This post was originally published on TKer.com. Low financing costs, excess savings, and a demand for more space during the pandemic fueled a frenzy in the housing market that sent home prices surging. Homebuyers, however, are now confronting an increasingly unaffordable housing market that’s been plagued by shortages. And with the Federal Reserve forcing financing costs higher in recent months, housing market activity has cooled off considerably. “Housing is likely just at the beginning… Source link

Read More »This CEO warns that the Fed’s strategy has created a giant bubble in housing. Here’s what he likes for protection

‘The biggest Ponzi scheme in history’: This CEO warns that the Fed’s strategy has created a giant bubble in housing. Here’s what he likes for protection The Fed is tasked with a dual mandate: to ensure price stability and aim for maximum employment. But according to Dan Morehead, CEO of crypto hedge fund giant Pantera Capital, there’s a third thing that the Fed has been doing — running a Ponzi scheme. In his latest Blockchain Letter, Morehead says that the Fed’s “manipulation of… Source link

Read More »Home sellers are realizing it’s no longer their housing market

The housing market has rapidly changed. Sellers, once in the driver’s seat at the start of the year, are much more accommodating to complete a home sale as borrowing costs skyrocket for buyers. A growing number of home sellers have been forced to readjust their home prices in recent weeks. According to Redfin, an estimated 6.1% of homes for sale during the four weeks leading to June 19, asked for a price drop – a record high as far back as the data goes, through the start of 2015. That… Source link

Read More »JPMorgan’s mortgage business to slash workforce as housing market cools

JPMorgan Chase (JPM) is slashing jobs in its home-lending division as rising mortgage rates and inflation drive a slowdown in the housing market. The bank is expected to lay off or reassign more than 1,000 employees, Bloomberg News first reported on Wednesday. Bloomberg’s report indicated “about half” of these impacted workers will be moved to different departments within the bank. “Our staffing decision this week was a result of cyclical changes in the mortgage market,” a JPMorgan… Source link

Read More »A housing market reset has become ‘a bit more than that’

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Friday, June 17, 2022 Today’s newsletter is by Myles Udland, senior markets editor at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn. The Federal Reserve is trying to slow the economy, and the housing sector is bearing the full force of these actions right now. Costs are rising for buyers. Confidence from builders is falling…. Source link

Read More »These 40 ‘overvalued’ housing markets could see 15% to 20% home price declines if a recession hits

A housing bubble requires both a rush of speculators entering into the market and “overvalued” home prices. Oh, and the bust at the end, of course. Unlike the housing bubble that popped in 2008, the pandemic housing boom isn’t underpinned by a frenzy of speculation, Moody’s Analytics chief economist Mark Zandi says. While home flipping has certainly ticked up during the pandemic, he says, we aren’t seeing the exuberance of the last bubble. So is the coast clear? Well, not so fast. While… Source link

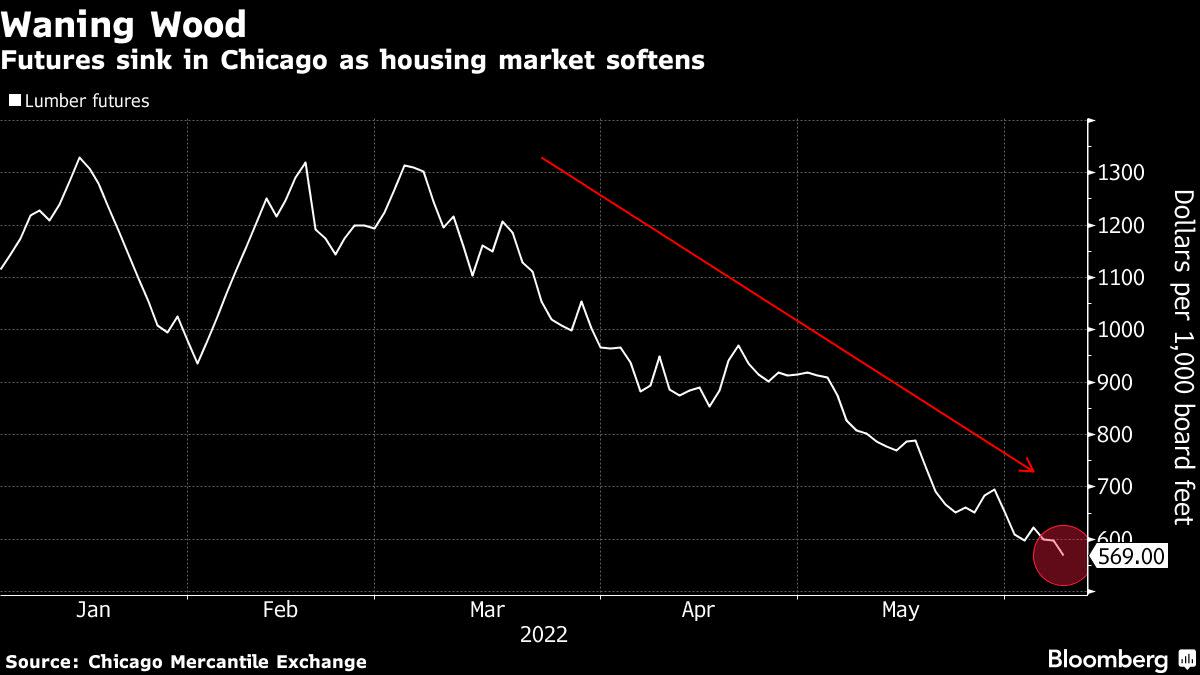

Read More »Lumber Price Gets Chopped in Half Amid Chill in Housing Markets

TipRanks Billionaire Paul Tudor Jones Loads Up on These 3 High-Yield Dividend Stocks For the retail investor, the only certainty of our current market environment is uncertainty. The reasons are multiplying: high inflation is rising higher, wages are not keeping up, Russia’s invasion of Ukraine has initiated Europe’s largest war since 1945, and energy and food commodities – key ingredients in the inflation mix – are sure to rise in price as a result of that fighting. In a time like… Source link

Read More »Mortgage rates fall a third week in a row as housing market tilts in homebuyers’ favor

Mortgage rates fall a third week in a row as housing market tilts in homebuyers’ favor Mortgage rates fell again this week amid relentless inflation and persistent doubt around the health of the U.S. economy. The rate drop — the third in as many weeks — was slight but still meaningful given rising home prices and generally higher borrowing costs. America’s most popular home loan — the 30-year fixed mortgage — is still significantly more expensive than it was last year. That’s… Source link

Read More »How a housing downturn could lead to a recession

The housing market is starting to show signs of a slowdown. If the trend persists, the U.S could see an impact in other sectors of the economy — starting with big-ticket items that go into furnishing a new home. “The housing market is very much a leading indicator of the economy because of the knock on effects through the various sectors, like consumption of durable goods,” Eric Basmajian, founder of EPB Macro Research, told Yahoo Finance. He predicts durable goods such as large appliances… Source link

Read More »Signs are piling up that the housing market is cooling down

Signs are emerging that the once-hot housing market may finally be cooling down. Bidding wars are down, sellers are cutting listing prices, and buyers have headed for the exits as higher mortgage rates put them over budget. But experts don’t expect the downturn to be nearly as rough as the housing crash that preceded the Great Recession. “The housing market appears to be at a turning point,” Doug Duncan, senior vice president and chief economist at Fannie Mae, told Yahoo Money. “Right… Source link

Read More »