Everybody’s unhappy with the latest inflation report, which shows that the annual change in price increases dropped by just one-tenth of a percentage point, from 8.3% in August to 8.2% in September. The Federal Reserve has been jacking up interest rates to force prices down, and inflation is turning out to be a stubborn foe. Investors keep hoping for a break in the data, showing the Fed’s medicine is starting to work. It keeps not happening. While overall inflation remains high, some… Source link

Read More »Core US Inflation Rises to 40-Year High, Securing Big Fed Hike

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast. Most Read from Bloomberg A closely watched measure of US consumer prices rose by more than forecast to a 40-year high in September, pressuring the Federal Reserve to raise interest rates even more aggressively to stamp out persistent inflation. The core consumer price index, which excludes food and energy, increased 6.6% from a year ago, the highest level since 1982, Labor Department… Source link

Read More »Stock futures sink as inflation report comes in hotter than expected

U.S. stock futures fell Thursday after inflation data showed that consumer prices climbed more quickly than expected. S&P 500 futures (^GSPC) fell 1.54% while futures on the Dow Jones Industrial Average (^DJI) ticked down 1.10%. The technology-heavy Nasdaq Composite (^IXIC) down by 2.50%. The 10-year treasury yield were back above 4%. The Bureau of Labor Statistics released its Consumer Price Index (CPI) for September early Thursday, which showed prices rose 8.2% over the prior year and 0.4%… Source link

Read More »A key inflation report that settles little for Wall Street: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Thursday, October 13, 2022 Today’s newsletter is by Jared Blikre, a reporter focused on the markets on Yahoo Finance. Follow him on Twitter @SPYJared. Read this and more market news on the go with Yahoo Finance App. Wall Street awaits this morning’s consumer price index release for September with bated breath despite the overall song remaining the… Source link

Read More »Stock futures edge higher ahead of inflation report, Fed minutes

U.S. stock futures were higher Wednesday but pared some earlier gains as investors weighed producer price data that came in slightly higher than expected. S&P 500 futures (^GSPC) rose 0.2% while futures on the Dow Jones Industrial Average (^DJI) ticked up 0.15%. The technology-heavy Nasdaq Composite (^IXIC) rose by 0.2%. Wall Street has been keeping a close eye on monetary action overseas, as Bank of England Governor Andrew Bailey announced the bank would end its emergency bond-buying program… Source link

Read More »The cure for inflation is on the way

Worrywarts have been blabbing about a recession since the spring, when U.S. GDP growth turned slightly negative and Russia’s invasion of Ukraine sent oil prices soaring. Now it looks like the naysayers might get their way. Economic forecasters are cutting their outlook for U.S. and global economic growth, with more of them predicting a recession. S&P Global Market Intelligence recently cut its forecast for the U.S. economy in 2023 from 0.9% GDP growth to a 0.5% decline. “The base… Source link

Read More »S&P, Nasdaq close lower ahead of inflation report, earnings

U.S. stocks fell on Tuesday to cap a back-and-forth session as investors gear up for a big inflation report Wednesday and the start of third-quarter earnings season. The S&P 500 (^GSPC) fell 0.6% after failing to retain a gains from an intraday rebound, and the Nasdaq Composite (^IXIC) tumbled 1.1% to a fresh two-year low. The Dow Jones Industrial Average was an outlier — ending 0.1% in the green. Meanwhile, the benchmark 10-year Treasury note came close again to the key 4% level. Investors… Source link

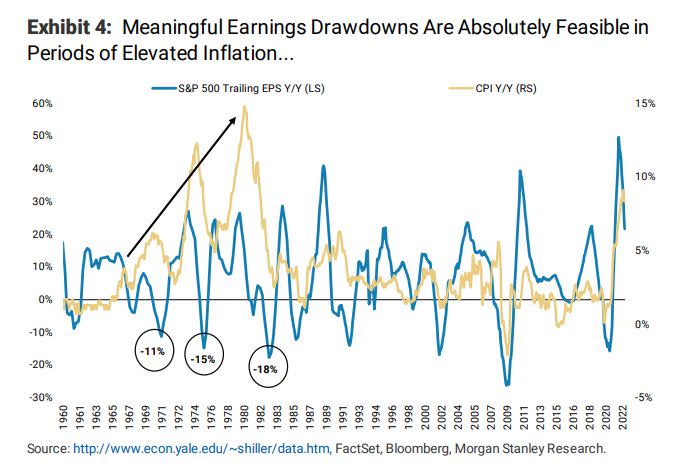

Read More »Wall Street Is Missing the Risk to Stocks If Inflation Is Beaten

(Bloomberg) — The conventional wisdom with stock bulls is that prices will take off when the Federal Reserve wins its fight against inflation. But the end of surging consumer costs could unleash another round of bad news. Most Read from Bloomberg A small chorus of researchers has for months warned of a potential hazard to earnings should the campaign to tamp down inflation succeed. Specifically, the squeeze on margins that could occur should an indicator known as corporate operating leverage… Source link

Read More »The cost of taming inflation could be 3 million lost jobs

Federal Reserve Chair Jerome Powell has warned that getting inflation under control will involve “some pain to households and businesses.” What kind of pain is he talking about? So far, the pain has been plunging stock values and higher borrowing costs for homes, cars, credit-card purchases and business investments. But the toll could also include a surge in unemployment, and all the strains that go along with it—which typically harms lower-income workers most of all. Powell won’t… Source link

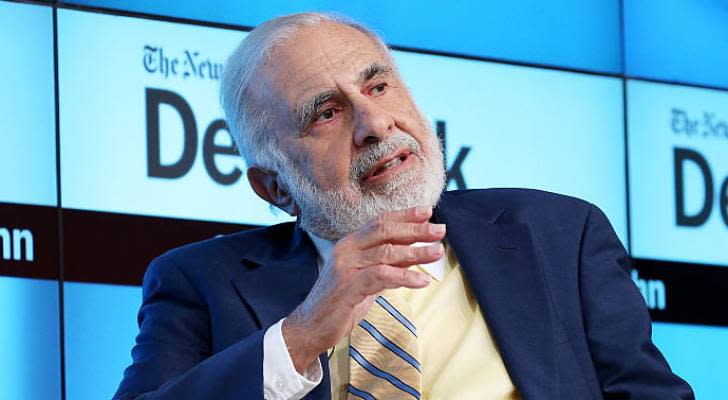

Read More »Billionaire Carl Icahn warns ‘you can’t cure’ hot inflation — but when an audience member asked him for stock picks, he gave these 2 ‘cheap and viable’ names

Billionaire Carl Icahn warns ‘you can’t cure’ hot inflation — but when an audience member asked him for stock picks, he gave these 2 ‘cheap and viable’ names Easy monetary policy might seem fun at the beginning, but it has consequences. While asset prices shot up in 2020 and 2021, they pulled back substantially in 2022. Meanwhile, inflation remains near 40-year highs and the Fed has to raise interest rates aggressively to bring price levels under control. “We printed up too much money, and… Source link

Read More »