Stock futures gained Tuesday morning after sliding a day earlier, as a bevy of concerns out of China and in Washington spurred a steep selloff across risk assets. Traders also turned their attention to the start of the Federal Reserve’s latest two-day monetary policy-setting meeting. Contracts on the S&P 500 advanced by about 0.8% after the blue-chip index logged its worst day since May by the end of Monday’s session. Dow futures added more than 300 points, or 0.9%, while Nasdaq futures… Source link

Read More »Fed seeks to downplay rate hike prospects as taper talks advance

The Federal Reserve is not expected to announce any major policy change at the conclusion of its meeting on Wednesday, but markets could jitter from Fed signals that one could be coming soon. The Fed has signaled that it will likely start pulling back on its extraordinary monetary support before the end of the year. The Fed’s playbook calls for slowing its asset purchase program first, followed by interest rate hikes down the line. But Fed Chairman Jerome Powell has already communicated to… Source link

Read More »REFILE-US STOCKS-Wall St drops 2% on growth worries; focus turns to Fed

(Corrects to remove extraneous text in headline) * Energy, bank stocks lead market declines * All eyes on Fed’s policy meeting later this week * Major airlines gain as U.S. relaxes travel rules * Indexes down: Dow 1.92%, S&P 2.04%, Nasdaq 2.53% By Devik Jain Sept 20 (Reuters) – Wall Street’s main indexes tumbled on Monday, as concerns about the pace of a global recovery spurred a selloff across sectors at the start of a week in which the Federal Reserve will decide on potentially tapering its… Source link

Read More »US STOCKS-Wall St tumbles on growth worries; focus turns to Fed

(For a Reuters live blog on U.S., UK and European stock markets, click LIVE/ or type LIVE/ in a news window.) * Energy, bank stocks lead market declines * All eyes on Fed’s policy meeting later this week * Indexes down: Dow 1.34%, S&P 1.35%, Nasdaq 1.63% (Updates to open; changes quote) By Devik Jain Sept 20 (Reuters) – Wall Street’s main indexes tumbled on Monday, as concerns about the pace of a global recovery hit economy-linked stocks at the start of a week in… Source link

