U.S. stock futures were higher Wednesday but pared some earlier gains as investors weighed producer price data that came in slightly higher than expected. S&P 500 futures (^GSPC) rose 0.2% while futures on the Dow Jones Industrial Average (^DJI) ticked up 0.15%. The technology-heavy Nasdaq Composite (^IXIC) rose by 0.2%. Wall Street has been keeping a close eye on monetary action overseas, as Bank of England Governor Andrew Bailey announced the bank would end its emergency bond-buying program… Source link

Read More »The cure for inflation is on the way

Worrywarts have been blabbing about a recession since the spring, when U.S. GDP growth turned slightly negative and Russia’s invasion of Ukraine sent oil prices soaring. Now it looks like the naysayers might get their way. Economic forecasters are cutting their outlook for U.S. and global economic growth, with more of them predicting a recession. S&P Global Market Intelligence recently cut its forecast for the U.S. economy in 2023 from 0.9% GDP growth to a 0.5% decline. “The base… Source link

Read More »S&P, Nasdaq close lower ahead of inflation report, earnings

U.S. stocks fell on Tuesday to cap a back-and-forth session as investors gear up for a big inflation report Wednesday and the start of third-quarter earnings season. The S&P 500 (^GSPC) fell 0.6% after failing to retain a gains from an intraday rebound, and the Nasdaq Composite (^IXIC) tumbled 1.1% to a fresh two-year low. The Dow Jones Industrial Average was an outlier — ending 0.1% in the green. Meanwhile, the benchmark 10-year Treasury note came close again to the key 4% level. Investors… Source link

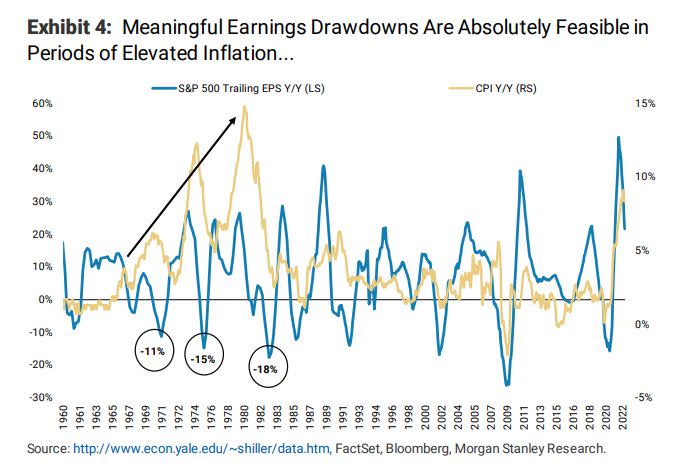

Read More »Wall Street Is Missing the Risk to Stocks If Inflation Is Beaten

(Bloomberg) — The conventional wisdom with stock bulls is that prices will take off when the Federal Reserve wins its fight against inflation. But the end of surging consumer costs could unleash another round of bad news. Most Read from Bloomberg A small chorus of researchers has for months warned of a potential hazard to earnings should the campaign to tamp down inflation succeed. Specifically, the squeeze on margins that could occur should an indicator known as corporate operating leverage… Source link

Read More »The cost of taming inflation could be 3 million lost jobs

Federal Reserve Chair Jerome Powell has warned that getting inflation under control will involve “some pain to households and businesses.” What kind of pain is he talking about? So far, the pain has been plunging stock values and higher borrowing costs for homes, cars, credit-card purchases and business investments. But the toll could also include a surge in unemployment, and all the strains that go along with it—which typically harms lower-income workers most of all. Powell won’t… Source link

Read More »Billionaire Carl Icahn warns ‘you can’t cure’ hot inflation — but when an audience member asked him for stock picks, he gave these 2 ‘cheap and viable’ names

Billionaire Carl Icahn warns ‘you can’t cure’ hot inflation — but when an audience member asked him for stock picks, he gave these 2 ‘cheap and viable’ names Easy monetary policy might seem fun at the beginning, but it has consequences. While asset prices shot up in 2020 and 2021, they pulled back substantially in 2022. Meanwhile, inflation remains near 40-year highs and the Fed has to raise interest rates aggressively to bring price levels under control. “We printed up too much money, and… Source link

