U.S. stocks were higher Wednesday afternoon after Fed Chair Jerome Powell said in a press conference on Wednesday signs of disinflation are building in the economy, which investors took as a sign the central bank could be close to ending its rate-hiking campaign. Tech stocks were leading the charge higher on Wednesday following Powell’s comments, with the technology-heavy Nasdaq Composite (^IXIC) rising as much as 2%. Meanwhile, the S&P 500 (^GSPC) was higher by 1.2% while the Dow Jones… Source link

Read More »Bank of Canada's rate hike pause supported by majority of Canadians: Yahoo/Maru poll – Yahoo! Voices

Reuters California authorities see no link between dance hall shooter and victims Los Angeles-area investigators have found no connection between the victims of a mass shooting at a Monterey Park, California, dance hall and the elderly man who carried out the massacre last weekend, authorities said. The 72-year-old assailant, Huu Can Tran, on Saturday killed 11 people and wounded nine others at the Star Ballroom Dance Studio, a venue just east of Los Angeles that is popular with older patrons… Source link

Read More »US STOCKS-Wall Street falls as jobs report keeps Fed on hike path

(For a Reuters live blog on U.S., UK and European stock markets, click or type LIVE/ in a news window) * Job growth beats expectations; unemployment rate steady at 3.7% * Ford falls on lower November vehicle sales * Dow down 0.29%, S&P 500 down 0.54%, Nasdaq down 0.75% (Updates to mid-afternoon, changes byline) By Chuck Mikolajczak NEW YORK, Dec 2 (Reuters) – U.S. stocks fell on Friday, although major indexes recovered from their lowest levels, as the November payrolls report fueled expectations the… Source link

Read More »Stocks rise after Fed minutes signal rate hike slowdown

Stocks rose on Wednesday after the minutes from the Federal Reserve’s latest policy meeting signaled a likely slowdown in the central bank’s pace of interest rate increases next month. When the closing bell rang on Wall Street, all three major indexes were in green figures, with the S&P 500 up 0.6%, the Dow up 0.3%, and the Nasdaq higher by 1%. Wednesday marked the week’s final full trading session for U.S. investors. U.S. markets will be closed for Thanksgiving, and markets are open for just… Source link

Read More »Fed’s Daly says ‘premature’ to rule out another 0.75% rate hike

San Francisco Fed President Mary Daly said Monday it’s premature to take another 75-basis point rate hike off the table ahead of the central bank’s December policy meeting. “It’s premature in my mind to take anything off the table,” Daly said when asked during a media Q&A whether a 75-basis point rate hike is still possible for the next policy meeting if forthcoming inflation reports came in hot. “I’m going into the meeting with the full range of adjustments that we could make… Source link

Read More »Stocks bounce as Fed delivers fourth 0.75% hike

U.S. stocks were firmly higher Wednesday afternoon following a move by the Federal Reserve to raise its benchmark policy rate by 75 basis points for a fourth straight time — on par with market expectations — while hinting at a potential slower pace of monetary tightening ahead. The S&P 500 (^GSPC) gained 0.6%, while the Dow Jones Industrial Average (^DJI) jumped 280 points, or 0.9%. The technology-heavy Nasdaq Composite (^IXIC) was up 0.3%. “In determining the pace of future increases in… Source link

Read More »Fed’s Bullard Leaves Open Possibility of Larger December Hike

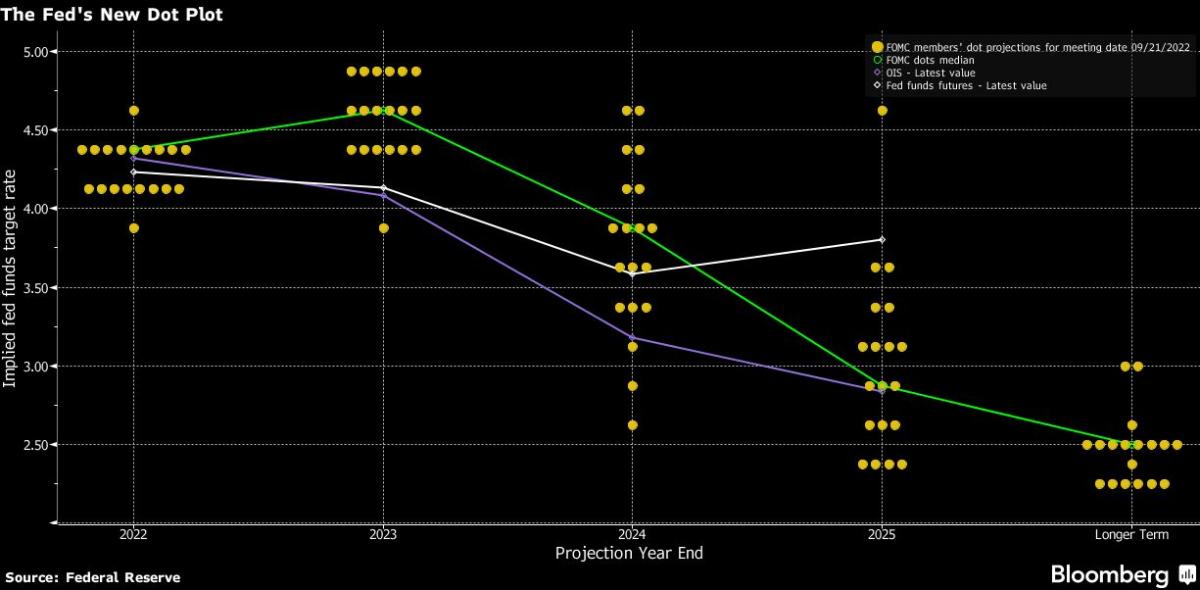

(Bloomberg) — Federal Reserve Bank of St. Louis President James Bullard left open the possibility that the central bank would raise interest rates by 75 basis points at each of its next two meetings in November and December, while saying it was too soon to make that call. Most Read from Bloomberg The Fed hiked rates by 75 basis points for the third straight meeting last month, to a target range of 3% to 3.25%. Officials projected 125 basis points of tightening for the rest of the year,… Source link

Read More »Core US Inflation Rises to 40-Year High, Securing Big Fed Hike

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast. Most Read from Bloomberg A closely watched measure of US consumer prices rose by more than forecast to a 40-year high in September, pressuring the Federal Reserve to raise interest rates even more aggressively to stamp out persistent inflation. The core consumer price index, which excludes food and energy, increased 6.6% from a year ago, the highest level since 1982, Labor Department… Source link

Read More »Stocks fall for third day as investors mull rate hike, Powell remarks

U.S. stocks closed lower Thursday to cap a turbulent session after the Federal Reserve’s latest policy announcement and subsequent remarks from Chair Jerome Powell sent markets into disarray. The benchmark S&P 500 slid 0.9%, while the Dow Jones Industrial Average shed 100 points, or 0.4%. The technology-heavy Nasdaq Composite tumbled 1.4%. The moves extend a Fed-induced sell-off Wednesday that saw the S&P 500 and Dow each erase around 1.7% and the Nasdaq plummet 1.8%, and mark a third… Source link

Read More »Stocks plunge after rate hike, Powell comments

U.S. stocks tumbled in volatile trading Wednesday afternoon as the Federal Reserve dealt another outsized interest rate hike in its fight against stubborn inflation. The U.S. central bank lifted its benchmark policy rate by 0.75% for a third consecutive time, bringing the federal funds rate to a new range of 3.0% to 3.25% — its highest level since 2008 — from a current range between 2.25% and 2.5%. The S&P 500 and Dow Jones Industrial Average each shed around 1.7%, while the… Source link

Read More »