U.S. stock futures pointed to deeper losses at Thursday’s open as investors reeled from shock inflation data that renewed worries over aggressive central bank action and awaited earnings from the biggest financial institutions on Wall Street. Futures tied the S&P 500 dropped 1.4% in pre-market trading, and the Dow Jones Industrial Average shed 470 points, or 1.5%. Contracts on the tech-heavy Nasdaq fell 1%. The moves come after all three major indexes tumbled Wednesday following fresh CPI… Source link

Read More »Market Coverage – Thursday July 14 Yahoo Finance – Yahoo Finance

Market Coverage – Thursday July 14 Yahoo Finance – Yahoo Finance Source link

Read More »Here’s why Jim Cramer believes that the market will soon bounce and have a ‘strong rally’ through late August

After the S&P 500 posted its worst first-half performance since 1970, many investors are wondering whether the downtrend would continue for the remainder of the year. But according to CNBC’s Jim Cramer, we could be at a turnaround. “I said to [David Faber] that July 13th will be the bottom. I said that in February,” he reminds viewers. Cramer also uses analysis from market technician Larry Williams to show that the market could be ready for a rebound in the not-so-distant future. “The… Source link

Read More »Resetting the market 10 days later, starting with Deandre Ayton

Much of the NBA’s summer business is done, save for the whole Kevin Durant thing. One of the 15 greatest players in the history of basketball requesting a trade as free agency opens has a tendency to muck up the process, but everyone else still plunged forward with billions of dollars worth of contracts. All-Stars Bradley Beal, Devin Booker, Darius Garland, Nikola Jokic, Zach LaVine, Ja Morant, Karl-Anthony Towns and Zion Williamson signed deals that could net them a combined $2 billion by… Source link

Read More »The world’s largest asset manager just cut its outlook for the stock market

BlackRock (BLK) has downgraded its outlook for stocks amid increasing economic uncertainty and persistent inflation. Strategists at BlackRock’s Investment Institute said Monday the firm cut its exposure to developed market equities, citing aggressive intervention by central banks to tame rising prices across the global economy. “Right now, we think the Fed has boxed itself in by responding to political pressures to rein in inflation,” strategists led by Jean Boivin said in a note… Source link

Read More »Real-time Bidding (RTB) Market 2022 Global Key Manufacturer Analysis – Yandex, Rubicon Project, Pubmatic, Salesforce, Mediamath, Appnexus (A Xandr Company), Platform One, Match2one

MarketsandResearch.biz conducted a comprehensive study on the Global Real-time Bidding (RTB) Market for a prediction period of 2022-2028. The global Real-time Bidding (RTB) market report assists in estimating statistics associated with the industry development in terms of value (US$ Bn/Mn). A unique analysis technique was used to analyze the global Real-time Bidding (RTB) market’s growth & draw conclusions regarding the industry’s future growth prospects. The R&D activities… Source link

Read More »Jim Cramer believes that the market will soon bounce. Here’s what he likes to ‘protect you’ while the Fed keeps tightening

‘I’m betting the second half turns out better’: Jim Cramer believes that the market will soon bounce. Here’s what he likes to ‘protect you’ while the Fed keeps tightening The S&P 500 has plunged nearly 21% in the first six months of 2022, marking its worst first-half performance since 1970. But not everyone is bearish. CNBC’s Jim Cramer, for instance, still sees opportunity in the months ahead — particularly in the Dow Jones Industrial Average. “These tend to be boring, mature… Source link

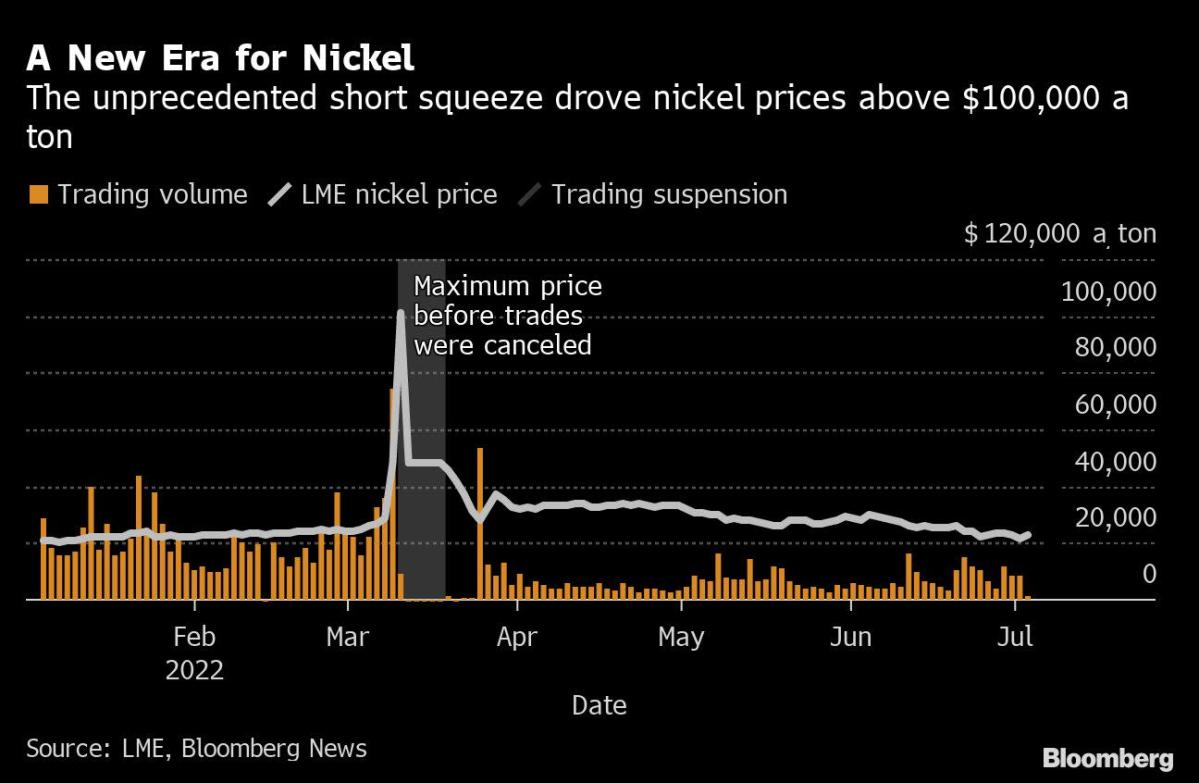

Read More »Tycoon Whose Bet Broke the Nickel Market Walks Away a Billionaire

(Bloomberg) — By 2:08 p.m. Shanghai time on March 8, it was clear that Xiang Guangda’s giant bet on a fall in nickel prices was going spectacularly wrong. Most Read from Bloomberg Futures had just skyrocketed above $100,000 a ton and his trade was more than $10 billion underwater. It was threatening not only to bankrupt Xiang’s company, but to trigger a Lehman Brothers-like shock through the entire metals industry and possibly topple the London Metal Exchange itself. But Xiang was calm…. Source link

Read More »Business News | Stock and Share Market News | Finance News

Here are 3 top stocks that insiders keep pouring millions into — following these ‘in-the-know’ bigwigs could be a sharp way to beat this nightmarish market

Here are 3 top stocks that insiders keep pouring millions into — following these ‘in-the-know’ bigwigs could be a sharp way to beat this nightmarish market Bear markets are noisy and volatile. It’s difficult for investors to cut through the noise, find the right signals and discover good opportunities. One of the clearest signals is insider trading activity. When the senior directors, founders, and large shareholders of a corporation buy or sell shares, it could be a signal of… Source link

Read More »