source link

Read More »Global Investors Flee China Fearing That Risks Eclipse Rewards

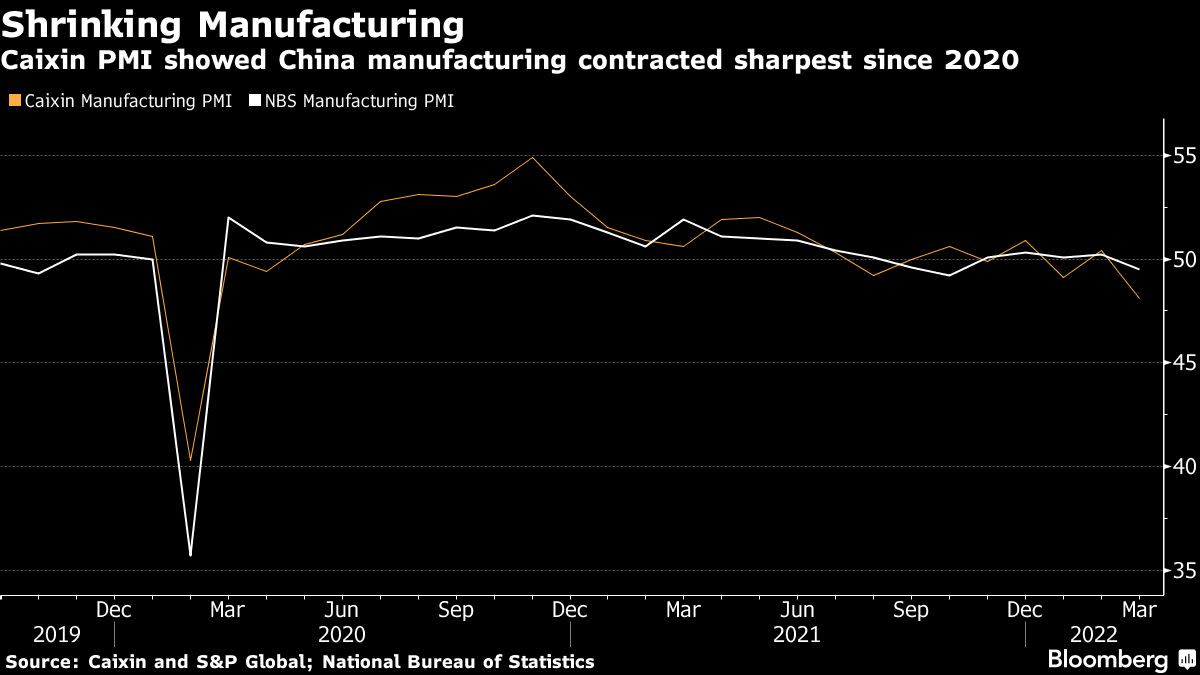

(Bloomberg) — A growing list of risks is turning China into a potential quagmire for global investors. Most Read from Bloomberg The central question is what could happen in a country willing to go to great lengths to achieve its leader’s goals. President Xi Jinping’s friendship with Russian leader Vladimir Putin has made investors more distrustful of China, while a strongman narrative is gaining momentum as the Communist Party doggedly pursues a Covid-Zero strategy and unpredictable… Source link

Read More »Recession Risks Duel Resilience Hopes in Global Economy Outlook

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast. Most Read from Bloomberg The fastest inflation in decades and the resulting rush by central banks to raise interest rates are stoking recession fears in financial markets — worries that are being compounded by the impact of aggressive coronavirus lockdowns in China and the war in Ukraine. In the last week alone, the the U.S. and U.K. logged inflation accelerating the most since the… Source link

