By Yoruk Bahceli and Sujata Rao (Reuters) -U.S. two-year Treasury yields rose above 10-year borrowing costs on Monday – the so-called curve inversion that often heralds economic recession – on expectations interest rates may rise faster and further than anticipated. Fears the U.S. Federal Reserve could opt for an even larger rate hike than anticipated this week to contain inflation sent two-year yields to their highest levels since 2007. But a view is also playing out that aggressive rate hikes… Source link

Read More »Gas prices over $5 a gallon isn’t the stock market’s only problem

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Monday, June 13, 2022 Today’s newsletter is by Brian Sozzi, an editor-at-large and anchor at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn. Many times in my career in financial markets, I’ve been able to spot trainwrecks before they happen. The trade-off for devoting every waking second to studying markets, the human beings… Source link

Read More »These 40 ‘overvalued’ housing markets could see 15% to 20% home price declines if a recession hits

A housing bubble requires both a rush of speculators entering into the market and “overvalued” home prices. Oh, and the bust at the end, of course. Unlike the housing bubble that popped in 2008, the pandemic housing boom isn’t underpinned by a frenzy of speculation, Moody’s Analytics chief economist Mark Zandi says. While home flipping has certainly ticked up during the pandemic, he says, we aren’t seeing the exuberance of the last bubble. So is the coast clear? Well, not so fast. While… Source link

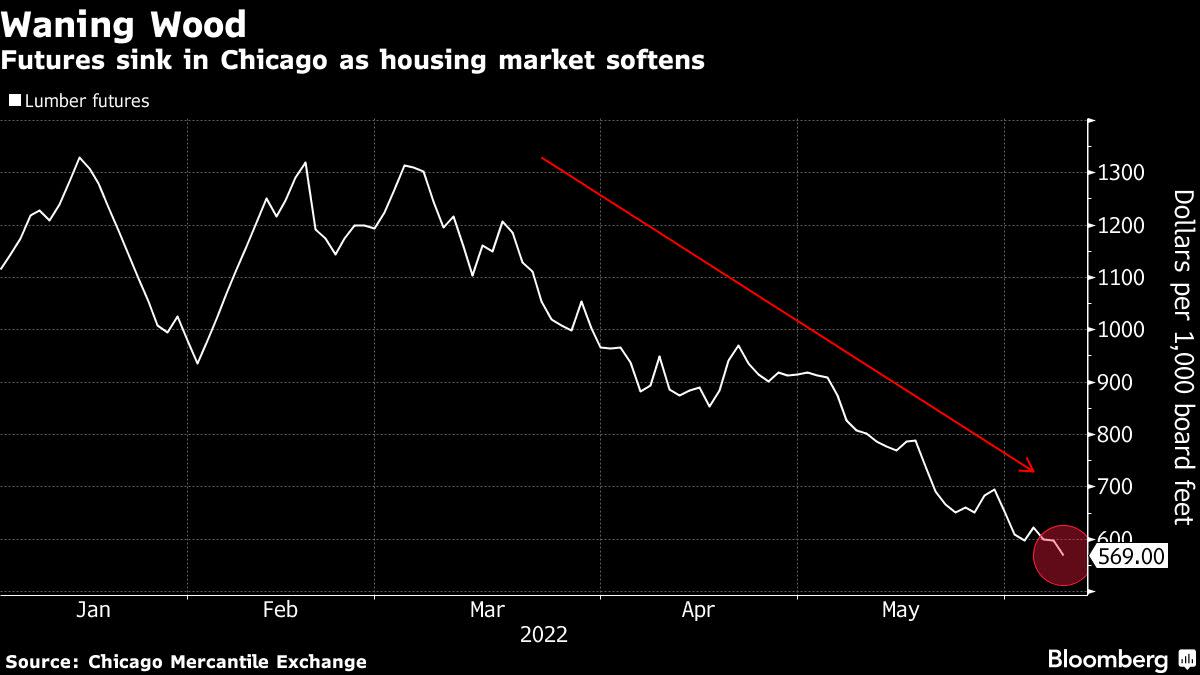

Read More »Lumber Price Gets Chopped in Half Amid Chill in Housing Markets

TipRanks Billionaire Paul Tudor Jones Loads Up on These 3 High-Yield Dividend Stocks For the retail investor, the only certainty of our current market environment is uncertainty. The reasons are multiplying: high inflation is rising higher, wages are not keeping up, Russia’s invasion of Ukraine has initiated Europe’s largest war since 1945, and energy and food commodities – key ingredients in the inflation mix – are sure to rise in price as a result of that fighting. In a time like… Source link

Read More »The stock market’s next big problem? Corporate earnings.

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Tuesday, June 7, 2022 Today’s newsletter is by Myles Udland, senior markets editor at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn. Earnings season may be done, but corporate results are set to be the stock market’s next big problem. Again. In a note to clients published Monday, Morgan Stanley strategist Mike Wilson noted… Source link

Read More »Don’t get too excited about the stock market’s recent rally. Some Wall Street experts say it could be a trap—and the bear market will still wreak havoc

The stock market is suddenly looking up. Or is it? Equities whipsawed throughout the month of May as investors contemplated falling economic growth projections and less-than-stellar earnings forecasts from retailers. Despite the bearish news, ongoing volatility, and consistent predictions of an impending recession, the S&P 500 ended the month roughly unchanged after mounting a recovery over the last few weeks. The rebound has some on Wall Street arguing that it’s time to be opportunistic and… Source link

Read More »Treasuries Sell Off, Asia Stocks Drop; Oil Jumps: Markets Wrap

(Bloomberg) — Stocks in Asia fell Tuesday and Treasuries sold off across the curve as investors remain cautious about whether central banks can raise interest rates to rein in inflation without derailing growth. Oil gained after the European Union backed a push to ban some Russian oil. Most Read from Bloomberg Equities in Japan, Korea and Australia inched down while Hong Kong futures fell. US contracts opened higher in the first day of trading after the Memorial Day weekend. Yields on… Source link

Read More »What to watch in markets, week of May 31

A bounce in U.S. stocks last week snapped a seven-week losing streak for the S&P 500 and Nasdaq, while the Dow logged gains for the first time in eight weeks. These gains ended the longest weekly losing streak in over a decade for the S&P 500 after the index tip-toed into bear market territory. All three major indexes logged weekly gains of at least 5%, buoyed by a batch of upbeat economic data and more positively received earnings reports from the retail sector. The S&P 500 has snapped a… Source link

Read More »Billionaire investor Bill Ackman says markets are imploding because investors don’t have confidence in the Fed’s ability to stop inflation

Bill Ackman is a billionaire investor and hedge fund manager.Elsa/Getty Images Markets aren’t confident that the Federal Reserve can tame record inflation, Bill Ackman tweeted Tuesday. He predicts that inflation can only come down if the Fed aggressively raises rates, or if stocks crash. “It ends when the Fed puts a line in the sand on inflation and says it will do ‘whatever it takes,'” Ackman said. Bill Ackman, the CEO and founder of Pershing Square Capital Management, said markets are facing a… Source link

Read More »Stock Markets Are Overpricing Recession Risk, JPMorgan Strategist Says

(Bloomberg) — Equity investors’ anxiety about a potential recession isn’t showing up in other parts of the market, which is giving JPMorgan Chase & Co. strategist Marko Kolanovic confidence in his pro-risk stance. Most Read from Bloomberg US and European stock markets are pricing in a 70% chance that the economy will slide into recession in the near-term, according to estimates by JPMorgan’s top-ranked strategist. That compares with a 50% chance priced into the investment-grade debt… Source link

Read More »