Bank of Canada Governor Tiff Macklem says inflation is too high and we need higher interest rates (REUTERS/Blair Gable The Bank of Canada is raising its target for the overnight rate by half a percentage point to 1 per cent. Canada’s central bank says it will also stop buying government bonds and begin quantitative tightening (QT), beginning April 25. The Bank of Canada also sharply increased its inflation expectations, saying Russia’s invasion of Ukraine is creating economic… Source link

Read More »Treasuries Slump Ignites Global Selloff as Rate Hikes Gain Focus

(Bloomberg) — U.S. Treasury yields’ advance to a three-year high kicked off a global jump in borrowing costs as traders refocused on intensifying bets on rate hikes from major central banks. Most Read from Bloomberg Ten-year U.S. yields climbed through 2.75% for the first time since March 2019 as investors priced in the impact of the Federal Reserve’s tightening plan and accelerating inflation. Traders are betting on nine quarter-point Fed rate hikes by year-end, which — including last… Source link

Read More »Bank earnings expected to decline despite boost from Fed rate hikes

Banks will kick off earnings season this week, with first-quarter results due out from a lineup of industry heavyweights led by JPMorgan Chase on Wednesday. The latest quarterly figures are expected to preface a lackluster year for bank profits despite the lift anticipated from higher interest rates. According to projections compiled by S&P Global Market Intelligence, U.S. bank earnings will fall by more than 8% in 2022 from last year, namely as the financial boost from releasing reserves… Source link

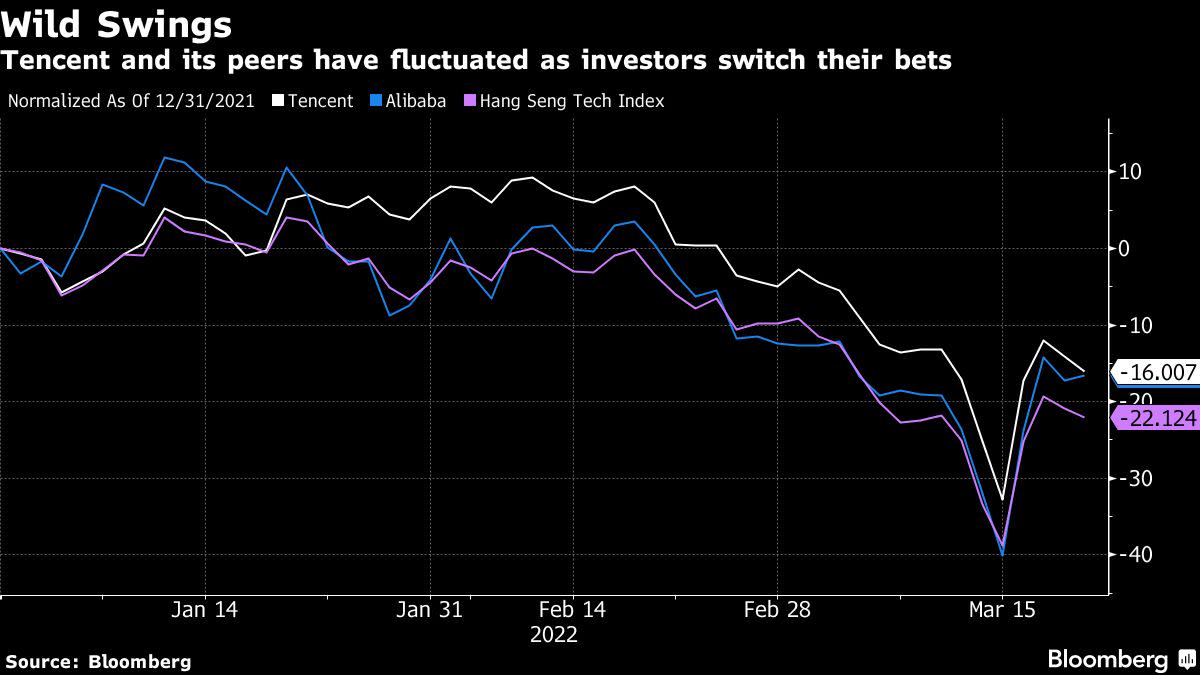

Read More »Alibaba Hikes Buybacks to $25 Billion as Crackdown Signals Ease

(Bloomberg) — Alibaba Group Holding Ltd. ramped up its share buyback program to $25 billion, expanding that arsenal for a second time in less than a year to stanch a $470 billion loss of value during Beijing’s internet crackdown. Most Read from Bloomberg The board of China’s e-commerce leader has approved the program, which will run for two years through to March 2024, the company said in a statement. It also appointed a new independent director in Shan Weijian, chairman of alternative… Source link

Read More »Expect price hikes of up to 10%

PepsiCo isn’t shying away from trying to protect its profit margins this year from surging inflation by increasing prices. “With levels of inflation and commodities as high as they are right now, we clearly are going to have to take some pricing. We have been investing heavily in our brands and heavily in product innovation. Because the world is in a bit of a stressful place, the simple pleasures of our products I think people are generally finding worth paying a few pennies more for. You… Source link

Read More »Starbucks hikes prices with more on the way, but insists demand is ‘very strong’

Starbucks (SBUX) customers are staying loyal to the Seattle-based coffee giant despite a higher cost for their cup of coffee, even as political pressure mounts in response to rising prices. In a phone interview with Yahoo Finance after Starbucks’ fiscal first-quarter earnings results, CEO Kevin Johnson said customer demand during the holiday season was “very strong” with revenue growth of 19%, coming in at a record $8.1 billion dollars for the coffee giant. Like a growing number of companies Source link

Read More »Here’s what 7 rate hikes from the Fed may do to the stock market

If the Federal Reserve raises interest rates seven times this year as Bank of America head of global economics Ethan Harris predicted in a new call, the stock market won’t be immune from those hikes. “I think it’s a flattish market, to be honest,” Harris told Yahoo Finance Live on Monday. “I think for now we have had the near-term corrections and the markets had to deal with the fact that the Fed isn’t going to be completely friendly going forward. They helped drive the stock market. Now they… Source link

Read More »‘Definitely feeling a sense of urgency to buy’ before interest rate hikes: Home seeker

It’s been a frustrating pandemic-long journey for house seekers like Adan Martinez. He’s been hoping to buy his first home near Harlingen, Texas, with a budget of $200,000. “There were several homes I was interested in but waited off on, $180K and $215K, respectfully. But mid-year last year, prices on them jumped to well over $50K-80K,” Martinez told Yahoo Finance. The rush to find a home is now greater than ever. Home prices keep rising — as mortgage rates inch higher. “[I’m] definitely… Source link

Read More »JPMorgan, BofA and others now see more rate hikes this year as Fed gets hawkish – Yahoo Finance

Federal Reserve watchers are quickly ramping up and revising forecasts on how many interest rate hikes they anticipate this year after the central bank doubled down on plans to tighten policy and rein in inflation. Economists at Bank of America and JPMorgan increased their forecasts Friday, two days after the Fed’s policy-setting meeting. BofA released one of the more aggressive predictions on the Street. It now expects seven hikes this year — that number was first uttered by JPMorgan CEO… Source link

Read More »What’s roiling stocks as the Fed moves toward rate hikes: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Tuesday, January 25, 2021 Fears of a policy error are overriding Q4 earnings Remember those “landmines” the Morning Brief recently warned could detonate in 2022? One of them is just days from going off, and at the worst possible time. The head-spinning volatility that’s been throttling investors since the new year culminated on Monday by… Source link

Read More »