(Bloomberg) — U.S. equity futures and Asian stocks fell Monday amid a slump in Hong Kong property developers and jitters before a Federal Reserve meeting that’s expected to hint at moving toward paring stimulus. The dollar rose. U.S. and European contracts dropped after the S&P 500 slid the most in a month, a test for the buy-the-dip mentality as the gauge jabs at its 50-day moving average. Hong Kong shares tumbled on growing concern about China’s crackdown on the real-estate sector and… Source link

Read More »China Adds $14 Billion Cash as Evergrande’s Pain Roils Markets

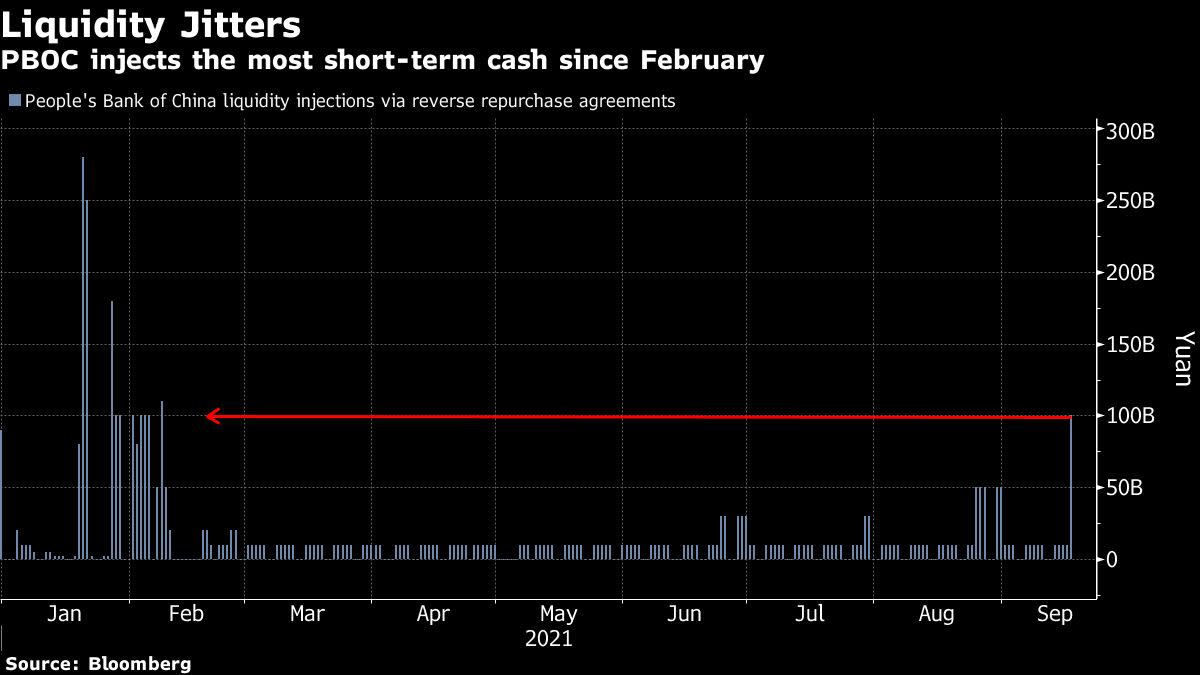

(Bloomberg) — China injected more cash into its banking system in a sign authorities are seeking to avert a funding squeeze amid a seasonal rise in financing demand and the intensifying debt crisis at China Evergrande. The People’s Bank of China added 90 billion yuan ($14 billion) of funds on a net basis through seven-day and 14-day reverse repurchase agreements on Friday, the most since February. Today was the first time this month it added more than 10 billion yuan short-term liquidity… Source link

Read More »Stocks Fall on China Curbs, Growth Risks; Oil Up: Markets Wrap

(Bloomberg) — Stocks fell Monday as the risk of a slower recovery from the pandemic shadowed global markets and Chinese technology stocks buckled under the weight of Beijing’s regulatory clampdown. A Hong Kong gauge of Chinese tech names tumbled after a report that officials are seeking to break up Ant Group Co.’s Alipay. China’s online platforms have also been told to protect the rights of workers in the so-called gig economy. China’s overall stock market fluctuated, while Japan… Source link

