(Bloomberg) — Equity investors’ anxiety about a potential recession isn’t showing up in other parts of the market, which is giving JPMorgan Chase & Co. strategist Marko Kolanovic confidence in his pro-risk stance. Most Read from Bloomberg US and European stock markets are pricing in a 70% chance that the economy will slide into recession in the near-term, according to estimates by JPMorgan’s top-ranked strategist. That compares with a 50% chance priced into the investment-grade debt… Source link

Read More »3 signs that recession fears are wildly overblown: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Monday, April 25, 2022 Tired of Wall Street talking heads pounding fears of recession into your overloaded brain day after day this month? So am I. There are valid reasons why some folks on the Street are calling for a recession later this year or early next year. Models being toyed around with by pros are outputting increasing recession risk…. Source link

Read More »Morgan Stanley analyst breaks down the ‘fire and ice’ recession indicators

As the earnings season gets underway, all eyes are on companies’ performance as markets will be gauging how big names across various sectors have been navigating inflation, rising interest rates, and the Russia-Ukraine war. According to Morgan Stanley (MS) Chief U.S. Equity Strategist and CIO Mike Wilson, there are two things that investors should focus on during this critical earnings season. “It’s really about, I think, two things. Number one, what did the companies guide to for 2Q and… Source link

Read More »The case against a near-term recession: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Tuesday, April 19, 2022 Today’s newsletter is by Emily McCormick, a reporter for Yahoo Finance. Follow her on Twitter Everybody’s talking about a recession that may not come — anytime soon. Calls for a downturn have escalated in recent months amid soaring inflation, inverted Treasury yield curves, and the specter of tighter monetary policy from… Source link

Read More »There is a 35% chance of a recession in 2 years: Goldman Sachs

With recession calls on Wall Street picking up as the Federal Reserve embarks on what could be up to eight interest rate hikes this year, Goldman Sachs no longer wants to be left out of the growing crowd. “Our analysis of historical G10 episodes suggests that although strong economic momentum limits the risk in the near-term, the policy tightening we expect raises the odds of recession. As a result, we now see the odds of a recession as roughly 15% in the next 12 months and 35% within the… Source link

Read More »Recession Risks Duel Resilience Hopes in Global Economy Outlook

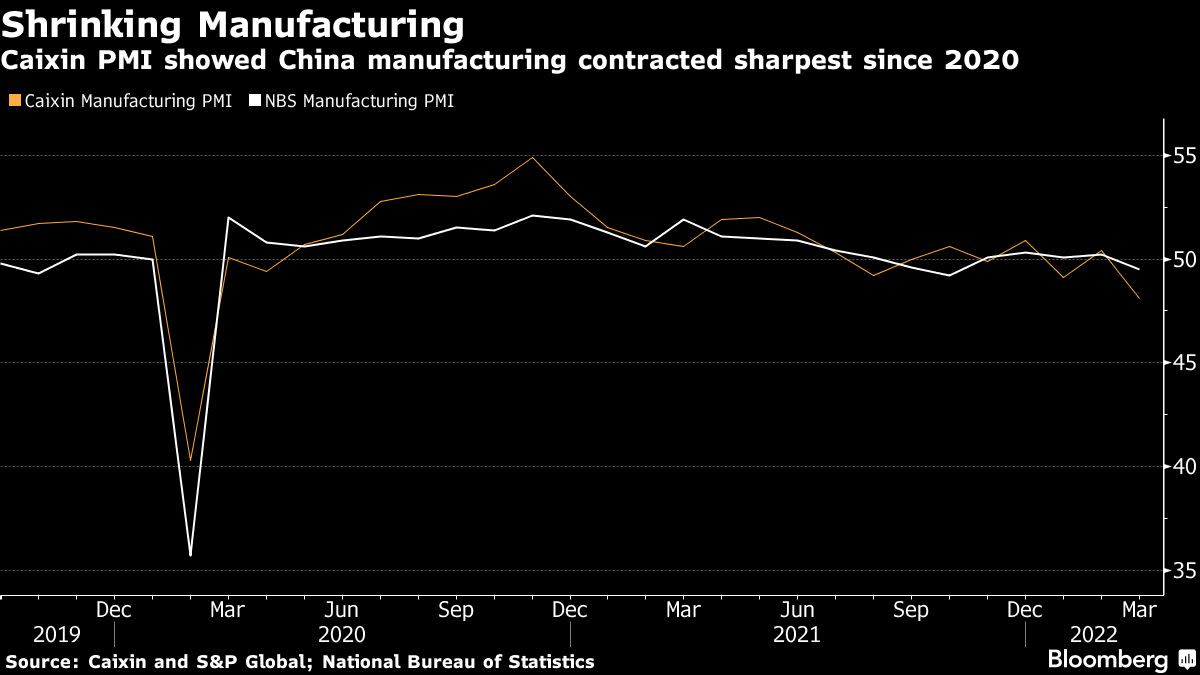

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast. Most Read from Bloomberg The fastest inflation in decades and the resulting rush by central banks to raise interest rates are stoking recession fears in financial markets — worries that are being compounded by the impact of aggressive coronavirus lockdowns in China and the war in Ukraine. In the last week alone, the the U.S. and U.K. logged inflation accelerating the most since the… Source link

Read More »Overheating job market has raised the risk of recession meaningfully, warns Goldman Sachs

Goldman Sachs isn’t yet ready to join the chorus of its peers in calling a U.S. recession, but it sure appears to be inching closer to that frenzied camp. “We do put some weight on the historical patterns [of the labor market] and believe that the overheating of the labor market has raised the risk of recession meaningfully. The yield curve seems to discount a recession probability in 2023 of about one in three, roughly double the unconditional average, and we would broadly concur with this… Source link

Read More »What $100 per barrel oil means for risk of recession

Oil prices have come down below $100/barrel after staying above that level for much of last month. The Ukraine-Russia war worsened the upward trend costs for energy across the globe. Yahoo Finance asked several experts what sustained prices above $100/barrel means for a risk of a recession in the U.S. and in other parts of the world. Most agree oil would have to stay closer to $130 in order to create enough demand destruction to spur a recession in this country. But some parts of the world… Source link

Read More »Will the US economy enter a recession? It’s ‘a coin toss,’ says strategist

Add another prominent voice in the field of economics warning about a looming recession. “I would say that it’s probably closer to a coin toss that the economy will be moving into recession by the end of the year,” said Dreyfus and Mellon Chief economist and macro strategist Vince Reinhart on Yahoo Finance Live. Reinhart’s comments come amid multiple negative forces playing out in the economy. The Consumer Price Index (CPI) rose by 7.9% in February, marking the fastest pace of annual inflation… Source link

Read More »Suddenly everyone is obsessed about a recession: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Monday, April 11, 2022 Today’s newsletter is by Brian Sozzi an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn. By sometime next year, the U.S. economy may be limping around like Tiger Woods this past weekend at the Masters (sorry Tiger, I had to go there — I was rooting for you to win though). And… Source link

Read More »