Read More »European Stocks Slide to Two-Month Low on China and Fed Concerns

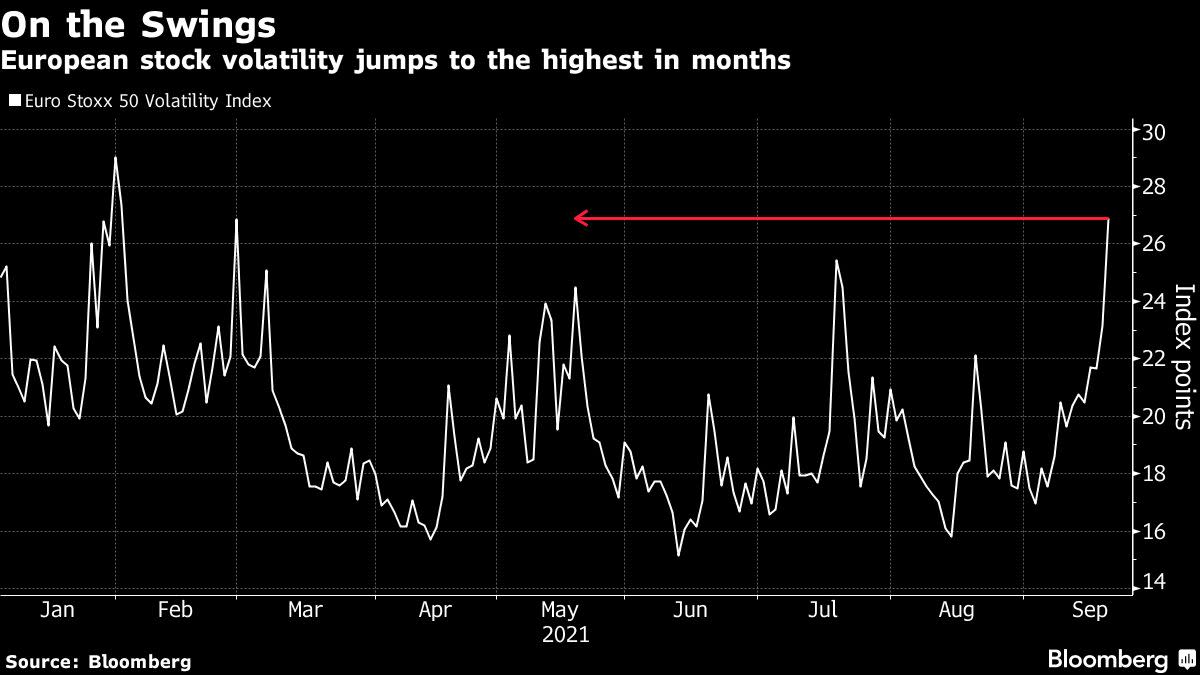

(Bloomberg) — European stocks slid to the lowest level in two months as China’s real estate crackdown and worries ahead of this week’s Federal Reserve fueled risk-off sentiment. The Stoxx Europe 600 index fell 2%, the most in a month and to the lowest level since July 21. Germany’s DAX slumped 2.3% on the day the index’s expansion takes effect, with banks and automotive shares underperforming. While all sectors retreated on the European gauge, miners declined the most, sliding to the… Source link

Read More »U.S. Futures, Stocks Fall Amid Fed, China Risks: Markets Wrap

(Bloomberg) — U.S. equity futures and Asian stocks fell Monday amid a slump in Hong Kong property developers and jitters before a Federal Reserve meeting that’s expected to hint at moving toward paring stimulus. The dollar rose. U.S. and European contracts dropped after the S&P 500 slid the most in a month, a test for the buy-the-dip mentality as the gauge jabs at its 50-day moving average. Hong Kong shares tumbled on growing concern about China’s crackdown on the real-estate sector and… Source link

Read More »Powell orders review of Fed ethics rules after stock trades made by senior officials

Federal Reserve Chairman Jerome Powell has directed staff to review the central bank system’s rules around stock trading as part of clean-up efforts related to the disclosure of several personal multi-million dollar transactions made by senior policymakers last year. “Chair Powell late last week directed Board staff to take a fresh and comprehensive look at the ethics rules around permissible financial holdings and activities by senior Fed officials,” a Fed spokesperson said. The Fed… Source link

Read More »Fed officials to sell stocks to avoid apparent conflict of interest

By Jonnelle Marte (Reuters) – Two Federal Reserve officials said on Thursday they would sell their individual stock holdings by the end of the month to address the appearance of conflicts of interest. Dallas Fed President Robert Kaplan and Boston Fed President Eric Rosengren issued statements saying they would invest the proceeds of those sales in diversified index funds and cash savings and would not trade in those accounts as long as they are serving in their roles. The announcements come… Source link

Read More »Stocks Rise as Traders Weigh Fed Taper Outlook: Markets Wrap

(Bloomberg) — U.S. equity-index futures rose and European stocks inched closer to a record high as investors bet slower hiring in the world’s largest economy may delay a tapering of Federal Reserve stimulus. Aluminum hit a decade high amid political unrest in Guinea. The Stoxx Europe 600 Index rebounded from last week’s losses, led by technology shares. Contracts on the S&P 500 Index rose 0.2% even as U.S. markets were closed for Labor Day. Aluminum supplier Norsk Hydro ASA headed for a… Source link

Read More »Fed Chairman Powell’s odds at renomination come down to politics

The White House is pondering whether or not to take the keys to the U.S. economy away from Federal Reserve Chairman Jerome Powell, with the decision likely boiling down to politics. Powell’s term as Fed chairman expires in February of next year, meaning President Joe Biden would have to decide on Powell’s fate relatively soon in order to give the Senate enough time to proceed with the confirmation process. But calls within the Democratic party are emerging to boot Powell. Politico reported… Source link

Read More »