Read More »SoFi Technologies, Inc. (NASDAQ:SOFI) Looks Cheap Thanks to Market’s Overreaction

After going through a combination of lockup expiry and uneventful earnings in August, SoFi Technologies, Inc. (NASDAQ: SOFI) held the line at US$14 level. While the stock is still struggling to break above US$16, we can probably agree that it is doing better than expected. Yet, in the face of the latest rating, we will examine our take on the intrinsic value through the discounted cash flow (DCF) method. Check out our latest analysis for SoFi Technologies The Latest Outlook With the worst,… Source link

Read More »Stocks Climb as Japan, China Gain; Treasuries Dip: Markets Wrap

(Bloomberg) — Most Asian stocks rose Tuesday as Japan extended a rally and traders took heart from indications that the global recovery is weathering challenges from the delta virus variant. Japan’s Nikkei 225 hit 30,000 for the first time since April as an index reshuffle added to optimism that a new prime minister will usher in favorable policies. China climbed, aided by a continuing rebound in technology stocks and better than expected trade data. S&P 500 and Nasdaq 100 futures edged up… Source link

Read More »Stocks Rise as Traders Weigh Fed Taper Outlook: Markets Wrap

(Bloomberg) — U.S. equity-index futures rose and European stocks inched closer to a record high as investors bet slower hiring in the world’s largest economy may delay a tapering of Federal Reserve stimulus. Aluminum hit a decade high amid political unrest in Guinea. The Stoxx Europe 600 Index rebounded from last week’s losses, led by technology shares. Contracts on the S&P 500 Index rose 0.2% even as U.S. markets were closed for Labor Day. Aluminum supplier Norsk Hydro ASA headed for a… Source link

Read More »European markets weighed down as investors brace for ECB tapering

Markets made muted moves on Thursday morning in London. Photo: Getty European markets saw a muted open on Thursday morning in London, with the FTSE 100 pulling back slightly at the opening bell. Markets are being weighed by talk of the European Central Bank withdrawing its monetary stimulus due to rising inflation. BHP Group (BHP.L) was among the top fallers in the FTSE, falling 4.8% in early trade as it was outbid for a nickel miner active in Canada’s highly-prospective Ring of Fire region… Source link

Read More »Asia Stocks Steady as Traders Mull Powell Remarks: Markets Wrap

(Bloomberg) — Asian stocks were steady Monday and Treasuries held an advance as traders weighed Jerome Powell’s signal that pandemic-era Federal Reserve policy support will be withdrawn cautiously and gradually. Shares gained in Japan, slipped in Hong Kong and fluctuated in China, where Beijing’s regulatory broadside remains in focus. U.S. futures were steady after a record Wall Street close in the wake of Chair Powell’s Jackson Hole speech. Powell said the Fed may start paring bond… Source link

Read More »Asian Stocks Climb After U.S. Rally on Dip Buying: Markets Wrap

(Bloomberg) — Asian stocks rose early Monday as traders sought to take advantage of last week’s selloff while weighing risks from the delta virus strain and China’s regulatory curbs. The dollar was firm. Shares climbed in Japan, South Korea and Australia. U.S. equity futures edged higher after an advance in the S&P 500 and tech-heavy Nasdaq 100 at the end of last week. Beijing’s clampdown on private industries is set to shadow the market open in China and Hong Kong later. The dollar… Source link

Read More »Goldman Sachs, BofA See Lost Decade Over for Emerging Markets

(Bloomberg) — Elevated commodity prices and expectations for earnings growth are igniting bullish bets on emerging-market equities after more than a decade of underperformance that left them approaching a 20-year low against developed-nation stocks. Goldman Sachs Group Inc., Bank of America Corp. and Lazard Asset Management expect a boost for developing equities as investors capitalize on cheap valuations once vaccine rollouts pick up, helping the global economy to recover from the pandemic…. Source link

Read More »