A Google sign is pictured outside the Google office in Berlin, Germany, August 31, 2021. REUTERS/Annegret Hilse Register now for FREE unlimited access to Reuters.com Register July 26 (Reuters) – Alphabet Inc (GOOGL.O) on Tuesday barely missed estimates for quarterly revenue, showing that its industry-leading Google search and advertising business may be able to withstand big countries potentially going into recession over the next year. Shares of Alphabet rose 3.5% in after-hours trading.

Read More »Why the stock market still hasn’t priced in a full recession

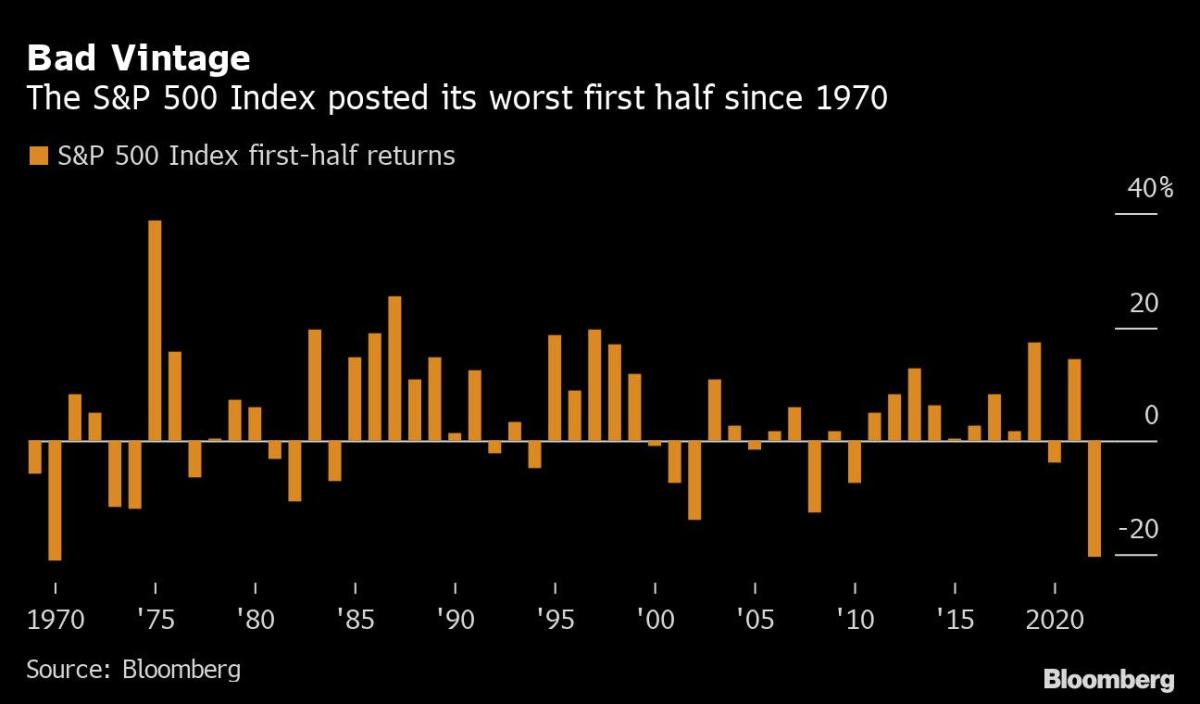

Recession calls are growing by the day, but the stock market remains wary of fully pricing in this scenario for the economy. Despite enduring the worst start to a year since 1970, the benchmark S&P 500 (^GSPC) is still trading 13% above a widely-cited recessionary target of 3,400, which would mark a ~29% decline from the record high reached on January 3, 2022. In the average recession since World War II, the S&P 500 has dropped 31%. “Investors and business managers alike tend to play the hand… Source link

Read More »What to expect as Morgan Stanley warns of ‘streaming recession’

