Goldman Sachs is pushing back on the notion that headline-grabbing layoffs from big-cap tech companies are a sign of a looming U.S. recession. “Tech layoffs are not a sign of an impending recession,” Goldman Sachs chief economist Jan Hatzius wrote in a note to clients on Tuesday. As the year nears a close, the layoffs announcements have picked up in tech land amid a terrible year for stock prices and slowing growth. In the past two weeks alone, Meta and Amazon have unveiled combined job cuts of… Source link

Read More »Goldman Says Sell S&P 500 Calls to Fund Bullish China View

(Bloomberg) — Goldman Sachs Group Inc. said investors should sell S&P 500 Index calls and fund buying of the same options on the Hang Seng China Enterprises Index to position for a likely catch-up in battered China-related assets. Most Read from Bloomberg “Sentiment on China-exposed assets has remained subdued this year and did not mirror the risk appetite rebound during the summer,” undershooting a measure of investor mood for global growth, strategists including Christian… Source link

Read More »Goldman Sees Some Bargains in US But Finds S&P 500 Expensive

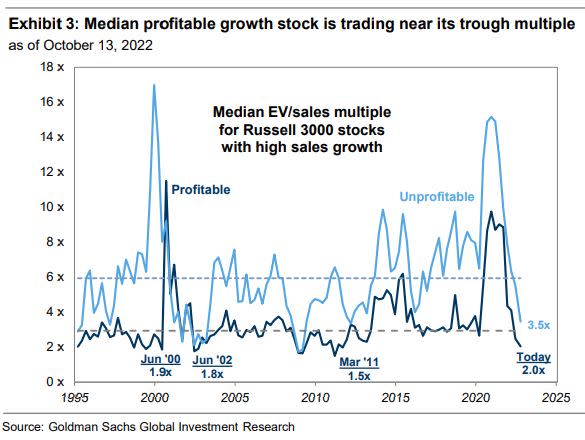

(Bloomberg) — Goldman Sachs Group Inc. sees attractive opportunities emerging in US stocks even as the S&P 500 benchmark remains expensive versus its history and accounting for interest rates. Most Read from Bloomberg The risk-reward for the S&P 500 Index remains unattractive but “the degree of valuation dispersion within the equity market is wide,” strategists including David J. Kostin wrote in a note dated Oct. 14. They see opportunities in stocks linked to quicker cash flow generation,… Source link

Read More »Goldman Sachs, Lyft, Mind Medicine and more

Goldman Sachs (GS), Morgan Stanley (MS), Bank of America (BAC), Citigroup (C): Wall Street banks were hit with $1.8 billion in fines Tuesday tied to probes into how the firms failed to monitor employee use of unauthorized messaging apps. The Securities and Exchange Commission announced 16 firms, including Goldman Sachs, Citigroup, Bank of America and Morgan Stanley, will pay $1.1 billion in fines. The Commodity Futures Trading Commission announced fines against 11 banks totaling $710… Source link

Read More »Goldman Sachs cuts 2022 target for S&P 500 by 16%

(Reuters) -Goldman Sachs has cut its year-end 2022 target for the benchmark S&P 500 index by about 16% to 3,600 points, as the U.S. Federal Reserve shows little signs of stepping back from its aggressive rate-hike stance. Analysts at Goldman Sachs wrote in a note late Thursday that the expected path of interest rates by the central bank is now higher than its previous estimate. Their previous target was 4,300 points. The benchmark index last closed at 3,758 points. “Based on our client… Source link

Read More »Railroad strike wouldn’t be an economic black swan, Goldman Sachs chief economist says

A potential railroad strike in the U.S. shouldn’t be viewed as a black swan event, according to Goldman Sachs chief economist Jan Hatzius, but it could still have an impact on the economy. “I don’t think it’s a black swan,” Hatzius told Yahoo Finance Live at the Goldman Sachs Communacopia + Technology Conference on Monday (video above). “I think it’s an indication, along with other indications of more labor strife and maybe more tensions, that labor still has a very significant amount of… Source link

Read More »Goldman Sachs CEO David Solomon details ‘the big thing to watch’ in markets

Goldman Sachs chairman and CEO David Solomon thinks it would be wise for investors to pay extra attention to the path of corporate earnings in the weeks ahead. “I do see a little bit more market volatility — but I think the volatility at this point, the market is expecting,” Solomon said on Yahoo Finance Live at the firm’s 10,000 Small Businesses Summit (video above). “I think you’ve got to watch corporate earnings. And up to this point, corporate earnings have hung in reasonably well. But… Source link

Read More »The job market is poised to slow ‘sharply,’ Goldman warns

The U.S. job market is poised for a rapid slowdown as economic growth cools, Goldman Sachs warned in a new report. “We continue to expect that the slowing economy will lead job growth to fall sharply to 150k/month in 2022H2 and to 60k/month in 2023, causing the unemployment rate to gradually rise to 3.8% at end-2023 and 4.0% at end-2024,” Goldman Chief Economist Jan Hatzius said. “We see risks around this forecast as two-sided, reflecting elevated risk of a recession that would cause greater… Source link

Read More »Goldman hires Google exec to co-head applied innovation unit – memo

NEW YORK, July 12 (Reuters) – Goldman Sachs has hired Jared Cohen, who founded technology incubator Jigsaw at Google, to co-head its newly created applied innovation unit, an internal memo showed, as the Wall Street powerhouse invests in technology expertise. Cohen, who also served as advisor to Google’s CEO Eric Schmidt in the past, will co-head the new Goldman unit with George Lee, the memo said, whose contents were confirmed by the bank’s spokesperson. “The Office of Applied Innovation will… Source link

Read More »Why Goldman is still very cautious on the stock market

The market’s challenges may persist, prompting Goldman Sachs to stay cautious on recommending stocks even though they are at far cheaper levels than six months ago. “Until the growth/inflation mix improves volatility is likely to linger as investors are shifting between inflation frustration and recession obsession,” Goldman Sachs strategist Christian Mueller-Glissmann wrote in a new note to clients, adding that Goldman is positioned “defensively” for the next three months until macroeconomic… Source link

Read More »

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MKDQJRABAFIC3HMZD22WIELI4I.jpg)