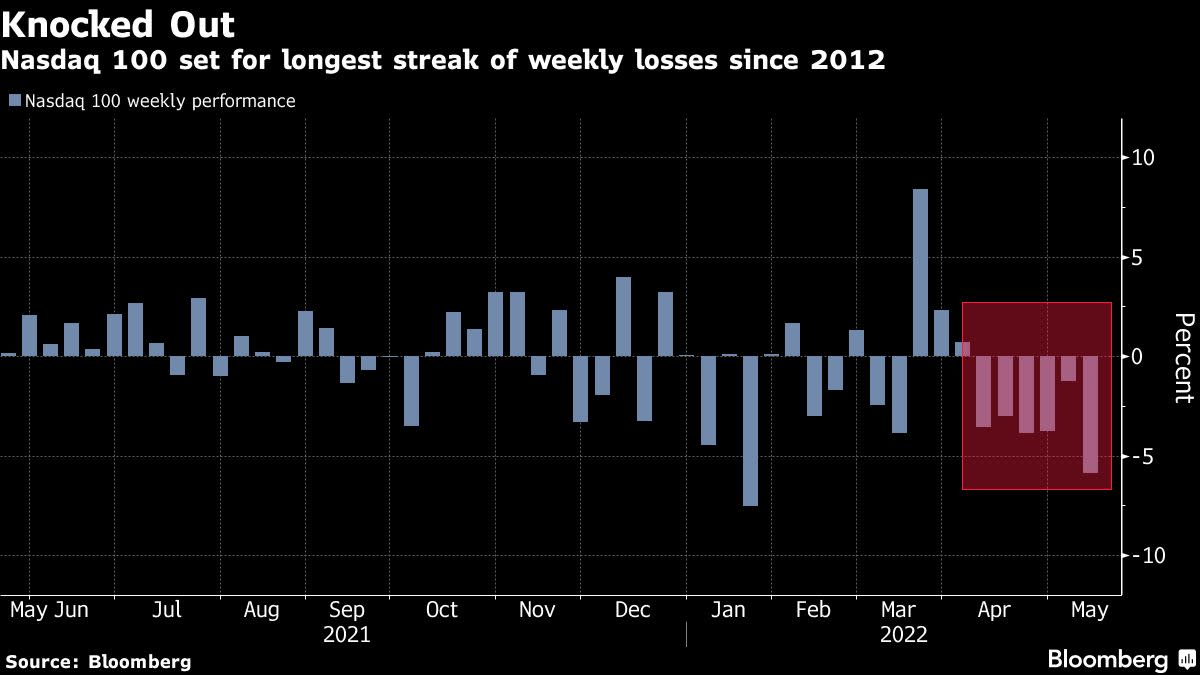

(Bloomberg) — Money is leaving every asset class and the exodus is deepening as investors rush out of names like Apple Inc., according to Bank of America Corp. strategists. Most Read from Bloomberg Equities, bonds, cash and gold all saw outflows in the week ended May 11, strategists led by Michael Hartnett wrote in a note, citing EPFR Global data. At $1.1 billion, technology stocks suffered their biggest withdrawals so far this year, second only to financials, which lost $2.6 billion. “The… Source link

Read More »The Fed ‘risks being too fast to act’ with more hikes going forward, tech investor says

Traders are betting the Federal Reserve’s 0.5% rate increase today is far from its last this year. Fed funds futures are pricing in hikes of varying sizes for the next five meetings, and Fed officials themselves have endorsed that view — and suggested again today in their statement — that increases will continue. But what if the U.S. economy isn’t strong enough to withstand those rate increases and the Fed is forced to stop? “The Fed was too slow to act when the economy was growing,… Source link

Read More »Musk Refiles Twitter Disclosure to Show He’s an Active Investor

(Bloomberg) — Elon Musk refiled the disclosure of his stake in Twitter Inc. to classify himself as an active investor, making the change after taking a seat on the social media company’s board. Most Read from Bloomberg Musk, a billionaire who is chief executive officer of Tesla Inc., filed a form 13D with the U.S. Securities and Exchange Commission on Tuesday, disclosing a stake of 9.1%. The new filing indicates that Musk plans to take an active role in shaping Twitter’s agenda. The form… Source link