Read More »China’s Covid Lockdowns, Surging Oil Add to Inflation Risks

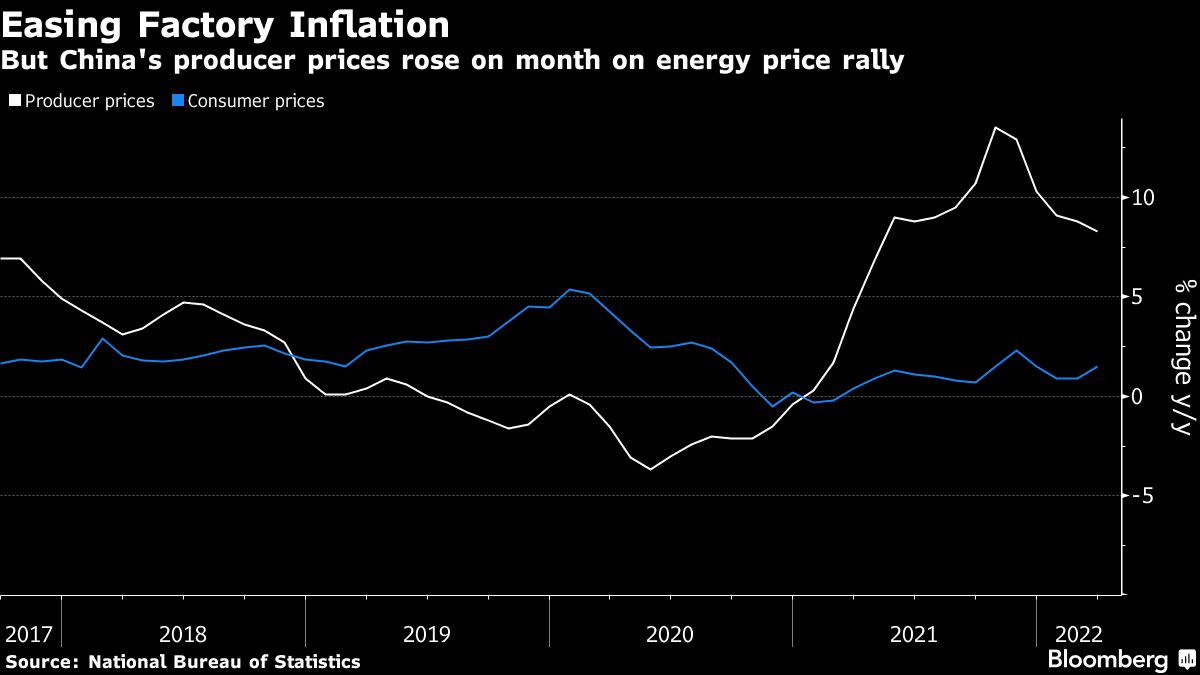

(Bloomberg) — China’s factory gate prices rose more than expected in March as oil prices climbed, while disruptions from Covid lockdowns drove up food costs, threatening the inflation outlook in the world’s second-largest economy. Most Read from Bloomberg The producer price index gained 8.3% from a year earlier, official data showed Monday, down from 8.8% in February and above the median estimate of an 8.1% increase in a Bloomberg survey of economists. Consumer-price growth accelerated to… Source link

Read More »Stocks, Treasuries Sink on Inflation, Policy Risks: Markets Wrap

(Bloomberg) — Stocks and U.S. equity futures fell along with Treasuries Monday amid heightened worries about inflation risks and tightening financial conditions. A gauge of the dollar climbed. Most Read from Bloomberg An Asia-Pacific equity index shed more than 1%, dropping to the lowest since mid-March. China and Hong Kong struggled, with tech shares skidding on new guidelines from Beijing aimed at curbing data monopolies at internet platforms. U.S. and European futures also declined,… Source link

Read More »JPMorgan CEO warns of “unprecedented” economic risks ahead from Russia-Ukraine war

Russia’s invasion of Ukraine and penalizing sanctions against Moscow have roiled financial markets and wreaked havoc on global supply chains. And JPMorgan CEO Jamie Dimon thinks the worst is yet to come. Dimon warned in his closely-read annual letter to shareholders on Monday that Russia’s ongoing invasion of Ukraine is expected to meaningfully slow the U.S. and global economy. JPMorgan economists predict consequences from the war and resulting sanctions against Russia will reduce the… Source link

Read More »Recession Risks Are Piling Up And Investors Need to Get Ready

(Bloomberg) — Even after one of the worst starts to an equity trading year in history, the market upheaval might just be getting started. Most Read from Bloomberg Ominous signs are piling up that more turmoil is still coming, as key indicators point toward a potential recession. That could deepen the market rout triggered by the Federal Reserve leading a hawkish shift among central banks and war in Ukraine. The U.S. Treasury yield curve has collapsed to near inversion — a situation when… Source link

Read More »UPDATE 1-Russia’s Yandex warns of bond repayment and supply risks

(Adds detail) MOSCOW, March 4 (Reuters) – Russian internet giant Yandex on Friday warned that a trading suspension on its Nasdaq-listed shares could trigger a redemption right on a convertible bond that it does not have the resources to cover. Unprecedented Western sanctions over Moscow’s invasion of Ukraine have hammered Russia’s financial system and investors have dumped Russian assets from the rouble to bonds and stocks. Yandex said that a suspension of trading of its Class A shares on… Source link

Read More »Russia’s Yandex warns of bond repayment and supply risks

MOSCOW, March 4 (Reuters) – Russian internet giant Yandex (YNDX.O) on Friday warned that a trading suspension on its Nasdaq-listed shares could trigger a redemption right on a convertible bond that it does not have the resources to cover. Unprecedented Western sanctions over Moscow’s invasion of Ukraine have hammered Russia’s financial system and investors have dumped Russian assets from the rouble to bonds and stocks. Yandex said that a suspension of trading of its Class A shares on Nasdaq of… Source link

Read More »