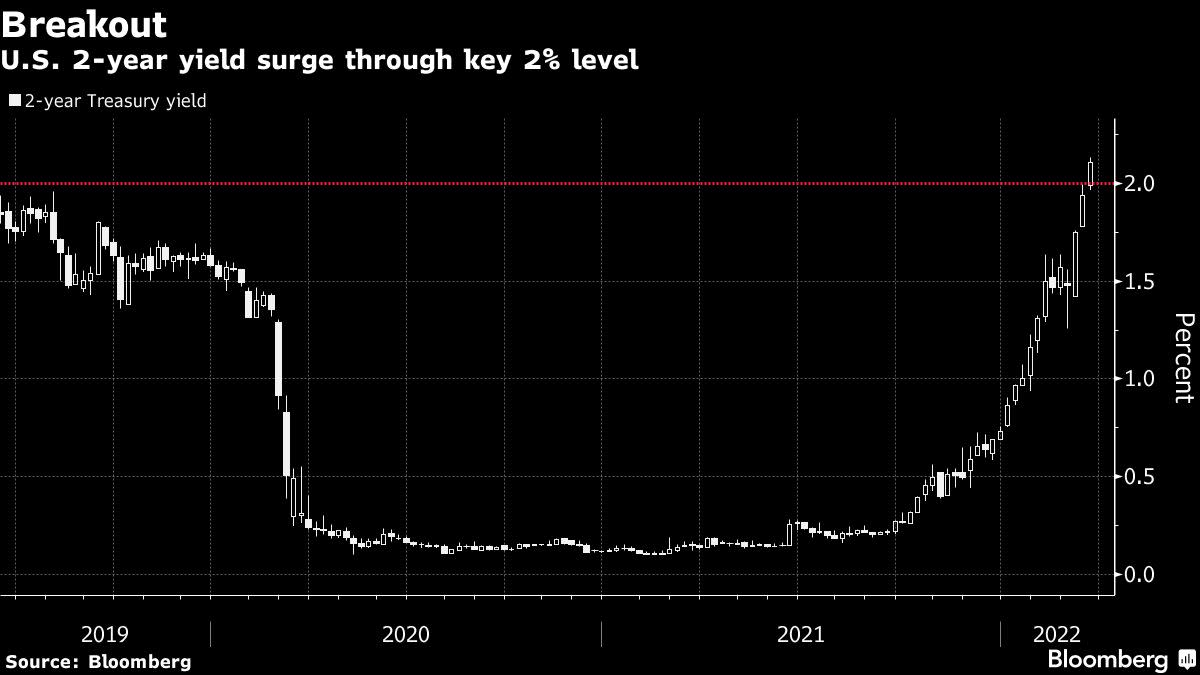

(Bloomberg) — The U.S. bond market reeled further on Tuesday, extending Monday’s declines after Federal Reserve Chair Jerome Powell’s aggressive rate hike comments drove yields on short-dated Treasuries to one of their biggest daily jumps of the past decade. Most Read from Bloomberg The central bank chief’s hawkish tone led traders to rapidly ratchet up estimates for how aggressively the Fed will tighten monetary policy this year as rising commodity prices threaten to add fuel to the… Source link

Read More »The Fed is on the verge of repeating history: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe Thursday, March 17, 2022 The Federal Reserve finally took the plunge and raised rates. As expected, Fed Chair Jerome Powell led the Federal Open Market Committee to raise its benchmark interest rate target by 25 basis points. The Fed famously operates according to two mandates (actually it has three by law): price stability and maximum employment…. Source link

Read More »Fed raises interest rates for the first time since 2018

The Federal Reserve on Wednesday raised short-term interest rates for the first time since 2018, as high inflation pushes the central bank to pull back on its extraordinary pandemic-era support. The U.S. central bank lifted its benchmark Federal Funds Rate by 0.25%, to a target range of between 0.25% and 0.50%. The Fed also noted that the economic outlook remains “highly uncertain” in the face of the war in Ukraine. By notching up rates, the Fed kicks off a process of raising borrowing… Source link

