This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Wednesday, December 7, 2022 Today’s newsletter is by Myles Udland, senior markets editor at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn. Read this and more market news on the go with Yahoo Finance App. Another month, another strong jobs report. News last Friday that some 263,000 jobs were created in November showed the Federal… Source link

Read More »Fed’s Daly says ‘premature’ to rule out another 0.75% rate hike

San Francisco Fed President Mary Daly said Monday it’s premature to take another 75-basis point rate hike off the table ahead of the central bank’s December policy meeting. “It’s premature in my mind to take anything off the table,” Daly said when asked during a media Q&A whether a 75-basis point rate hike is still possible for the next policy meeting if forthcoming inflation reports came in hot. “I’m going into the meeting with the full range of adjustments that we could make… Source link

Read More »US Stocks Drop as Investors Mull Fed’s Path: Markets Wrap

(Bloomberg) — US stocks swung between gains and losses as investors parsed fresh economic data and disappointing earnings while mulling the Federal Reserve’s path after the Bank of Canada announced a smaller-than-expected rate hike. Most Read from Bloomberg The S&P 500 struggled for direction. The tech-heavy Nasdaq 100 pared losses that topped 2%. Treasuries rallied after data showed the US merchandise-trade deficit widening. Sales of new US homes fell in September, another indication that… Source link

Read More »Fed’s Bullard Leaves Open Possibility of Larger December Hike

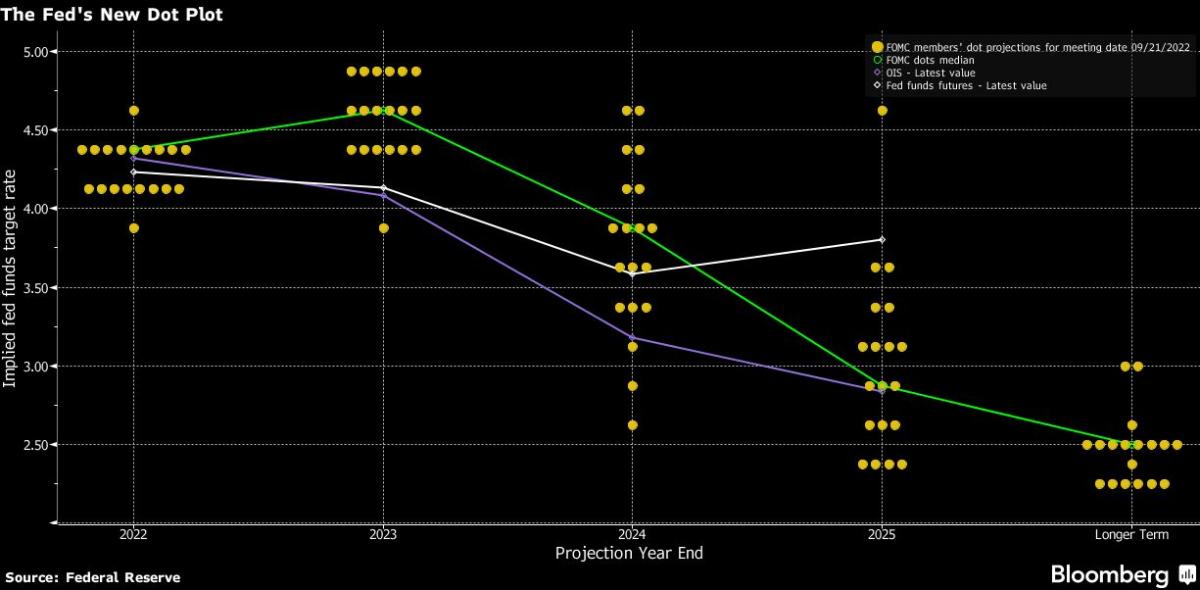

(Bloomberg) — Federal Reserve Bank of St. Louis President James Bullard left open the possibility that the central bank would raise interest rates by 75 basis points at each of its next two meetings in November and December, while saying it was too soon to make that call. Most Read from Bloomberg The Fed hiked rates by 75 basis points for the third straight meeting last month, to a target range of 3% to 3.25%. Officials projected 125 basis points of tightening for the rest of the year,… Source link

Read More »Wall Street is finally getting the Fed’s message on interest rates: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Thursday, September 22, 2022 Today’s newsletter is by Jared Blikre, a reporter focused on the markets on Yahoo Finance. Follow him on Twitter @SPYJared. Stocks are finally listening to Jay Powell and the Federal Reserve. In a highly anticipated move Wednesday, the Federal Reserve hiked its benchmark interest rate by 0.75 percentage points after… Source link

Read More »Fed’s instant payment service ‘FedNow’ set to launch by July 2023

The Federal Reserve is on track to deliver an instant payment service called FedNow between May and July 2023, the central bank’s clearest timeline yet for a new system enabling settlement of U.S. payments in seconds. The FedNow service also potentially negates the need for the creation of a central bank digital currency, or CBDC. “The FedNow Service will transform the way everyday payments are made throughout the economy, bringing substantial gains to households and businesses through the… Source link

Read More »Why markets care so much about the Fed’s annual Jackson Hole meeting

For more business and finance explainers, check out our Yahoo U page. Every year in August, the Federal Reserve holds a small gathering of the world’s leading economists and policymakers against the backdrop of the Grand Teton Mountains in Wyoming. Only about 120 people attend the event every year, but the publicly-released papers and speeches — as well as media engagements by policymakers — have made the Kansas City Fed’s Economic Policy Symposium a landmark event for Fed watchers and… Source link

Read More »Recent economic data have been the Fed’s ‘worst nightmare,’ economist says

The economy is looking pretty dreadful, and that won’t make the Federal Reserve’s job any easier as it tries to engineer a soft economic landing, one top Wall Street economist warns. “I would say that the recent economic data have been central banks’ worst nightmare,” said Citi Global Chief Economist Nathan Sheets on Yahoo Finance Live (video above). “On the one hand, I would say there is very clear evidence of a slowing in global demand. And on the other hand, there is also clear evidence… Source link

Read More »This CEO warns that the Fed’s strategy has created a giant bubble in housing. Here’s what he likes for protection

‘The biggest Ponzi scheme in history’: This CEO warns that the Fed’s strategy has created a giant bubble in housing. Here’s what he likes for protection The Fed is tasked with a dual mandate: to ensure price stability and aim for maximum employment. But according to Dan Morehead, CEO of crypto hedge fund giant Pantera Capital, there’s a third thing that the Fed has been doing — running a Ponzi scheme. In his latest Blockchain Letter, Morehead says that the Fed’s “manipulation of… Source link

Read More »Inflation will probably fall, but it won’t be the Fed’s doing: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Tuesday, June 28, 2022 Today’s newsletter is by Emily McCormick, a reporter for Yahoo Finance. Follow her on Twitter. The Federal Reserve is working hard to bring down inflation, raising interest rates at the fastest pace in nearly 30 years. Recently, some analysts have begun to explore the idea that inflation may moderate in the coming months. But… Source link

Read More »