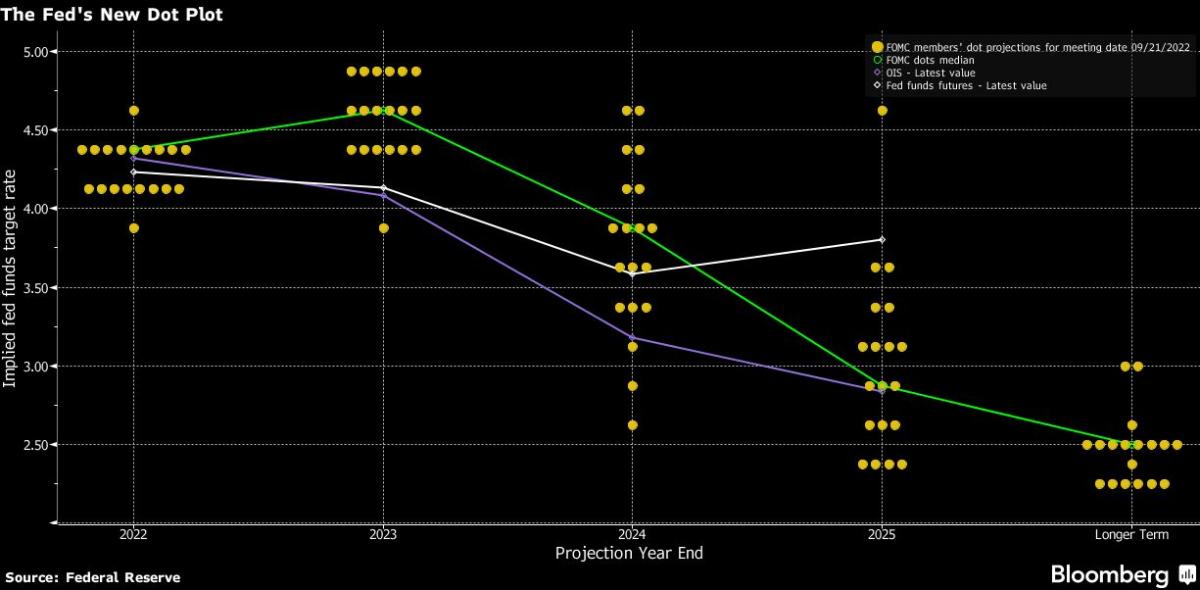

Read More »Fed hikes interest rate 0.75 percentage point to tame inflation, and sees aggressive increases ahead. What’s it mean for you?

WASHINGTON – The Federal Reserve barreled ahead with a third straight outsize interest rate hike Wednesday in an effort to squash high inflation – but economists worry the campaign is increasingly risking a recession by next year. The Fed raised its key short-term rate by three-quarters of a percentage point to a range of 3% to 3.25%, a higher-than-normal level designed to ease inflation by slowing the economy. It also significantly bumped up its forecast for what that rate will be at… Source link

Read More »Powell Says Rates to Be Raised ‘Purposefully’ to Curb Inflation

(Bloomberg) — Federal Reserve Chair Jerome Powell said officials were determined to curb inflation after they raised interest rates by 75 basis points for a third straight time and signaled even more aggressive hikes in the future than expected by investors. Most Read from Bloomberg “We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2%,” he told a press conference in Washington on Wednesday after officials lifted the… Source link

Read More »More than half of Americans are living paycheck to paycheck — even the wealthy are feeling the heat of continued inflation

Pushing yourself to save can be a challenge, but more and more consumers are tallying up their monthly expenses to find they have nothing left to save anyway. A recent study shows 58% of Americans report living paycheck to paycheck in May, up from 54% the same month last year. Of those earning $50,000 to $100,000, about 62% were stuck in this cycle. But it’s not just lower-income groups struggling to foot the bills, according to the report produced by payments and commerce platform PYMNTS… Source link

Read More »Renowned strategist Tom Lee says inflation could be ‘falling far faster than expected’ — here’s the 1 left-for-dead sector to bet on if that holds true

Renowned strategist Tom Lee says inflation could be ‘falling far faster than expected’ — here’s the 1 left-for-dead sector to bet on if that holds true According to Fundstrat’s Tom Lee, rampant inflation may not last much longer. “In the past week, we’ve gotten some data that I think really shows inflation could be falling far faster than expected,” the strategist tells CNBC earlier this month. Lee notes the drop in gasoline prices. He also looks at indices that are showing signs… Source link

Read More »