Read More »European stocks climb as Fed to raise rates for first time since 2018

European stocks rose as all eyes are firmly focused on the Federal Reserve meeting later today – the first in four years, where an interest rate hike is expected. Photo: Tom Williams/CQ-Roll Call, Inc via Getty European stocks pushed higher on Wednesday as investors awaited a widely anticipated decision by the US Federal Reserve on interest rate policy. In London, the FTSE 100 (^FTSE) rose 1.3% after opening, while the CAC (^FCHI) gained 2.1% in Paris, and the Frankfurt DAX (^GDAXI) was 2%… Source link

Read More »Stock futures drift ahead of Fed decision

Stock futures opened little changed Tuesday evening as traders stood by for the Federal Reserve’s latest monetary policy decision and updated economic outlook on Wednesday. Contracts on the S&P 500 drifted flat to slightly lower. Earlier, the index closed higher by more than 2%, gaining for the first time in four sessions as volatility gripped U.S. equities. The Nasdaq Composite also ended a three-session losing streak to end nearly 3% higher. Energy prices unwound more recent gains, and West… Source link

Read More »Stock futures jump ahead of Fed decision, oil extends declines

Stock futures jumped Wednesday morning as traders awaited the Federal Reserve’s latest monetary policy decision and updated economic projections later in the day. More positive developments on the outlook for Russia-Ukraine talks also helped boost U.S. and global equities. Contracts on the S&P 500, Dow and Nasdaq were each higher by more than 1% in pre-market trading. These moves built on gains from Tuesday, when the S&P 500 closed higher by more than 2% to shake off some of the volatility… Source link

Read More »Stocks mixed, oil prices fall as traders look ahead to Fed decision

The S&P 500 and Dow rose Monday to shake off some recent losses, with investors looking ahead to the Federal Reserve’s next monetary policy decision later this week amid an ongoing war in Ukraine and soaring inflation. The Dow Jones Industrial Average gained more than 0.7% just after market open as the index recovered some losses following five straight weekly losses. The Nasdaq erased earlier gains to trade lower. U.S. crude oil prices (CL=F) briefly dipped below $103 per barrel to a… Source link

Read More »Fed up with Google, conspiracy theorists turn to DuckDuckGo – The Denver Post

By Stuart A. Thompson, The New York Times Company On an episode of Joe Rogan’s popular podcast last year, he turned to a topic that has gripped right-wing communities and other Americans who feel skeptical about the pandemic: search engines. “If I wanted to find specific cases about people who died from vaccine-related injuries, I had to go to DuckDuckGo,” Rogan said, referring to the small, privacy-focused search engine. “I wasn’t finding them on Google.” Praise for DuckDuckGo… Source link

Read More »Russia attack on Ukraine may nudge Fed to less aggressive move next month

Russia’s attack on Ukraine is fueling geopolitical risk that may push the Federal Reserve away from a more aggressive interest rate increase in March. Fed officials, who are still eager to begin the process of paring back pandemic-era easy money policies, say they are monitoring any spillover effects of the conflict onto U.S. economic activity. “These create a lot of uncertainty and uncertainty, as we know, is a demand shock,” San Francisco Fed President Mary Daly told reporters on Feb…. Source link

Read More »Ukraine-Russia crisis won’t stop Fed from jacking up interest rates: Goldman Sachs

The Federal Reserve is unlikely to back off raising interest rates starting at its March meeting as it wrestles with trying to fight red-hot inflation against the backdrop of Russia invading Ukraine. “The current situation is different from past episodes when geopolitical events led the Fed to delay tightening or ease because inflation risk has created a stronger and more urgent reason for the Fed to tighten today than existed in past episodes,” said Goldman Sachs Chief Economist Jan Hatzius… Source link

Read More »