Yandex (NASDAQ:YNDX – Get Rating) was the target of unusually large options trading activity on Wednesday. Traders bought 1,814 put options on the stock. This represents an increase of 1,437% compared to the typical daily volume of 118 put options. Institutional Investors Weigh In On Yandex Several hedge funds have recently added to or reduced their stakes in the business. Invesco Ltd. boosted its position in Yandex by 0.4% during the 1st quarter. Invesco Ltd…. Source link

Read More »Google’s stock just got a lot cheaper for average investors

Alphabet (GOOGL) split its two classes of shares (GOOG) by a 20-to-1 margin, a move that reduced the price of one share from just over $2,200 on Friday to about $112 on Monday. The stock split doesn’t change Alphabet’s market capitalization. The company is still worth about $1.5 trillion, making it one of the most valuable firms on the planet. But the split has two potential benefits. First, it may make Alphabet shares more enticing for everyday investors. Second, it increases the odds that… Source link

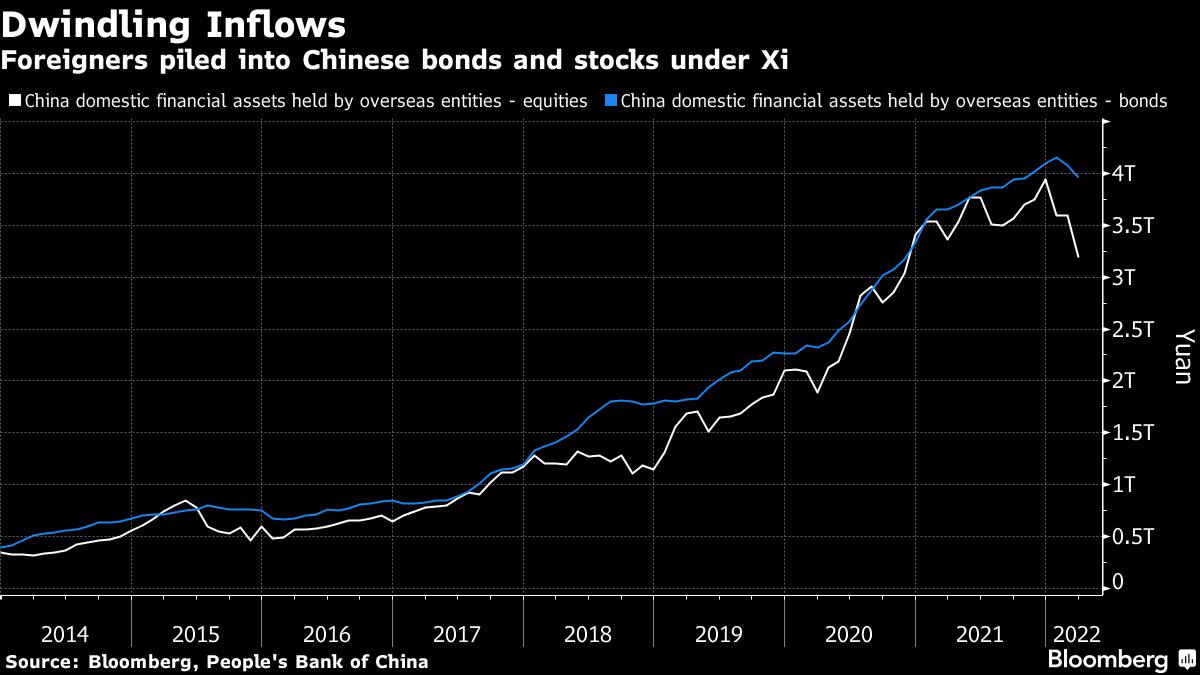

Read More »China Is Pariah for Global Investors as Xi’s Policies Backfire

(Bloomberg) — After drawing foreign capital into China’s markets for years, President Xi Jinping is now facing the risk of a nasty period of financial de-globalization. Investors point to one main reason why: Xi’s own policies. Most Read from Bloomberg Money managers once enticed by China’s juicy yields and huge tech companies now say reasons to avoid the country outweigh incentives to buy. They cite everything from unpredictable regulatory campaigns to economic damage caused by strict… Source link

Read More »Investors Purchase Large Volume of Yandex Put Options (NASDAQ:YNDX)

Yandex (NASDAQ:YNDX – Get Rating) was the recipient of unusually large options trading activity on Wednesday. Traders bought 1,814 put options on the company. This represents an increase of 1,437% compared to the average volume of 118 put options. NASDAQ YNDX opened at $18.94 on Thursday. The company’s 50-day moving average price is $18.94 and its 200-day moving average price is $28.33. The company has a current ratio of 0.84, a quick ratio of 0.77 and a… Source link

Read More »What Does Google’s Stock Split Mean for Investors?

For the second time in its history Google’s parent company, Alphabet (GOOGL) (GOOG), is set to split its stock for the second time in its history. The 20-for-1 split means Alphabet investors will receive an additional 19 shares for each one they already own. It will be the company’s first stock split since April 2014, when it split its shares 1,998-for-1,000. Google Stock Split Date The Google stock split is set to take place after the market’s close on July 15. Alphabet’s Stock… Source link

Read More »Bill Ackman to wind up SPAC, return $4 billion to investors

By Svea Herbst-Bayliss, Anirban Sen and Arunima Kumar NEW YORK (Reuters) -Billionaire investor William Ackman, who had raised $4 billion in the biggest-ever special purpose acquisition company (SPAC), told investors he would be returning the sum after failing to find a suitable target company to take public through a merger. The development is a major setback for the prominent hedge fund manager who had initially planned for the SPAC to take a stake in Universal Music Group last year when… Source link

Read More »Thousands of crypto investors have their life savings frozen as Voyager files for bankruptcy protection

Robert first came across Voyager Digital in March 2020. Like countless others, he decided to give the cryptocurrency broker a try. The platform was easy to navigate. It offered him an up to 9% annual percentage yield (APY)—much higher than a traditional savings account. It claimed to be FDIC (Federal Deposit Insurance Corporation) insured. And being a publicly traded company on the Toronto Stock Exchange, he thought, how bad could Voyager be? Robert, who asked to be identified by only his… Source link

Read More »The ‘most important thing’ about day trading for retail investors

Discipline is the most important trait for day traders, says stock trading educator Teri Ijeoma. “The most important thing about day traders is having discipline,” the founder of Trade and Travel told Yahoo Finance Live. “You have to be able to follow a trading plan,” she said, adding that the “discipline to be able to sell or buy at the right time is important.” The S&P 500 (^GSCP) just capped its worst first half of the year since 1970 amid tighter monetary policy and fears of a recession…. Source link

Read More »Long-time bull Cathie Wood warns investors about the ‘big problem’ in the economy. Here’s what she likes today

‘We are in a recession’: Long-time bull Cathie Wood warns investors about the ‘big problem’ in the economy. Here’s what she likes today The official GDP estimate for Q2 won’t be available until later next month, but many experts – including Ark Invest’s Cathie Wood – are calling for a recession. “We think we are in a recession,” Wood says in a recent CNBC interview. “We think a big problem out there is inventories — the increase of which I’ve never seen this large in… Source link

Read More »Investors, consumers are pushing the health care industry to tackle health inequity: Deloitte

Health inequity is costing the U.S. health system billions of dollars annually, and could reach $1 trillion by 2040, according to a new report from Deloitte. But, according to the report’s authors, there is one bright spot on the horizon. Boards of health companies are increasingly focused on addressing inequity. Health equity became a popular phrase during the pandemic and following the murder of George Floyd as calls grew to address systemic inequities in the U.S. For years, studies have… Source link

Read More »