Netflix (NFLX) is set to report its fiscal second quarter earnings on Tuesday after market close as the company battles ongoing inflationary pressures, increased competition, and an uptick in subscriber churn. Here’s what Wall Street expects, according to Bloomberg consensus estimates: Revenue: $8.05 billion expected Adj. earnings per share (EPS): $2.99 expected Subscribers: Loss of 2 million users expected The streaming giant’s anticipated loss of 2 million paying users for the second quarter… Source link

Read More »Recession barometer flashes new warning sign as inflation pressures Fed policy

Following inflation data showing worse-than-expected price increases in June, bond markets are now flashing signs of deeper investor concerns about recession. On Wednesday, the U.S. 10-year note yield slipped as much as 0.21% lower than the yield on the 2-year, the largest negative spread between the two securities since 2000. A yield curve inversion, in which short-dated bonds yield more than longer-dated ones, shows a reversal in typical risk attitudes, as investors usually expect more… Source link

Read More »TopGolf CEO plans to outdrive recession risk

TopGolf is to driving ranges what Pizza Planet was to pizza shops, except non-fictional. The sport of golf saw tremendous growth during the height of the pandemic drove sportspeople towards socially-distanced outdoor activities. Now, during an inflationary reality for consumers, TopGolf looks to weather a cost-conscious visitor — while replicating its driving range formula at new geographic locations. “We’re really looking everywhere globally,” TopGolf CEO Artie Starrs told Yahoo Finance… Source link

Read More »BofA Says Brace for Recession Shock After Worst Rout in 52 Years

(Bloomberg) — A “recession shock” begins for markets following the worst first-half for the S&P 500 in more than 50 years, Bank of America Corp.’s Chief Investment Strategist Michael Hartnett says. Most Read from Bloomberg While expectations of aggressive rate hikes by the Federal Reserve are peaking, inflation expectations are not, and Bofa’s bull and bear indicator remains at “maximum bearish” for a third week in a row, Hartnett wrote in a note. Both stocks and bonds were rocked… Source link

Read More »Here’s how America’s millionaires are positioning themselves for a recession — if you’re doing something different, you might want to think twice

Here’s how America’s millionaires are positioning themselves for a recession — if you’re doing something different, you might want to think twice With the U.S. economy showing some signs of stalling, talk of a recession is heating up. But it’s not just average Americans who are fretting about what that might mean for their finances. Even those with at least seven figures in their bank accounts are concerned, according to CNBC’s Millionaire Survey. The group surveyed — millionaires… Source link

Read More »The bottom of the bear market is still 10% away, Morgan Stanley Wealth Management says. And the odds of a recession have doubled, too

The stock market is off to one of its worst starts ever this year, with the S&P 500 falling more than 20% year to date. It’s a rout that has left many investors wondering when they will be able to “buy the dip.” Morgan Stanley Wealth Management’s Lisa Shalett says don’t hold your breath. The chief investment officer believes stocks have more room to fall as many companies have yet to change their earnings forecasts after the Federal Reserve’s decision to increase the pace of its… Source link

Read More »Metals Haven’t Crashed This Hard Since the Great Recession

(Bloomberg) — Industrial metals are on track for the worst quarter since the 2008 financial crisis as prices are pummeled by recession worries. Copper, the great economic bellwether, has ricocheted into a bear market from a record four months ago, while tin just tumbled 21% in its worst week since a 1980s crisis froze London trading for four years. Most Read from Bloomberg It’s a dramatic reversal from the past two years, when metals surged on a wave of post-lockdown optimism, inflationary… Source link

Read More »What to expect from a recession ‘everyone’ sees coming

It seems like “everybody” these days is saying we’re going into recession. So: are they right? I’ve covered the markets and the economy for four decades, and I can’t recall a time when more people — or at least prognosticators, economists, and bankers — were more certain that an economic downturn was imminent. And if so many people believe that a recession is inevitable does that make it, well, inevitable? Or does it mean that a recession won’t occur? Or that any recession will at… Source link

Read More »/cloudfront-us-east-2.images.arcpublishing.com/reuters/SWHVEZ5JEFOTFDUN7WF3M6YBAE.jpg)