The markets went into bloodbath mode on Thursday as all the main indexes tumbled by at least 3%, with the NASDAQ’s 5% drop the most acute. That represented the tech-heavy index’s biggest one-day dive since June 2020. The force of the plunge confirms what we all know by now – the market headwinds are piling up, one upon the other. At its base, the issue is simple: there are too many problems, coming in too fast, and both the impersonal markets and the individual investors are finding it… Source link

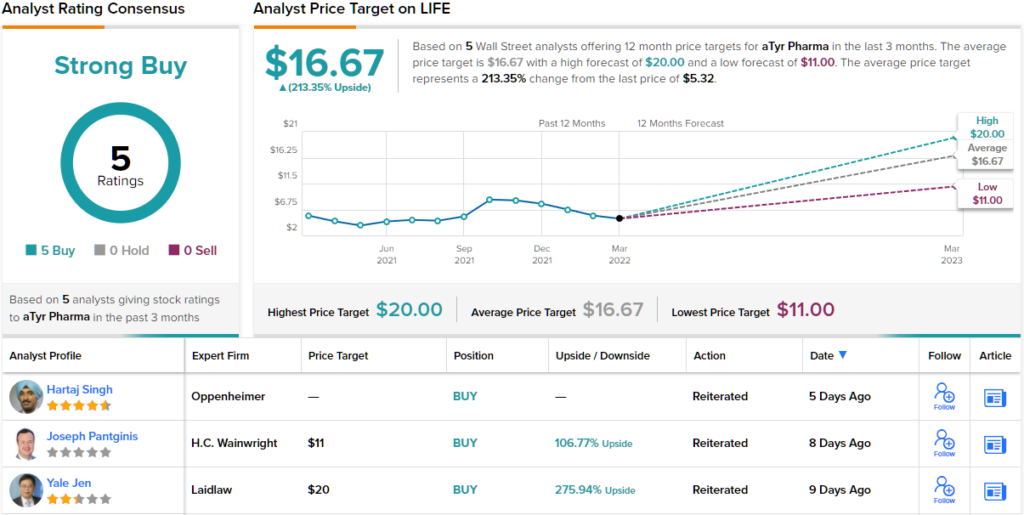

Read More »Oppenheimer Predicts Over 90% Rally for These 2 Stocks

After a period of sustained losses, the stock market has been staging a comeback, with valuations across the board moving in one direction – higher. Between March 14 and March 23, the S&P 500 rose ~8%, while the NASDAQ was up ~12%. Oppenheimer’s Chief Investment Strategist John Stoltzfus offers an explanation for the powerful rally: “In our view it wasn’t so much that investor sentiment had turned broadly positive last week but rather that enough investors started to see numerous… Source link

Read More »Oppenheimer Bets on These 2 Stocks; Sees at Least 80% Upside Ahead

The stock markets are responding to conflicting signals lately, and the result is concurrent trends of volatility and gains that have been causing some confusion. Inflation has ticked up in recent months, as pent-up demand now let loose by the economic reopening is crossing limited supply and still-disrupted distribution chains. But there’s a strong feeling that the inflation is transitory, and that as people get back to work the inflationary trends will be pushed back by improved… Source link

Read More »