Mortgage rates, over 7% or so, are at their highest levels in 20 years and loan applications are down. So, it should follow, that homeowners looking to refinance loans would also be headed to the sidelines in droves. But according to experts, it might still make sense for homeowners to refinance. Why? Rates, even at current levels, can still be a decent deal compared to alternatives. “People would still be refinancing if they need the cash, so they are withdrawing equity, even at much higher… Source link

Read More »Mortgage lenders do what they can to survive rising rates: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Wednesday, Nov. 2, 2022 Today’s newsletter is by Janna Herron, Yahoo Finance’s personal finance editor. Follow Janna on Twitter @JannaHerron. Read this and more market news on the go with Yahoo Finance App. It’s no secret the mortgage market is getting hammered. Just look at last week’s stats on new home sales and pending ones and you… Source link

Read More »Homebuyers are having a ‘come to Jesus’ moment as mortgage rates now top 7% — here’s when things are expected to get better

Homebuyers are having a ‘come to Jesus’ moment as mortgage rates now top 7% — here’s when things are expected to get better The rate on America’s most popular home loan has topped 7% for the first time in 20 years as the housing market faces a potentially lengthy slowdown. Rapidly rising mortgage rates have taken a toll on home buying, and forecasts show continued weakness into 2023. Home sales and new listings have hit record lows since the early days of the pandemic, and more than… Source link

Read More »Mortgage rates top 7% for first time since April 2002

Mortgage rates surpassed 7% for the first time since April 2002, adding more reason for price-struck homebuyers to stay on the sidelines. The rate on the average 30-year fixed mortgage hit 7.08%, up from 6.94% the week prior, according to Freddie Mac. Rates have jumped 3.86 percentage points since the start of the year, the largest year-to-date increase in over 50 years. The dramatic increase in rates – driven by the Federal Reserve’s aggressive fight on inflation – has crushed homebuyer… Source link

Read More »Homebuyers aren’t buying and homebuilders aren’t building in the face of untamed mortgage rates

‘Unhealthy and unsustainable’: Homebuyers aren’t buying and homebuilders aren’t building in the face of untamed mortgage rates U.S. mortgage rates crept up once again this week as demand for home loans tumbled, according to a pair of widely followed reports. Buyers and sellers are increasingly on edge as the average 30-year fixed mortgage rate — now more than double what it was at the beginning of the year — inches closer to 7%. Homebuilders, too, are losing confidence in the… Source link

Read More »While rising mortgage rates have some homebuyers giving up, others think they’ve found a workaround

‘The numbers just don’t work’: While rising mortgage rates have some homebuyers giving up, others think they’ve found a workaround America’s most popular home loan got more expensive again this week, striking yet another blow to haggard home shoppers staring at the steepest borrowing costs in 20 years. The average 30-year fixed mortgage rate — now flirting with the 7% mark — is more than double what it was at the beginning of the year. Even as the surge in home prices continues to… Source link

Read More »Mortgage rates jump again, remain above 6%

Mortgage rates jumped more than a quarter point this week and remain at the highest level in 14 years, offering no relief to sidelined homebuyers. The average rate on the 30-year fixed mortgage increased to 6.29% from 6.02% last week, according to Freddie Mac, marking the highest point since the last week of October 2008. Rates are more than 3 percentage points higher than at the start of the year. Rapidly rising rates this year have only made what was an unaffordable housing market for many… Source link

Read More »Wall Street is finally getting the Fed’s message on interest rates: Morning Brief

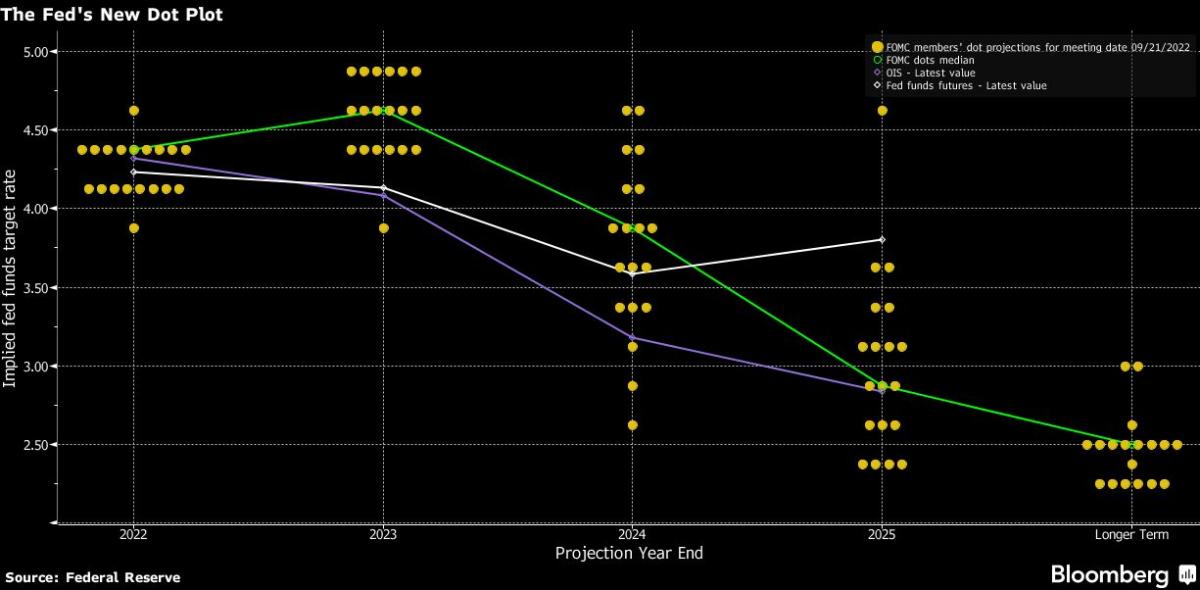

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Thursday, September 22, 2022 Today’s newsletter is by Jared Blikre, a reporter focused on the markets on Yahoo Finance. Follow him on Twitter @SPYJared. Stocks are finally listening to Jay Powell and the Federal Reserve. In a highly anticipated move Wednesday, the Federal Reserve hiked its benchmark interest rate by 0.75 percentage points after… Source link

Read More »Powell Says Rates to Be Raised ‘Purposefully’ to Curb Inflation

(Bloomberg) — Federal Reserve Chair Jerome Powell said officials were determined to curb inflation after they raised interest rates by 75 basis points for a third straight time and signaled even more aggressive hikes in the future than expected by investors. Most Read from Bloomberg “We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2%,” he told a press conference in Washington on Wednesday after officials lifted the… Source link

Read More »Tech giants have bigger problems than rising interest rates: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Friday, September 16, 2022 Today’s newsletter is by Julie Hyman, anchor and correspondent at Yahoo Finance. Follow Julie on Twitter @juleshyman. Another day, another tumble in tech stocks. The disproportionate shellacking the sector has suffered recently has raised questions about why, exactly, technology is seemingly so vulnerable to rising… Source link

Read More »