Read More »Hasbro activist investor Alta Fox: we are stunned

With Hasbro’s stock (HAS) hovering at a 52-week low, the battle with its new activist investor Alta Fox Capital is heating up. Alta Fox founder Connor Haley tells Yahoo Finance his firm — a 2.5% holder in Hasbro — has been rebuffed in its effort to reach a settlement. “We’ve got a world class slate of advisers, and they are all collectively stunned at the level of entrenchment of the current Hasbro board. I think we went well out of our way to offer a beyond reasonable settlement,” Haley… Source link

Read More »Be an ‘investor, not a trader’ amid turbulent market, BMO’s Belski says

The first quarter of 2022 has been marked by continued surging inflation, geopolitical risks, and now, concerns of a looming recession. In light of these headwinds, however, BMO Capital Markets Chief Investment Strategist Brian Belski has a word of advice for investors to navigate the current market environment. “You know, the market does not like uncertainties. And [the market] cleared up one uncertainty when the Fed came out and was very clear about raising interest rates during its… Source link

Read More »A crypto investor lost $120,000 from clicking on one bad link. His horror story is becoming increasingly common.

Crypto crimes are on the rise, and a man who lost $120,000 after clicking one bad link shows how vulnerable investors are right now. Reddit user PowerofTheGods said he had been investing since 2016 and kept his investments in a Ledger Nano S (a crypto wallet) and four Metamask digital hot wallets. When he checked his accounts last December, he noticed they were empty. At the time, the currency was valued at more than $120,000. He later realized that hackers stole his crypto after he clicked… Source link

Read More »Activist investor who shook up Bed Bath & Beyond agrees with GameStop chair’s plan

Activist investor Jonathan Duskin at Macellum Capital Management fought a failed management team at Bed Bath & Beyond and won big in 2019. Duskin — whose successful campaign led to a board overhaul and ultimately the addition of current Bed Bath & Beyond CEO Mark Tritton — tells Yahoo Finance Live what GameStop Chairman Ryan Cohen is doing with the home goods retailer makes sense. “Ryan has a great following and is very well respected,” Duskin says. “I think we’ve articulated there is a… Source link

Read More »Kohl’s board must be sent packing, hints activist investor

Out with the old and entrenched board members at struggling Kohl’s, in with the new and open-minded. That’s the hot take from Yahoo Finance’s chat on Monday with activist investor Macellum Capital, which is back in the trenches slinging the mud at Kohl’s after a bizarre bit of posturing by the retailer Friday. “The board doesn’t appear to be working on shareholders’ behalf. It’s troubling to us, and we will continue to put pressure on the board by nominating another slate and give shareholders… Source link

Read More »‘The system is in jeopardy’ after events like Jan. 6: Billionaire investor Ray Dalio

The legendary hedge fund manager Ray Dalio became a billionaire by picking up on patterns in the stock market. More recently, he has turned his attention to trends throughout world history. In a new book, “Principles for Dealing with the Changing World Order,” Dalio wrote that wealth inequality often leads to the rise of populism and division. Yahoo Finance’s editor-in-chief, Andy Serwer, asked Dalio in a new interview just how bad America’s divisiveness has gotten and who’s to blame for… Source link

Read More »Famed investor Jeremy Grantham says the next decline will be ‘bigger and better’ than anything in US history — here are 3 of his safe haven stock picks

Famed investor Jeremy Grantham says the next decline will be ‘bigger and better’ than anything in US history — here are 3 of his safe haven stock picks Jeremy Grantham, legendary investor and pioneer of index fund investing, expects today’s sky-scraping stock market to come crashing back to earth. Grantham recently told Bloomberg that investors, who enthusiastically drove the stock market to new heights during a global recession, are in for a shock. “When the decline comes, it will… Source link

Read More »